Billion-Dollar Bets or Paper Orders? China's Humanoid Robot Rush

Why the headline numbers tell only half the story–and what investors should actually be watching.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

China’s humanoid robot sector has abruptly shifted gears. After years of tech demonstrations and incremental progress, the industry has exploded into what can only be described as an “order rush”–a frantic competition where nine-figure RMB contracts have become the new currency of credibility. In recent months, UBTECH announced record-breaking deals, StarDust Intelligence claimed a thousand-unit order, and multiple companies secured major contracts with China’s largest state-owned enterprises.

This represents a fundamental inflection point. The question is no longer whether these robots work, but whether the torrent of announced orders represents genuine commercial demand or a sophisticated mirage designed to attract investment and justify soaring valuations. For investors navigating this rapidly evolving landscape, the ability to distinguish between real contracts and “vanity orders” has become the critical skill separating winners from casualties.

The stakes could not be higher. As UBTECH’s Chief Brand Officer Tan Min recently stated, “We’re not worried about lacking orders; we’re worried about being slower than competitors.” This sentiment captures the industry’s new reality: companies are moving from the laboratory to what industry insiders are calling “delivery hell”–the brutal transition from signed contracts to successful, large-scale deployment. Understanding this shift, and the hidden risks it contains, is essential for anyone seeking to profit from–or avoid losses in–one of the world’s most hyped emerging industries.

Why Everyone’s Suddenly Buying Robots

The transformation began with a psychological trigger: Figure AI’s $2.6 billion valuation, achieved before delivering meaningful commercial scale, created severe “valuation anxiety” among Chinese competitors. Suddenly, R&D milestones and technical demonstrations were insufficient. Investors–both venture capitalists and public market participants–demanded tangible evidence of commercial traction. Large-scale orders, regardless of their immediate profitability, became the most potent currency for justifying valuations and signaling market leadership.

This pressure coincided with Beijing’s strategic push for “New Quality Productive Forces,” a policy directive that unlocks state capital for advanced manufacturing and creates protected demand for domestic automation. The result: a perfect storm where companies desperately need orders to satisfy investors, and the state is actively creating demand to advance industrial policy goals.

The numbers are staggering. UBTECH recently announced a 250 million RMB contract that set a new global record for single humanoid robot orders. Galbot secured contracts worth 700+ million RMB, while Xingchen Zhinen (星尘智能) and Zhipingfang Keji (智平方科技) each reported deals exceeding 500 million RMB. The China Mobile tender–124 million RMB won jointly by AgiBot and Unitree Robotics–marked another significant milestone in large-scale procurement. But this is just the beginning. Across the sector, companies are announcing contracts that dwarf their previous revenue by orders of magnitude. The question investors must answer is deceptively simple: which of these orders are real?

Real Money vs. Fake Orders: The Credibility Hierarchy

Not all orders are created equal. Through extensive analysis of recent announcements, contract details, and customer verification, a clear hierarchy of order quality emerges. Understanding this taxonomy is crucial for investment decision-making.

Tier 1: The Blue-Chip Contracts (High Credibility)

These represent genuine, well-capitalized demand from established entities with clear use cases and proven payment capacity. The characteristics are unmistakable:

Sophisticated Buyers: Major SOEs, established automotive manufacturers, consumer electronics giants, and multinational corporations with genuine operational needs

Transparent Procurement: Formal tender processes, public announcements, and verifiable contract terms

Logical Use Cases: Clear automation benefits in manufacturing, logistics, or service environments where labor costs justify investment

Payment Security: Buyers with strong balance sheets and budget allocation history

The China Mobile contract exemplifies this tier. As one of the world’s largest telecommunications companies with over $100 billion in annual revenue, China Mobile has both the financial capacity and operational rationale to deploy robots across retail locations and service centers. The 124 million RMB joint contract awarded to AgiBot and Unitree Robotics, with formal bidding processes and public procurement announcements, signals genuine commercial intent with phased deployment plans spanning 2025–2027.

Similarly, contracts from automotive manufacturers represent high-quality demand. These companies have decades of experience with industrial automation, sophisticated ROI calculations, and proven ability to integrate complex systems into production workflows.

Tier 2: The Growth Vectors (Medium Credibility)

This category encompasses orders from private enterprises, emerging market players, and international clients where the commercial logic is sound but execution risk is higher:

Private Industrial Enterprises: Smaller manufacturers seeking competitive advantage through early automation adoption

Logistics Companies: Regional and specialized logistics providers experimenting with warehouse automation

International Clients: Overseas buyers, particularly in Middle Eastern markets where sovereign wealth funds drive technology adoption

These orders often start smaller but represent the most potent indicator of genuine market-driven demand. They lack state subsidy support, requiring robots to demonstrate clear ROI. Success here signals true product-market fit and global competitiveness.

Leju Robotics’ partnerships with German factories fall into this category. While smaller in scale than the headline-grabbing SOE contracts, these deals represent customers making purely commercial decisions based on expected returns. Their success or failure will determine whether Chinese humanoid robots can compete in global markets without policy support.

Similarly, Unitree Robotics’s performance provides a valuable benchmark. The company reported over 1 billion RMB in revenue for 2024, with humanoid robots accounting for approximately 30% of total revenue and roughly 1,400 units delivered. This demonstrates the potential for diversified robotics companies to build sustainable businesses across multiple product lines.

