China's Solar Panel Playbook, Now Running on AI

Chinese AI labs are commoditizing coding models with the same strategy that reshaped solar and batteries. Western startups are adapting--by building on Chinese foundations they won't acknowledge.

Editor’s Note: This is FlashPoint, Hello China Tech’s premium quick-strike column. In about 700 words, we cut through the noise to unpack one market-moving China tech event and why it matters. FlashPoint drops whenever the story demands it–weekdays or weekends.

Today’s column exposes what U.S. investors missed: the AI startups they funded are quietly building on Chinese infrastructure. Cursor’s “proprietary” model thinks in Chinese. Windsurf runs on GLM. Chinese coding models now match Claude at 8 per cent of the price–and Western startups are betting on them while calling it innovation. This is the solar panel playbook running on software. If you’re investing in the AI stack, the dynamics below are already affecting your portfolio. For the FlashPoint overview, see our introduction here.

Western AI startups are quietly building on Chinese foundations–and pretending they are not. Last week Cursor launched version 2.0 featuring Composer, marketed as its first proprietary model. Developers quickly noticed Composer “thinks” in Chinese and exhibits reasoning patterns matching Alibaba’s open-source Qwen Code. Separately, U.S. unicorn Cognition AI released SWE-1.5 for its Windsurf IDE, claiming it runs six times faster than Anthropic’s models. Jailbreak tests revealed the model identifies itself as GLM, Zhipu AI’sfoundation model family.

Industry observers view this as validation rather than scandal. But the pattern runs deeper than opportunistic startups cutting corners. Chinese firms are executing a familiar playbook: flood the market with technically competitive, radically cheaper alternatives until incumbent pricing collapses. The target this time is not solar panels or batteries, but the foundation models powering enterprise software development.

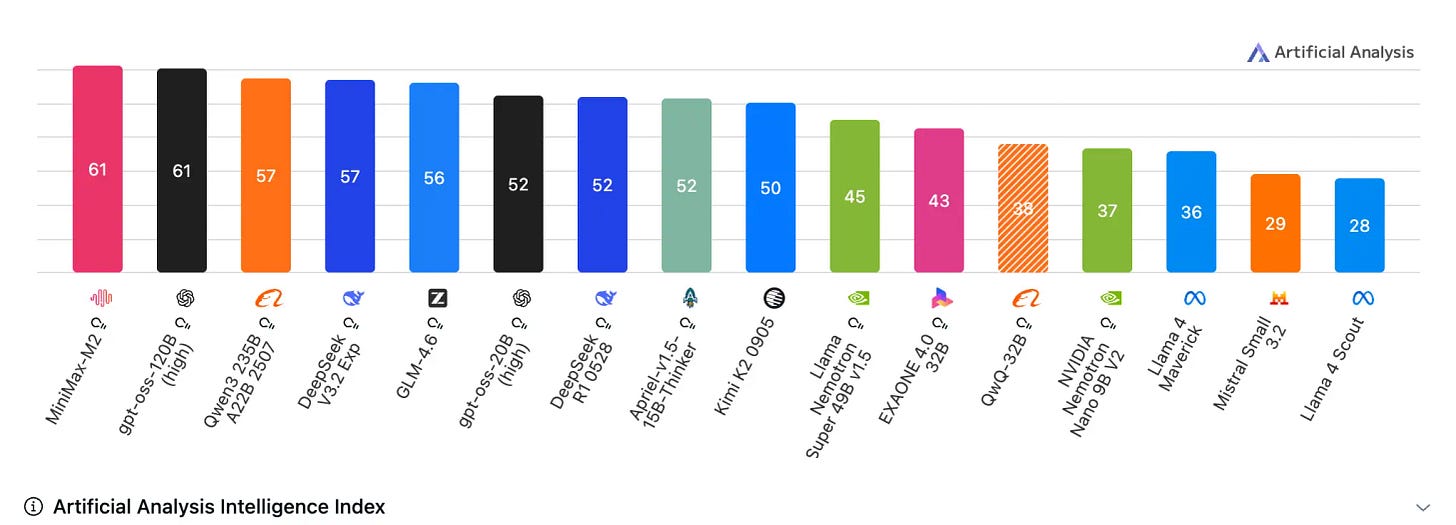

Between July and October 2025, Moonshot AI’s Kimi K2, Zhipu AI’s GLM 4.6, and MiniMax’s M2 all launched with explicit positioning as “coding and agent” specialists. Performance metrics suggest parity with frontier models. GLM 4.6 scored 68.0 percent on SWE-bench Verified, a benchmark testing real GitHub issue resolution, clustering near Claude Sonnet 4.5’s 77.2 percent. On LiveCodeBench, which evaluates multi-language coding, GLM 4.6 hit 82.8 with tool support, approaching Claude Sonnet 4’s 84.5. Kimi K2 and MiniMax M2 show similar results–all within striking distance of Western leaders.

The pricing tells a different story. MiniMax M2charges $0.30 per million input tokens and $1.20 per million output tokens–roughly 8 percent of Claude Sonnet’s rate. Zhipu markets GLM 4.6 as one-seventh the cost of Claude with three times the usage allowance. All three models carry MIT licenses, permitting unrestricted commercial use. This is not cost leadership; it is strategic commoditization. By open-sourcing weights and undercutting API pricing, Chinese labs are treating coding capability as a commodity input rather than a defensible moat.

Coding models present ideal conditions for this strategy.