China’s $5.5 Billion AI Unicorn Just Killed Its Product Team

Zhipu AI’s pre-IPO pivot reveals the hidden economics of building a national AI champion–and why “China’s OpenAI” might become China’s Palantir instead.

In the high-stakes world of generative AI, a pre-IPO unicorn conducting layoffs is typically a sign of one of two things: a last-minute dash to beautify financials or a worrying indicator of underlying weakness. When news broke that Zhipu AI, China’s Tsinghua-spun, state-backed answer to OpenAI, was making sudden and deep cuts–reportedly dismantling its entire standardized product center–the initial reaction was to see it as a classic case of pre-listing belt-tightening. The company’s official response, framing the move as routine performance optimization while simultaneously advertising nearly 50 open roles, did little to clarify the situation.

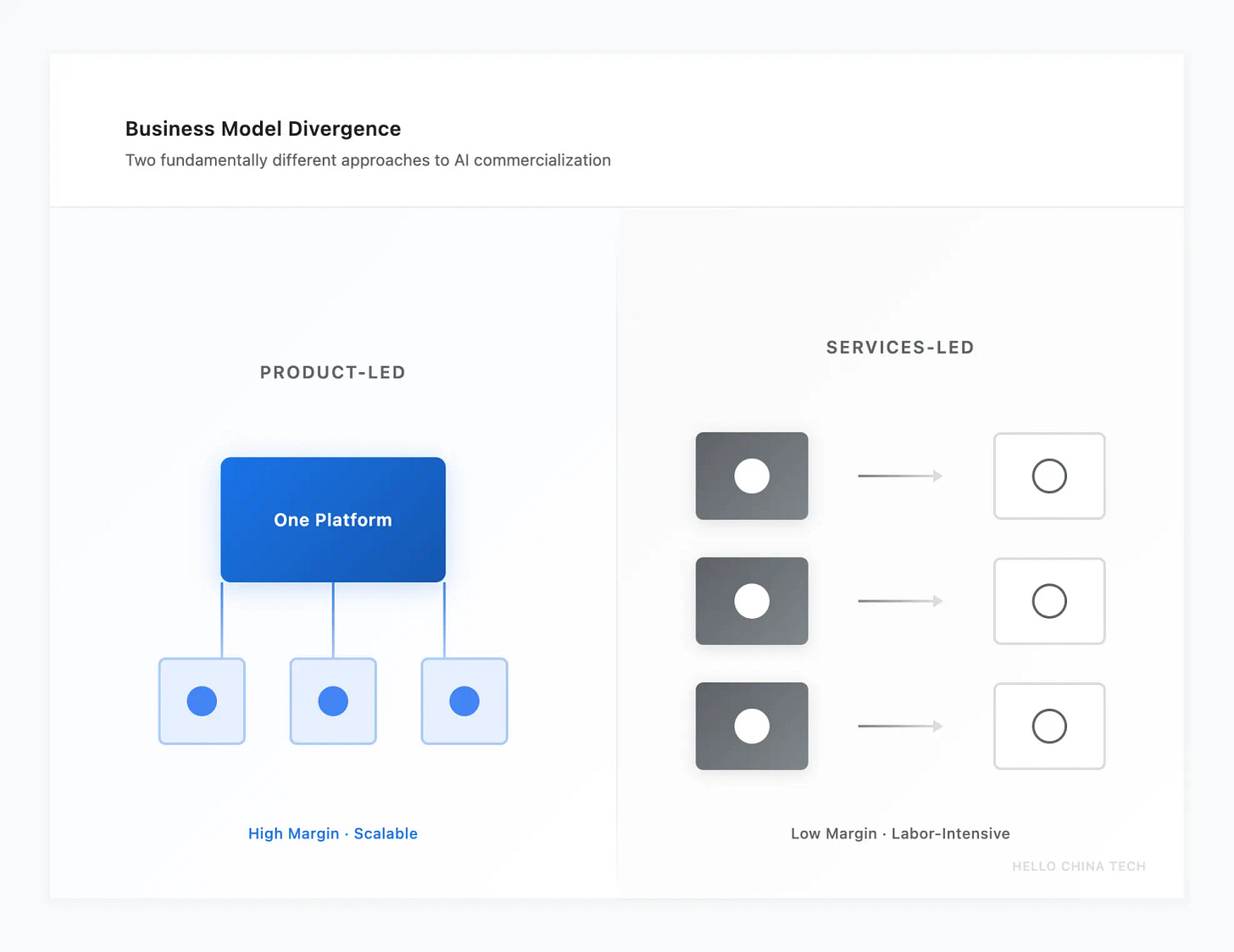

But to view these layoffs through a standard Silicon Valley lens is to miss the real story. This is not merely about trimming costs for a better-looking P&L ahead of its much-anticipated public offering. It is a fundamental strategic pivot, one that speaks volumes about the unique commercial realities of building an AI champion in China. Zhipu AI is not just shedding staff; it is shedding a Western-style, product-led growth strategy in favor of a model that is far more familiar, and perhaps more viable, within China’s state-dominated economy: a high-touch, labor-intensive, custom services business.

This move is a tacit admission that the dream of building a highly scalable, low-friction AI software-as-a-service (SaaS) empire–the model that underpins the colossal valuations of Western AI leaders–does not neatly map onto the current structure of China’s most lucrative AI market. For global investors, this pivot forces a critical question: what kind of company is Zhipu AI actually becoming, and can a business built on custom projects for state clients ever justify a valuation on par with the world’s most scalable technology platforms?

From SaaS Dream to Services Reality

The heart of Zhipu’s restructuring appears to be the dismantling of its “产研中心” (Product Research & Development Center). In a typical tech company, this division is the engine of scalability. It builds standardized, replicable products that can be sold to thousands of customers with minimal customization, leading to the high gross margins that investors cherish. For Zhipu, this center was responsible for creating its standardized intelligent agent and MaaS (Model-as-a-Service) platforms. Its dissolution, with remaining staff reportedly being re-assigned to “delivery” roles within vertical business units, is a strategic white flag on the product-led growth model.

