Inside China’s Consensus Machine: How the Robot Investment Frenzy Actually Works

A framework for international investors to decode market signals from amplified noise.

In March 2025, one of China’s most influential venture capitalists publicly announced he was “batch exiting” his robotics investments. Zhu Xiaohu, managing partner of GSR Ventures and the man who backed Didi Chuxing before it became China’s ride-hailing giant, declared that commercial pathways in humanoid robotics remained unclear. Within hours, Zhang Ying, founding partner of Matrix Partners China, fired back on his WeChat Moments feed: “Don’t mess around, Mr. Zhu.“ Zhang insisted that given enough time, the humanoid robot sector would ”definitely produce big companies.”

This public spat between two of China’s most respected investors reveals something that aggregate funding numbers obscure. The supposed “strong consensus” around embodied AI may be more fragile than it appears.

The Surface Story: Explosive Growth

The headline figures suggest overwhelming market conviction. Chinese embodied AI startups raised RMB 39.8 billion (approximately $5.5 billion) across 325 deals in 2025, representing year-over-year growth of 326% in funding amount and 216% in deal count.

Valuations have climbed even more dramatically. Projects that struggled to raise capital at RMB 200 million valuations in late 2024 found themselves oversubscribed at RMB 3 to 5 billion just months later. Early seed investments in companies like Galbot have returned nearly 70 times their original investment on paper.

Chinese tech media and multiple investors have described the same scenes repeatedly: partners waiting outside company offices for a chance to get meetings, and warm introductions being treated as prerequisites for basic access. These are anecdotes, not statistics, but they are consistent with a market where attention becomes the scarce asset and time for diligence collapses.

These dynamics suggest a market where demand for deals far outstrips supply, where capital chases a limited number of credible opportunities. By conventional venture logic, this represents a seller’s market with strong consensus around the sector’s potential.

Yet the Zhu-Zhang confrontation suggests otherwise. If consensus were truly solid, why would a prominent investor publicly abandon the sector while another felt compelled to rebuke him in real time?

Because the real story is not robotics. It is how a view becomes investable consensus in China faster than fundamentals can catch up.

Understanding China’s Consensus Machine

In any venture market, shared beliefs rarely form in a purely “bottom-up” way. Narratives, anchors, and social proof exist everywhere. The difference in China is the strength of the coordination channels and the speed of amplification. Policy signals, state-linked capital, and a concentrated set of opinion leaders compress the time it takes for a view to become tradable consensus. What looks like organic convergence often behaves like synchronized movement.

Here “consensus machine” does not mean fabrication. It describes a repeatable pattern where visible signals accelerate alignment, so a narrative becomes investable before independent underwriting fully catches up. Understanding this pattern provides a framework for evaluating any Chinese tech investment wave, because the same dynamics will repeat across future technology cycles.

