China's Humanoid Robot Boom Hits the Factory Floor

Can these machines beat the RMB 150,000 worker?

China’s humanoid robot sector just completed its most aggressive quarter of order announcements. Eight companies disclosed thousand-unit contracts within sixty days. The numbers look impressive until you examine who’s buying and why. Behind the headlines lies a deeper story: an industry discovering that factory economics are far more unforgiving than venture capital pitch decks.

The question is not whether these orders exist. The question is what these orders actually represent.

From Spectacle to Sales

The industry operated on venture theater for 18 months. Companies engineered robots to maximize social media virality. Backflips. Coffee pouring. Synchronized dancing. These demonstrations targeted one audience: institutional investors.

October 2025 marked a regime change.

Eight manufacturers announced thousand-unit orders within sixty days. The announcements follow a template: “Strategic partnership signed.” “Industrial deployment beginning.” “Delivery schedule confirmed.” The vocabulary shifted from capability to commercialization.

This transition is not market maturity. It is financing anxiety.

Venture funds are tightening deployment criteria. Series B rounds now require demonstrated revenue traction. The spectacle strategy has exhausted its utility. Companies need transaction evidence to justify valuations. They are forcing immature products into distribution channels.

The Economics Problem

Industrial buyers operate under rigid economic constraints. In Jiangsu and Zhejiang manufacturing clusters, comprehensive labor costs total RMB 150,000 annually per worker. This figure includes wages, mandatory insurance, dormitory expenses, and recruitment overhead.

This number establishes an absolute performance threshold for humanoid robotics.

Factory operators require 24-month payback periods for capital equipment. Total cost of ownership–hardware purchase, preventive maintenance, electricity consumption, software subscriptions–cannot exceed RMB 300,000 over two years. Any solution above this threshold fails commercial viability tests.

Current humanoid platforms struggle to meet this benchmark when configured for actual industrial tasks. Most high-capability robots cost RMB 200,000+ at wholesale. Operating expenses and downtime push total expenditure well beyond the ceiling.

The math creates an existential problem. These machines are not competing against Boston Dynamics prototypes. They are competing against human workers who are already deployed, already trained, and already cost-effective.

Can you beat Zhang from Suzhou on a spreadsheet? Most robots cannot.

In practice, this is not a metaphor. It is a spreadsheet.

Factory operators in Jiangsu and Zhejiang evaluate robots through a simple, brutal model built around three variables: cost, output, and risk.

Cost is the obvious one. Total expenditure over twenty-four months–hardware, maintenance, downtime penalties, electricity, software–must stay below RMB 300,000. Anything above that line fails immediately.

Output is less forgiving. A robot must deliver at least one full human-equivalent of annual work hours. That requires sustained uptime, fast task switching, and stable performance in dusty, hot, or noisy factory environments. Few current platforms meet these conditions outside controlled demos.

Risk is the silent killer. A single joint failure that stops a production line for thirty minutes can erase the economic benefit of weeks of flawless operation. Human workers make mistakes. Robots impose liabilities.

The Manufacturing Gamble

How do you solve a cost structure problem? You change the manufacturing paradigm.

