China’s Robot Funds Bet on Exits, Not Engineering

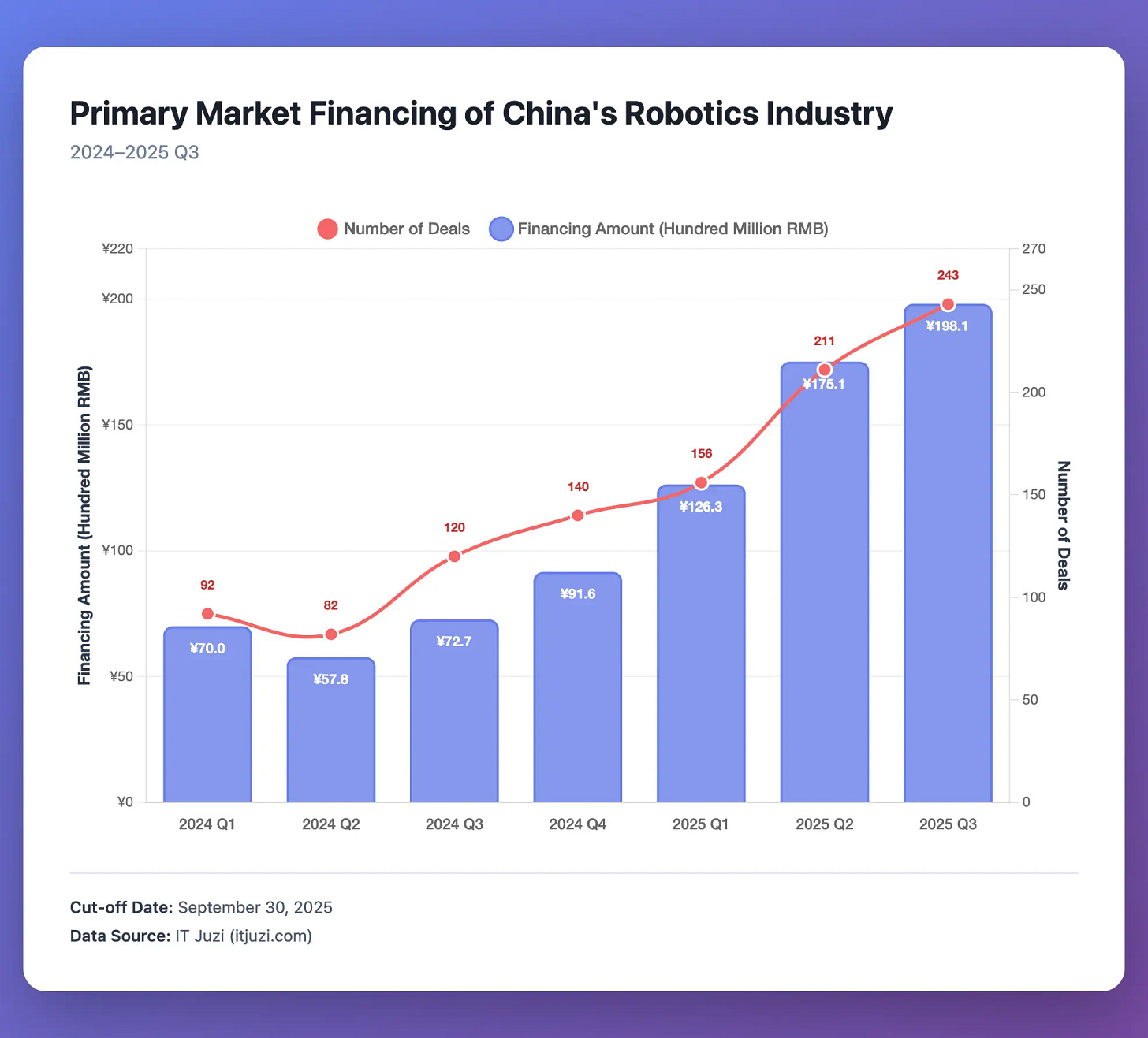

Local governments deploy $3.6bn to pre-position humanoid “assets” for near-term listings as land sales fade.

Editor’s note: This is Flashpoint, Hello China Tech’s premium quick-strike column. In about 700 words, we cut through the noise to unpack one market-moving China tech event and why it matters. Flashpoint drops whenever the story demands it–weekdays or weekends.

Today’s column tracks Beijing, Shanghai, Shenzhen, and Hubei racing to deploy $3.6 billion into humanoid robotics. Fund managers claim 10x returns in under 18 months. Three portfolio companies are queuing for IPO within a year. The robots lack mass markets. The timeline doesn’t care. This is municipal balance-sheet engineering–local governments converting robotics startups into listable “advanced manufacturing champions” as land-sale revenue vanishes. Beijing wants exits, not patient capital. The question isn’t whether the technology scales. It’s whether the listings clear. For the Flashpoint overview, see our introduction here.

Chinese local governments are deploying capital into humanoid robotics with a velocity that suggests fiscal engineering rather than patient technology investment. Since early 2025, Beijing, Shanghai, Shenzhen, and Hubei have established robotics-focused funds totaling over 26 billion yuan ($3.6 billion), with managers already claiming triple-digit portfolio returns and eyeing near-term listings. The scale and speed point to a familiar playbook: replicate the new energy vehicle subsidy model, but compress the timeline.

The numbers tell the story. Beijing’s 1 billion yuan robotics fund, established in early 2024 and managed by Hong Kong-listed Shoucheng Holdings, completed over ten deals in 2025 alone. Portfolio companies include high-profile names like Unitree Robotics and Galaxy General. By April, management claimed the fund’s book value had tripled since inception, with select holdings returning ten-fold. More tellingly, three portfolio companies are slated for IPO within the next year. Shanghai’s 560 million yuan first-close fund, registered in April, led its debut investment in domestic player Embodied Intelligence within a month. Hubei’s 10 billion yuan parent fund (5 billion yuan first phase) closed its first deal–local dexterous hand developer Hand Intelligence–within months of establishment.

This is not venture capital. It is municipal balance-sheet repositioning.