1. The Trigger Events

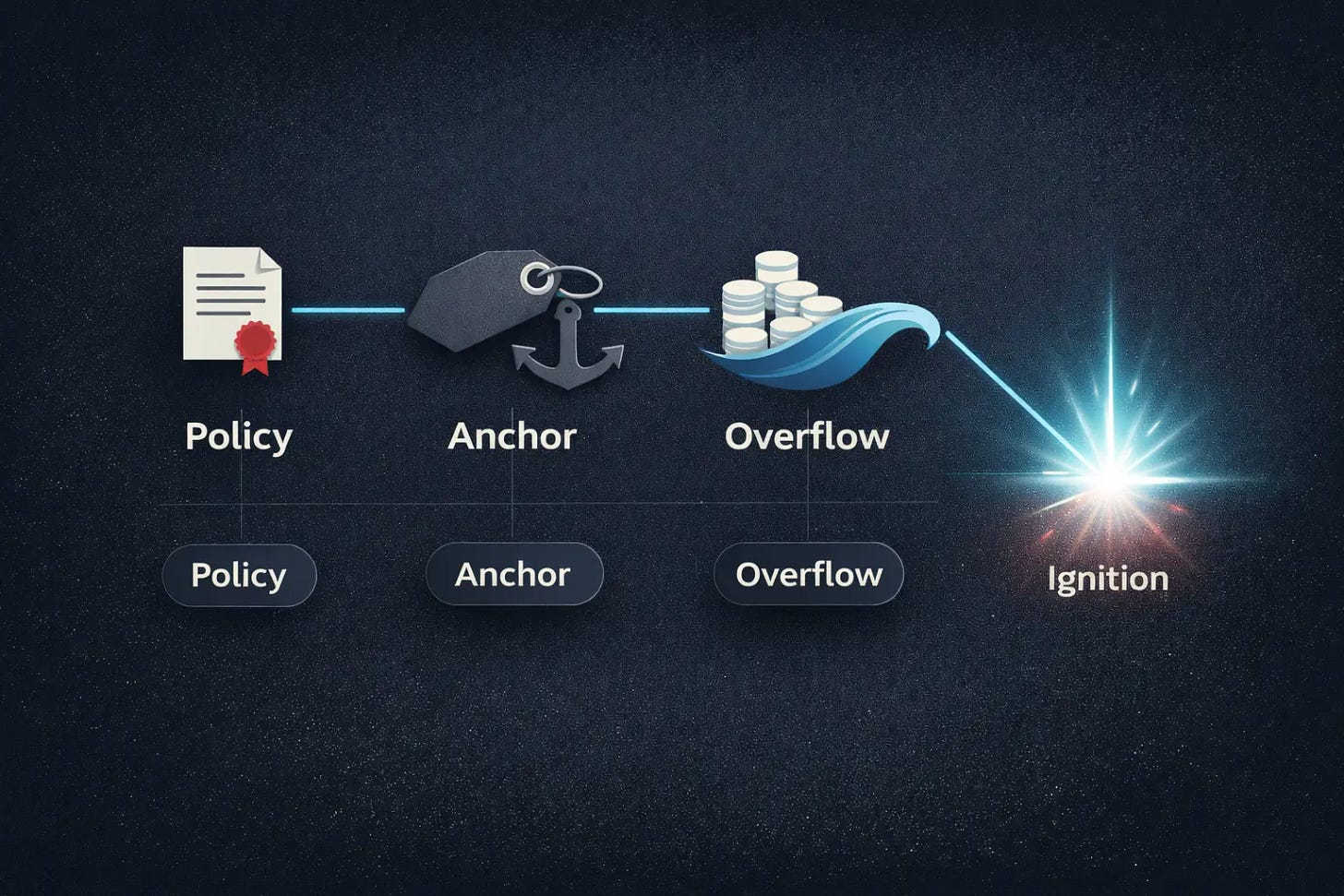

Every Chinese tech funding cycle begins with specific trigger events that signal “permission” for aggressive investment. In embodied AI, three triggers converged in late 2023 and early 2024.

The Valuation Anchor: In late 2023, Agibot announced an A3 round raising over RMB 600 million at a post-money valuation of RMB 7 billion. This single transaction established what Chinese investors call an “估值锚点” (valuation anchor point). Before this deal, investors questioned whether embodied AI companies deserved billion-yuan valuations. After this deal, they had a reference point that legitimized such prices.

The Capital Overflow: Simultaneously, China’s large language model startups (often called the “Six Little Tigers”) had all achieved valuations exceeding $1 billion. Some investors who found pure software valuations excessive, or who struggled to evaluate AI model companies, began seeking alternatives. Embodied AI, with its combination of software and hardware and relatively earlier-stage valuations, became that alternative.

The Policy Signal: Beijing issued the “Humanoid Robot Innovation Development Guidance” in 2023, followed by the Beijing Municipal Robot Industry Innovation Development Action Plan. For experienced China investors, policy signals carry weight that international observers often underestimate. When Beijing explicitly names a technology in planning documents, ministries align resources, local governments launch funds, and state-owned enterprises become potential customers.