This shift stems directly from the nature of Zhipu’s target customer base. The primary market for foundational AI models in China today is not a fragmented landscape of agile SMEs eager to adopt off-the-shelf SaaS tools. Instead, it is dominated by a concentrated group of powerful and deep-pocketed clients: large state-owned enterprises (SOEs) and government bodies (a market often shorthanded as ToB/ToG).

These clients operate under a completely different logic than their Western commercial counterparts. Their primary concerns are not just efficiency and cost, but data security, regulatory compliance, and strategic alignment with national objectives. Consequently, they almost universally demand:

Private Deployments: They will not send their sensitive data to a public cloud API. Models must be deployed on-premises or within a private, controlled environment.

Heavy Customization: Off-the-shelf solutions are rarely sufficient. The model must be fine-tuned on their proprietary data and integrated deeply into legacy IT systems.

“Delivery” Over “Product”: They are not buying a piece of software; they are procuring a complete, end-to-end solution. This involves extensive consulting, implementation, training, and ongoing maintenance.

This market reality turns the scalable software model on its head. Instead of one product serving many, Zhipu is being forced into a model where it provides a bespoke service for each major client. While this can lead to large, impressive-sounding contracts–like the reported ¥60 million deal with Hangzhou City Investment–the underlying unit economics are fundamentally different. These are not high-margin, recurring revenue streams. They are people-intensive projects with the financial profile of a high-tech consultancy or a systems integrator, not a hyper-growth software company.

The financial data underscores the immense pressure. A reported revenue of ¥300 million in 2024 against a staggering loss of ¥2 billion reveals the brutal cash burn required to stay at the cutting edge of model training. In this context, securing predictable, albeit lower-margin, project revenue becomes a matter of survival. The pivot is a pragmatic choice to secure cash flow, even at the expense of the scalable dream.

Zhipu’s layoffs are not just cost-cutting. They reveal the true economics of building a national AI champion — and the limits of scalability inside China’s political economy.

Let’s unpack that — what exactly is Zhipu becoming?