China's GPU Gold Rush: Betting Billions on Sub-3% Market Share

Billions are flowing into Chinese GPUs with almost no market share. This is why investors still buy.

Editor’s Note: This is FlashPoint, Hello China Tech’s premium quick-strike column. In about 600 words, we cut through the noise to unpack one market-moving China tech event and why it matters. FlashPoint drops whenever the story demands it, weekdays or weekends.

Today’s column examines China’s GPU IPO frenzy–four chipmakers raising billions with combined sub-3% market share. Moore Threads, MetaX, Biren, and Iluvatar CoreX are burning cash at unprecedented rates while Nvidia still holds over half their home market. The investment thesis only makes sense if you believe geopolitics, not fundamentals, determines winners. We’ve tracked this IPO wave since venture funding evaporated in November.

The question now shifts from why they listed to why investors are buying.

Four Chinese chipmakers–the so-called “GPU Four Dragons”–have raised billions in the past months, riding investor enthusiasm for homegrown alternatives to Nvidia. Moore Threads surged over 400% on its Shanghai debut, MetaX Integrated broke A-share records with Rmb395,200 single-lot gains, while Biren Technology and Iluvatar CoreX just cleared Hong Kong listing hurdles last week. Strip away the IPO frenzy, however, and the fundamentals look sobering: combined market share below 3%, research spending outpacing revenue fourfold, and profitability timelines pushed to 2026 or beyond.

The investment case rests on necessity rather than achievement. Washington’s semiconductor controls have effectively barred Chinese AI developers from accessing Nvidia’s H100 chips, creating forced demand for domestic substitutes. Moore Threads, MetaX, Biren, and Iluvatar–all founded between 2015 and 2020 by former Nvidia and AMD executives–position themselves as Beijing’s answer. Their technical pedigree is genuine. Their commercial traction is not.