2.The Amplification Mechanism

Once triggers fire, a self-reinforcing amplification cycle begins. Each element strengthens the others until the entire system reaches what one investor described as a “market ignition point.”

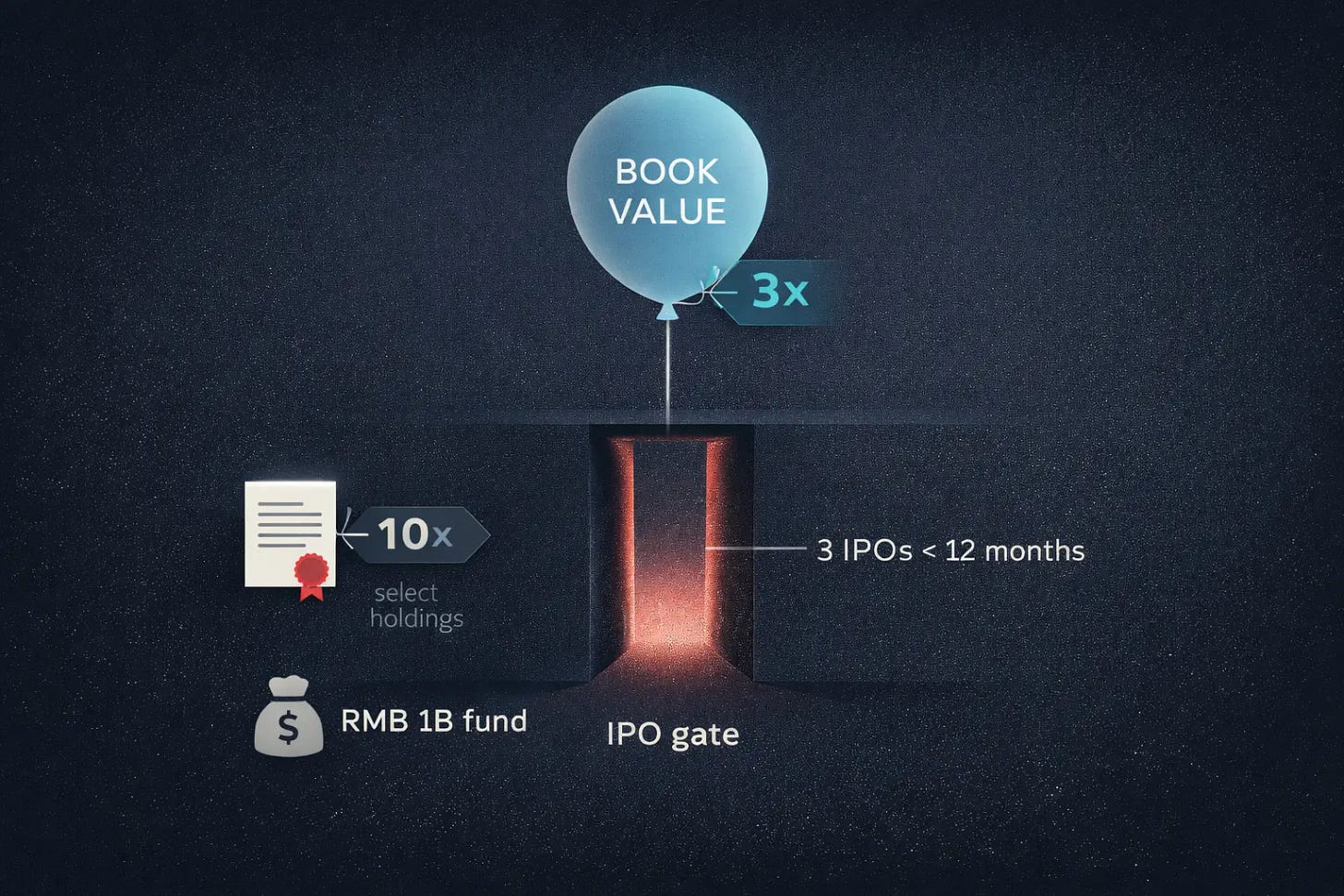

Government Capital Creates Legitimacy: Beijing’s RMB 10 billion (approximately $1.4 billion) robotics fund, managed by Hong Kong-listed Shoucheng Holdings, completed over ten investments by early 2025. Portfolio companies include high-profile names like Unitree Robotics and Galaxy General. The fund’s management claimed portfolio book values had tripled since inception, with select holdings returning ten-fold on paper. More tellingly, several portfolio companies are slated for IPO within the next year.

These returns create a powerful demonstration effect. When a government-backed fund reports three-times gains, private capital reads this as both validation and competition. If the state is generating returns in robotics, private investors fear missing the opportunity.

Industry Giants Signal Commitment: During 2025, Meituan, Alibaba, JD.com, Tencent, and CATL all made embodied AI investments. When China’s largest technology and manufacturing companies simultaneously enter a sector, the signal transcends individual deal logic. Their participation tells the market: this sector has reached the strategic priority list of the country’s most sophisticated corporate allocators.

The FOMO Cascade: The transition from caution to frenzy follows a specific behavioral pattern. When no clear leader has emerged and commercial validation remains distant, Chinese VCs tend toward collective hesitation. Each fund waits for others to establish valuation precedents or take conviction positions. But once trigger events stack up (a high-profile funding round, explicit policy support, major corporate participation), the calculus inverts. Staying out starts to feel riskier than piling in. The same investors who months earlier questioned whether embodied AI deserved premium valuations suddenly compete to pay those premiums.

This observation captures something essential about Chinese venture markets. The transition from “silence” to “frenzy” happens faster and more completely than in most Western markets. Investors who might spend months conducting independent due diligence instead accelerate their processes to match competitors. The result is compressed evaluation timelines and convergent investment decisions.