Tier 3: The Red Flags (Low Credibility)

The intense pressure to announce impressive numbers has inevitably created a category of questionable deals that investors must learn to identify:

Newly Established Buyers: Companies incorporated days or weeks before contract announcements

Related-Party Transactions: Deals involving shared personnel, investors, or ownership structures

Vague Terms: Announcements lacking specific delivery schedules, payment milestones, or technical specifications

Implausible Scale: Orders that exceed reasonable operational capacity or market demand

The Tiantai Jiqiren (天太机器人) case provides a perfect example. The company announced a spectacular 10,000-unit order worth billions of RMB. Investigation revealed the purchasing company–Shandong Future Robot Technology Co., Ltd.–was established on August 8, 2025, just 12 days before the deal announcement. Further scrutiny uncovered overlapping personnel between buyer and seller, with Shandong Future Data indirectly controlling Shandong Future Robot through subsidiary structures. These are classic hallmarks of a non-arm’s-length transaction designed for publicity rather than genuine deployment.

Such deals pose significant risks to investors who take them at face value. They inflate market expectations, distort competitive analysis, and often collapse under scrutiny, damaging company credibility and investor confidence.

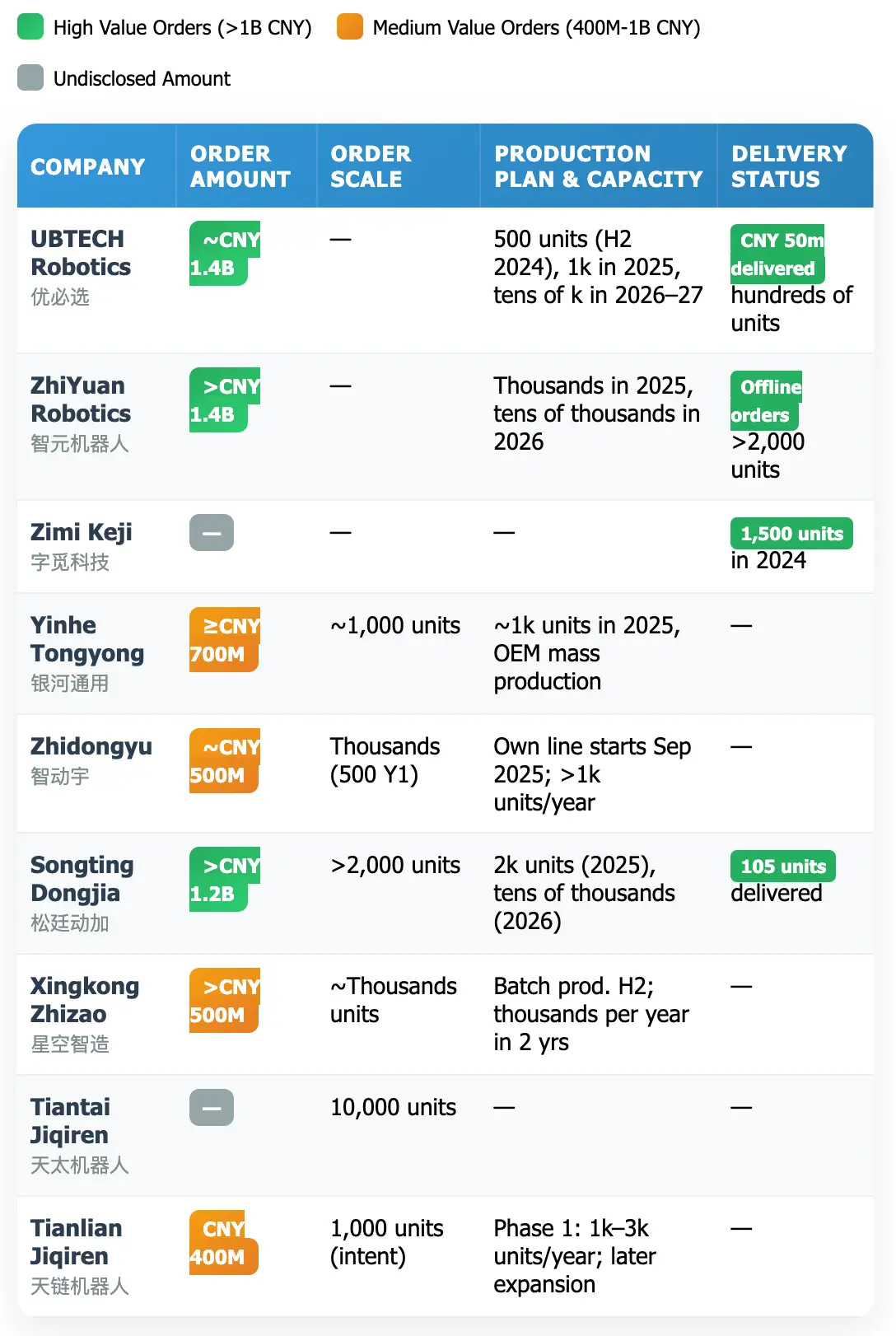

The following comprehensive data analysis of major Chinese humanoid robotics companies illustrates these credibility patterns in practice:

Table 1: Order Scale vs. Production Reality - Major Chinese Humanoid Robotics Companies

But raw order numbers only tell half the story. The real test begins with execution.