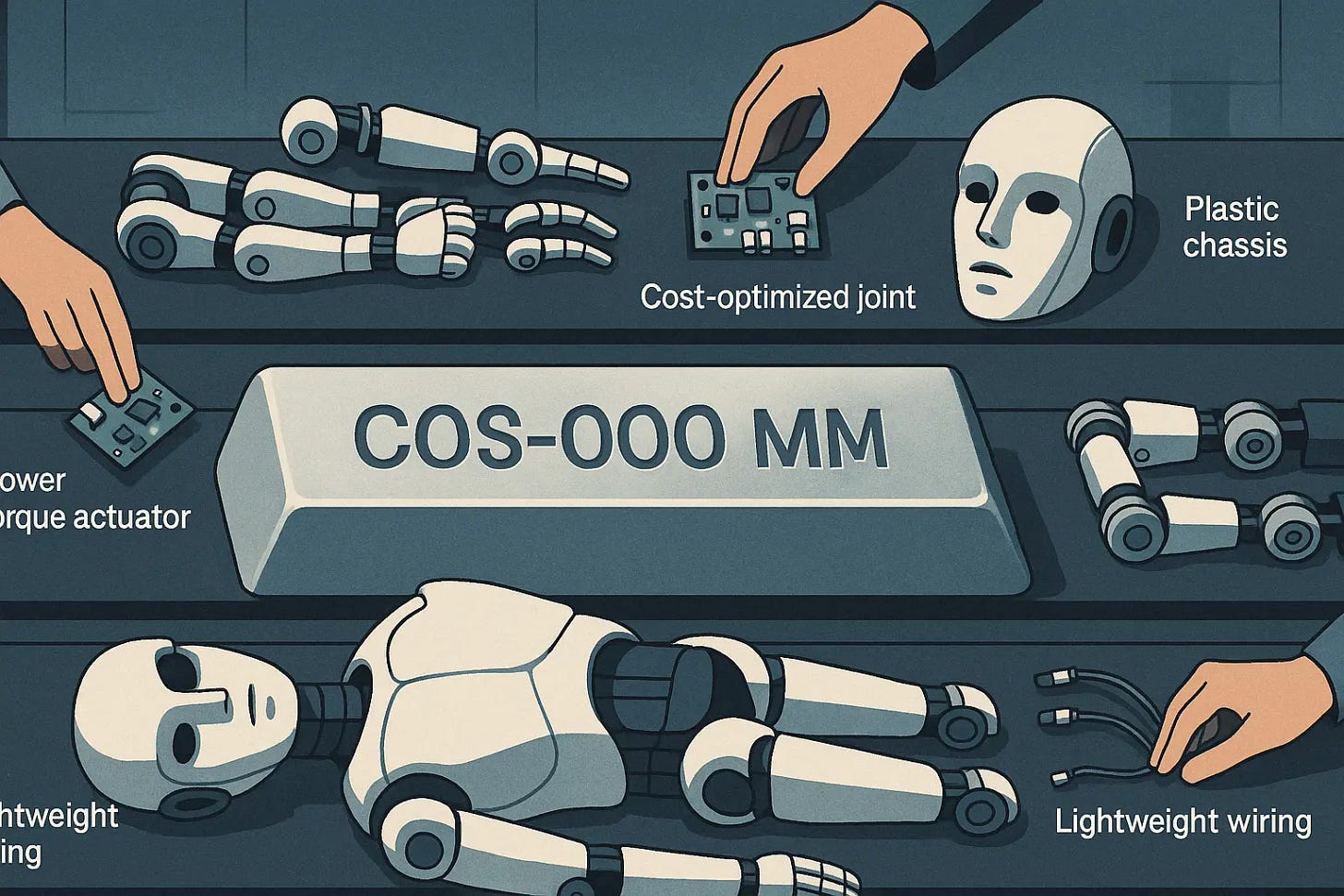

Agibot’s partnership with Longcheer Technology reveals the strategic direction. Longcheer operates as a top-tier ODM for Xiaomi and Huawei, producing millions of smartphones annually under contract. They apply consumer electronics supply chain logic to robot production.

This represents fundamental industry transformation. The humanoid robot is being reconceived as a consumer gadget rather than precision industrial equipment.

The smartphone-ization strategy employs brutal cost reduction. Replace aerospace aluminum with injection-molded plastics. Specify lower-torque actuators. Eliminate redundant sensors. Accept reduced performance envelopes. Optimize exclusively for bill-of-materials cost.

Noetix Robotics exemplifies the extreme version. Their RMB 9,998 Xiaobumi undercuts existing market pricing by 60–70%. This price point sits below estimated material costs for Western competitors. The strategy accepts thin or negative gross margins to capture volume.

The logic mirrors Xiaomi’s Redmi line: saturate the market with “good enough” products at predatory prices. Establish dominant market position. Iterate quality improvements over time.

Whether this approach works for robotics remains unproven. Smartphones benefit from massive economies of scale, standardized components, and clear value propositions. Robots face uncertain demand, immature supply chains, and poorly defined use cases.

The industry is racing toward commoditization before establishing defensible differentiation.

The Quality Crisis

Software scales frictionlessly. Hardware scales through friction.