3.The Fragility Points

The same mechanisms that accelerate consensus also create structural fragilities. International investors need to understand these vulnerabilities when evaluating entry points and managing risk.

Valuation Anchors Can Mislead: The RMB 7 billion valuation that Agibot achieved in late 2023 established a reference point. But reference points work by comparison, not by fundamentals. When subsequent companies raised at RMB 3 to 5 billion, investors felt these prices were “reasonable” relative to the anchor. Whether the anchor itself was reasonable remained unexamined.

Paper Returns Require Exits: Government fund managers reporting “three-times book value” gains face an uncomfortable reality. These returns exist only on paper until portfolio companies achieve liquidity events. Shoucheng Holdings projects several portfolio companies may IPO within the next year. If those IPOs succeed, the returns become real. If public markets reject these companies, or if IPO windows close, paper gains evaporate.

One additional accelerator may be fiscal incentives at the local level. In many cities, tighter budgets make “financially legible” outcomes, such as IPO readiness, more attractive to local officials. That does not mean industrial policy is fake. It means capital timelines can conflict with technology timelines.

The “Hexagonal Warrior” Problem: Investors increasingly describe successful embodied AI founders as “六边形战士” (hexagonal warriors), meaning they must excel across six dimensions: software, hardware, scenario understanding, engineering, fundraising, and ecosystem building.

This requirement differs fundamentally from the mobile internet era, when a strong product manager or exceptional user experience designer could build a billion-dollar company. WhatsApp had about 50 employees when Meta acquired it for $19 billion. Robotics does not scale like messaging. It scales like manufacturing plus software.

The complexity of robotics means fewer founders qualify, which means capital concentrates into a smaller number of companies, which means valuations rise regardless of fundamental progress.

A Decision Framework for International Investors

Understanding consensus amplification provides a framework for evaluating Chinese tech investments at any stage of the cycle. The framework has three components.