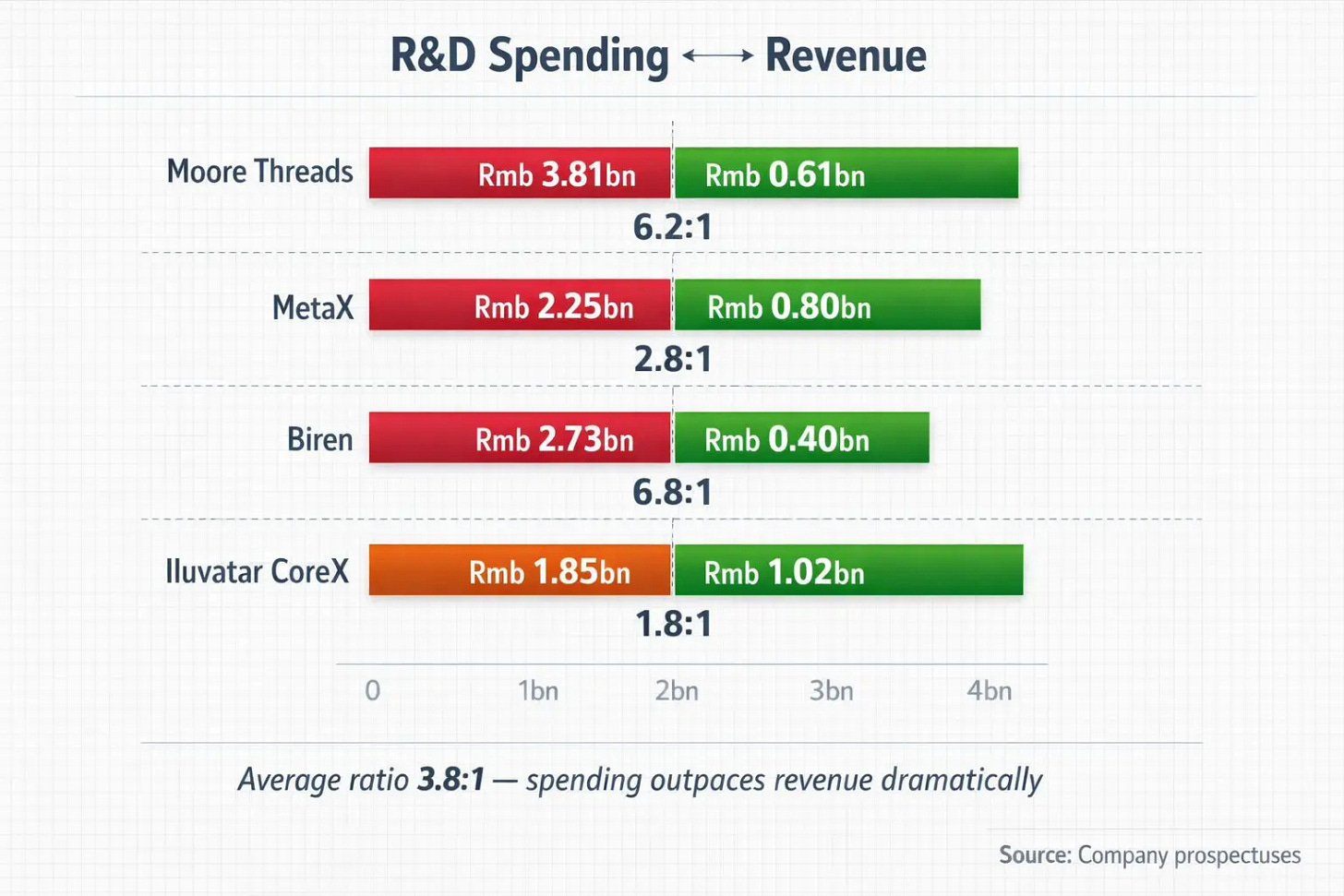

Consider the cash burn. Across 2022–2024, the quartet poured Rmb10.63bn into R&D while generating just Rmb2.82bn in cumulative revenue. Moore Threads alone spent Rmb1.36bn on development last year against sales of Rmb438m–a ratio exceeding 300%. Iluvatar burned through Rmb1.85bn in R&D over three years while booking Rmb1.02bn in revenue. Losses over three years total Rmb15.02bn, with Moore Threads accounting for Rmb5bn, MetaX for Rmb3.06bn, Biren for Rmb4.76bn, and Iluvatar for Rmb2.26bn. First-half 2025 figures show scant improvement: Biren burned Rmb1.6bn while booking just Rmb59m in revenue; Iluvatar lost Rmb609m against Rmb324m in sales.

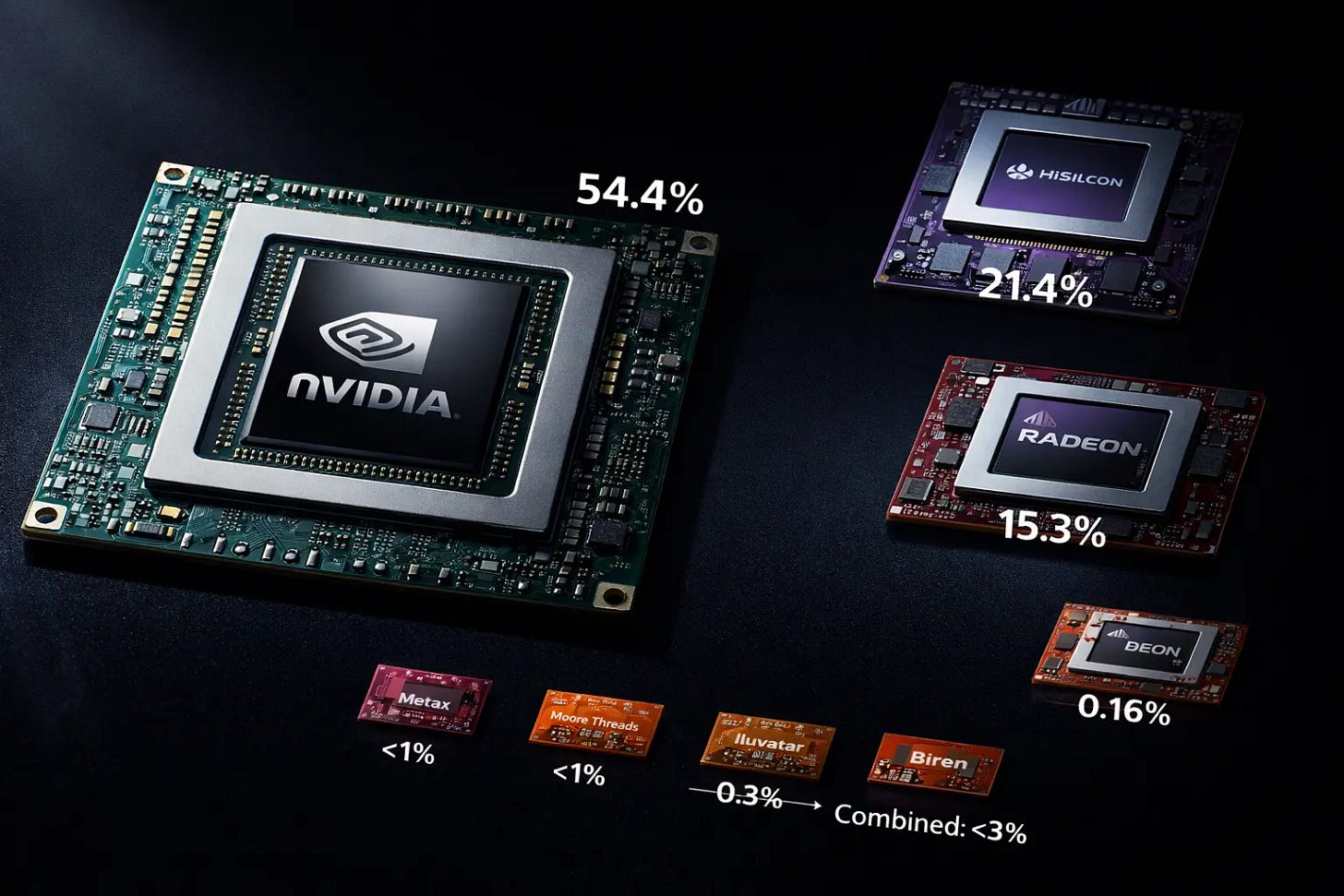

Market penetration tells the real story. Despite export restrictions, Nvidia held 54.4% of China’s 2024 AI chip market, according to Moore Threads’ prospectus. Huawei’s HiSilicon captured 21.4% through custom ASICs, AMD took 15.3%. The four GPU specialists combined barely register in the general-purpose GPU segment: MetaX claims roughly 1%, Moore Threads admits to “under 1%,” Iluvatar manages 0.3%, and Biren captures just 0.16% of the broader smart computing segment. Over 15 domestic players chase the remaining scraps, with none breaking 1% penetration individually.