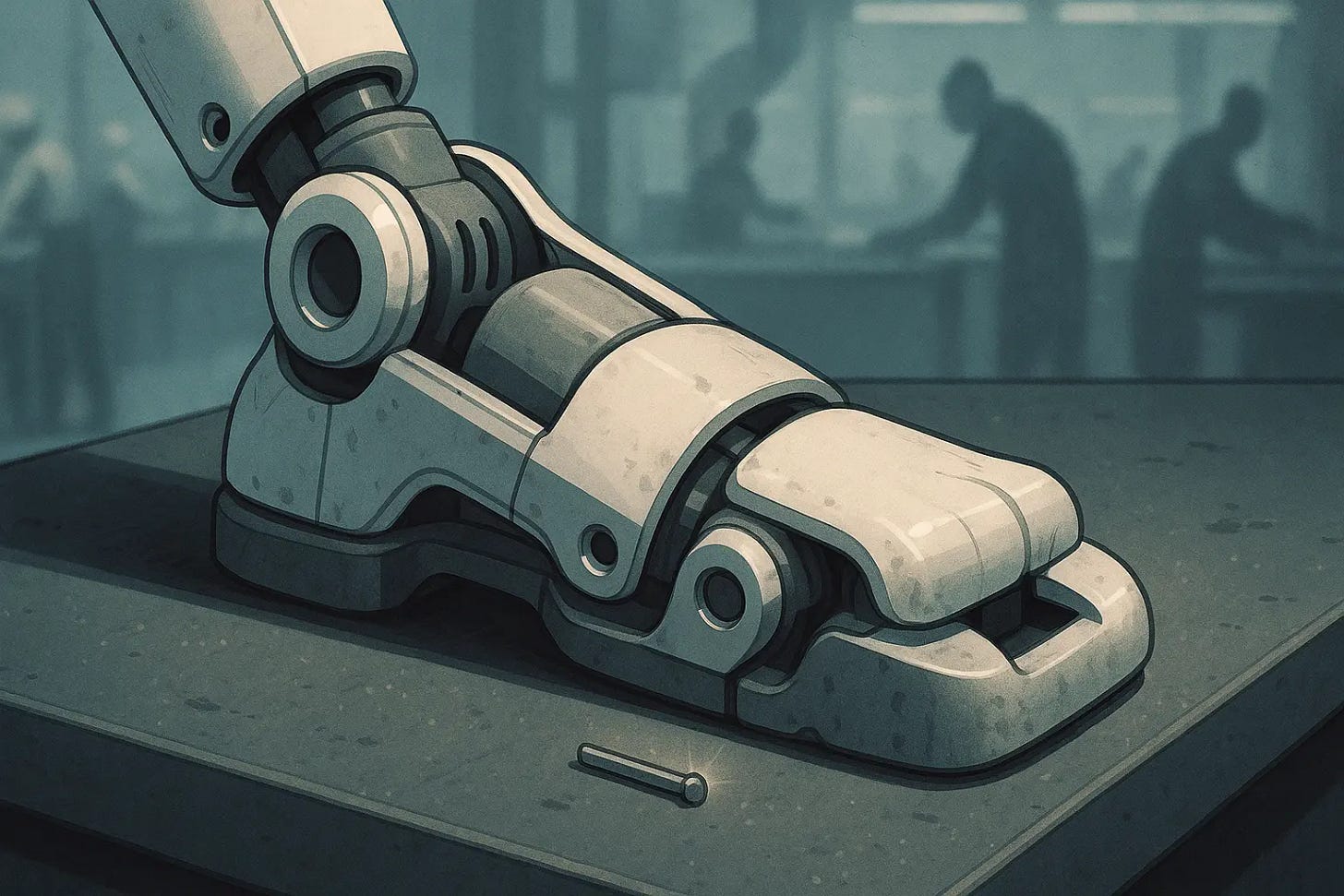

Noetix Robotics disclosed that early production runs suffered systematic ankle joint failures. The root cause: assembly line workers consistently omitted a small mechanical locking component. In laboratory conditions, expert technicians hand-assemble each robot with meticulous attention. In volume manufacturing, contract workers optimize for throughput.

The company’s response is instructive. Rather than implementing quality control procedures, they redesigned the assembly sequence to install pins during component receiving. This eliminates the failure mode regardless of worker behavior.

This incident crystallizes the delivery challenge. These machines integrate thousands of precision components under tight tolerances. Supply chains accustomed to smartphone production (high precision, low mechanical stress) or automotive manufacturing (high stress, looser precision) struggle with the hybrid requirements.

Yield rates remain inconsistent. A gear that functions correctly in one unit fails prematurely in the next. Surface treatments that pass inspection develop corrosion under field conditions. Joint assemblies that test within specification exhibit different performance characteristics.

Current production capacities expose the scale gap. Noetix Robotics operates a 200-unit monthly facility with a 300-unit plant coming online. Accelerate Evolution has delivered 700 total units since inception. These numbers are rounding errors compared to consumer electronics manufacturing.

The “thousand-unit orders” being announced will require multiple quarters to fulfill. Framework agreements structure deliveries across multi-year timelines. This creates revenue visibility for fundraising purposes while postponing the moment when deployed hardware faces actual performance validation.

Who’s Actually Buying?

Examine the customer identities. The pattern becomes clear.