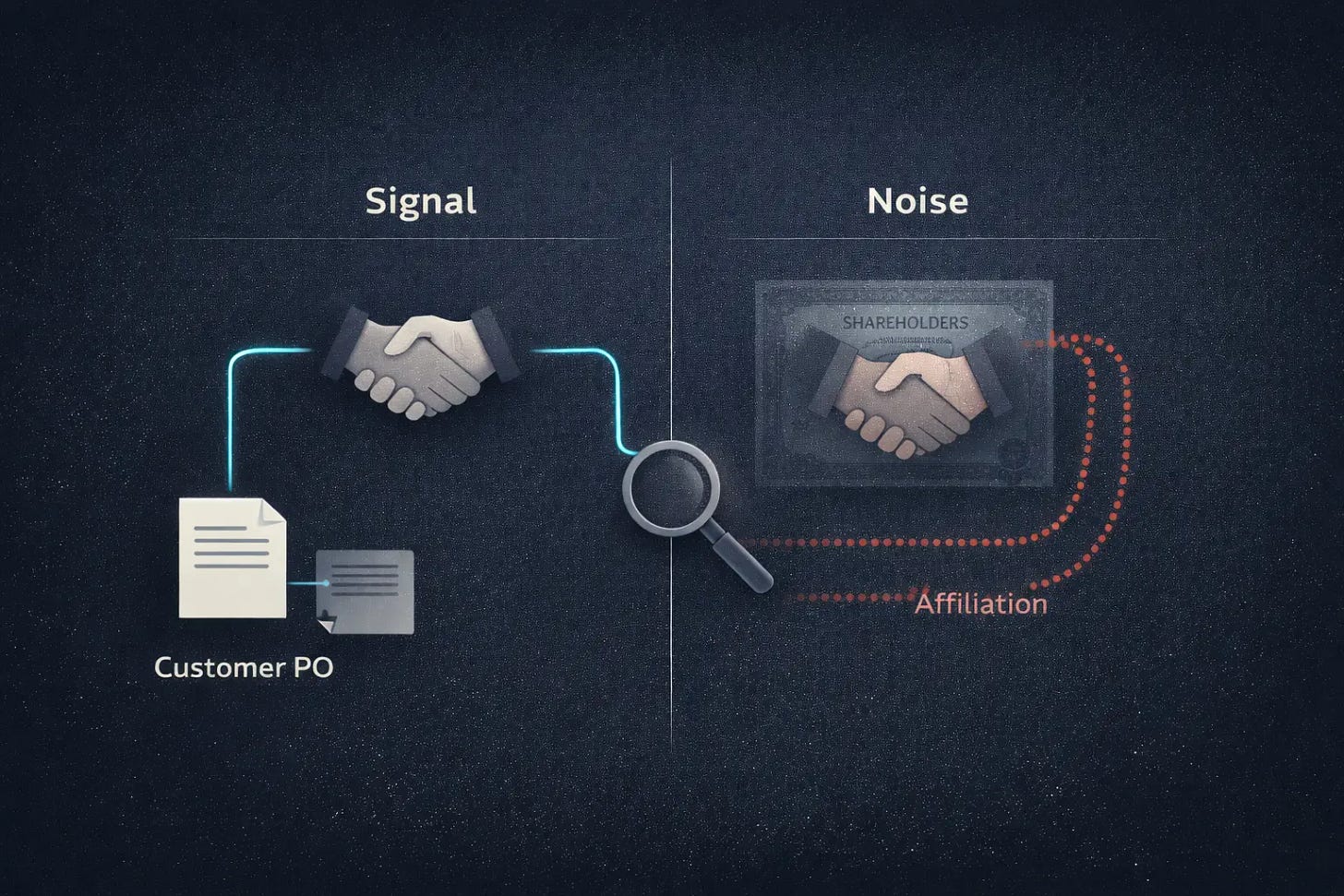

Distinguishing Signal from Noise

Genuine Market Traction vs. Amplified Traction:

When Chinese robotics companies announce orders, examine the buyer’s identity. Major announced orders often come from equity investors rather than independent customers. Agibot’s largest announced order came from Longcheer Technology, an equity investor. Zhipingfang’s RMB 500 million commitment came from HKC, a shareholder. As we have previously documented, this pattern is widespread across the sector.

This does not make these orders fraudulent. Strategic investors often become early customers. But orders from shareholders and orders from arm’s-length customers signal different things about product-market fit.

Technology Progress vs. Capital Market Progress:

Watch for inverse correlations between marketing intensity and product maturity. Companies with less capable products sometimes advertise most aggressively, because their priority is capital market perception rather than deployment success. When a robotics company outspends its revenue on marketing, ask what that spending ratio suggests about near-term commercial viability.

Timing Within the Cycle

The Zhu-Zhang debate suggests China’s embodied AI sector has reached a specific cycle stage: strong enough consensus to attract massive capital, but weak enough that prominent investors publicly exit and others feel compelled to defend the sector.

This stage typically precedes one of two outcomes. Either commercial validation arrives and silences skeptics, or validation fails to materialize and early bulls look prescient while late entrants suffer losses.

From early 2026 to mid 2027, the market will get clearer answers, not from demos, but from deliveries, renewals, and paid deployments. Companies that announced delivery commitments will either meet those commitments or explain why they could not. Many high-profile contracts represent framework agreements with uncertain execution likelihood rather than firm purchase commitments.

Risk-Adjusted Entry Points

For international investors seeking China robotics exposure, component suppliers may offer better risk-adjusted returns than integrated humanoid platforms. Motor manufacturers, sensor developers, and dexterous hand specialists face less binary outcomes. Their products serve multiple end markets. Their revenues depend less on any single application achieving commercial breakthrough.

Hillhouse Ventures has pursued this approach, investing in motor supplier Fuxing Electromechanical and tactile/dexterous hand developer Qianjue. The logic: even if humanoid robot volumes disappoint, these components find applications across industrial automation.

The Deeper Pattern

China’s embodied AI investment wave is not unique. The same consensus amplification sequence has appeared in electric vehicles, solar panels, mobile internet, and other sectors that attracted coordinated capital deployment.

Understanding the sequence matters more than evaluating the current sector. Today the subject is robotics. Tomorrow it will be brain-computer interfaces, or synthetic biology, or quantum computing. The mechanisms will remain constant: trigger events establish permission, amplification cycles create urgency, and fragility points determine which investments survive the inevitable correction.

International investors who master this pattern gain something more valuable than any single investment thesis. They gain a framework for participating in Chinese technology markets across multiple cycles, distinguishing amplified consensus from genuine opportunity, and timing their entries and exits accordingly.

The Zhu-Zhang debate will resolve itself. One of them will be proven right. But the mechanisms that created the debate, and the capital frenzy surrounding it, will generate similar debates in future sectors. The investors who profit consistently will be those who understand the machine itself, not merely the products it currently promotes.

What Comes Next

This analysis provides a starting framework. But frameworks require ongoing calibration.

Over the coming months, Hello China Tech will track the specific metrics that distinguish signal from noise in China’s robotics sector: independent customer acquisition rates, renewal patterns from early deployments, and the gap between announced orders and confirmed deliveries.

For readers who want deeper coverage: Hello China Tech Premium delivers weekly analysis of China’s technology and investment landscape, including sector deep-dives, policy tracking, and early signals on emerging consensus cycles.

Great analysis! Another question from international investors - once the next amplification wave becomes obvious, how do you identify the winners? In the EV wave, 400 out of 500 players died. The ones with the best of 六边形战士 qualities? Or with better GR / IR capabilities?

So we have a Ai and robot bubble,

Chinese investors never learn, ev bubbles, solar bubbles, bubble tea bubbles.