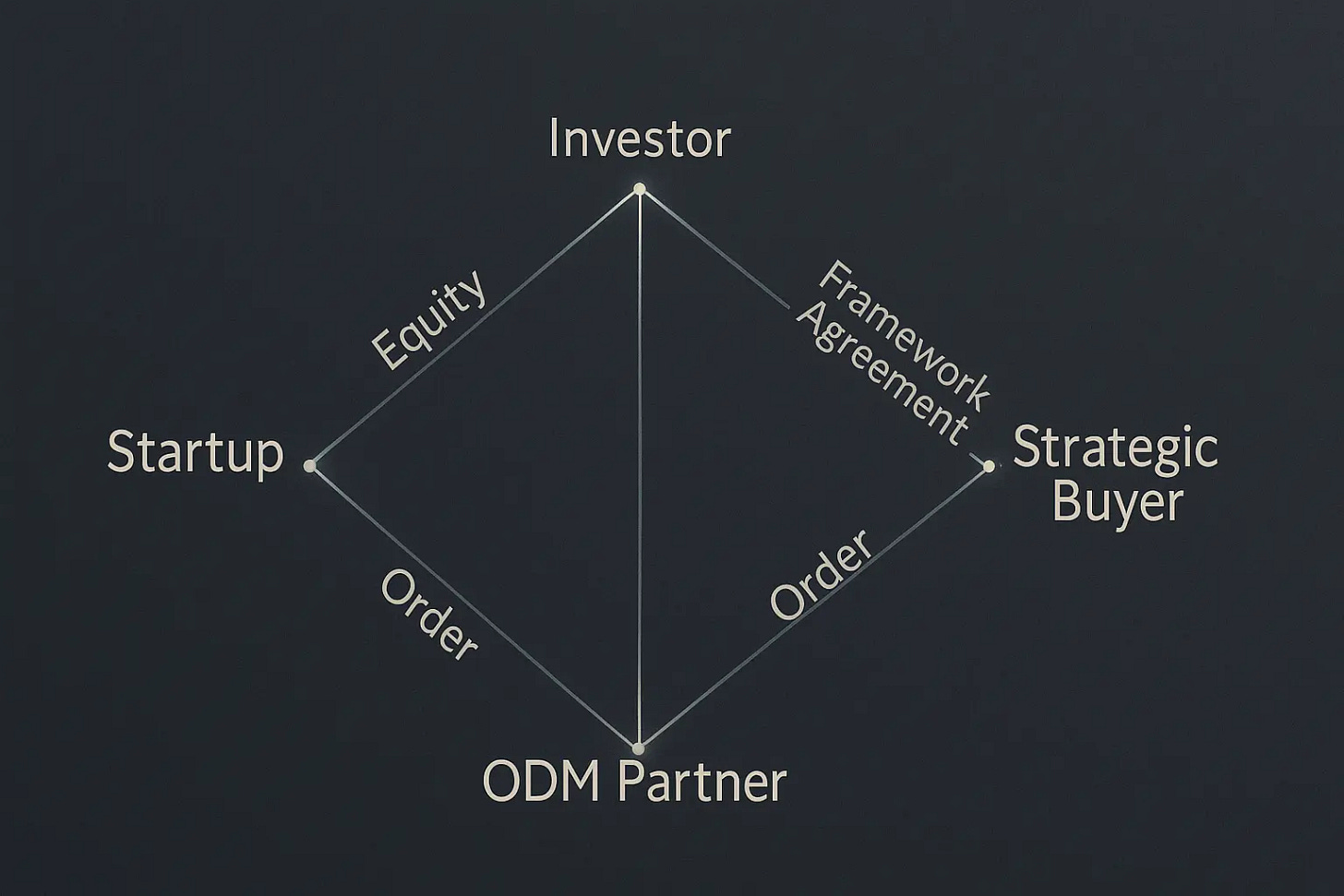

Agibot’s largest announced order comes from Longcheer Technology, an equity investor. Zhipingfang’s RMB 500 million commitment comes from HKC, a shareholder. Zhongqing’s 2,000-unit deal is with Duolun Technology, also an investor.

These transactions serve strategic purposes. Investors gain early technology access. Startups secure committed revenue for production planning. The structures provide mutual risk mitigation.

They do not, however, represent organic market demand. Price discovery becomes opaque when capital flows between affiliated entities. Payment terms may include non-cash considerations. Delivery schedules accommodate ongoing development requirements.

For external investors evaluating these companies, this distinction is critical. Revenue figures that satisfy accounting recognition may mask fundamental questions about standalone commercial viability.

The second major customer category–educational institutions–presents different concerns. Schools purchase robots for programming competitions and STEM demonstrations. These deployments face benign operating conditions: supervised use, short duty cycles, controlled environments.

A robot that succeeds in a university laboratory proves nothing about industrial readiness. The environments are incomparable. Factory floors feature dust, electromagnetic interference, continuous operation, and zero tolerance for downtime.

Educational sales generate legitimate revenue. They create the appearance of traction. They do not validate that the product can beat Zhang from Suzhou on a spreadsheet.

The Data Play

Despite these challenges, Chinese manufacturers are pursuing a coherent strategy. It is an asymmetric bet on training data accumulation.