China's GPU Makers Burn Rmb6bn Racing Toward IPO Exits

Moore Threads and rivals are heading to market with billion-yuan burn rates and captive customers. Public investors will fund what venture capital won’t.

Editor’s Note: This is FlashPoint, Hello China Tech’s premium quick-strike column. In about 700 words, we cut through the noise to unpack one market-moving China tech event and why it matters. FlashPoint drops whenever the story demands it, weekdays or weekends.

Today’s column reveals why China’s AI chip startups are rushing to IPO–and it’s not because they’re winning. Moore Threads just launched its prospectus with ticker secured, leading a wave of Chinese GPU makers toward public markets. The startups spent Rmb3.8bn and Rmb2.5bn respectively on R&D while generating barely 30% of that in revenue. Venture capital has stopped writing checks. The real question is whether public market patience will outlast product development timelines–or whether quarterly scrutiny will expose what private investors already know. For the FlashPoint overview, see our introduction here.

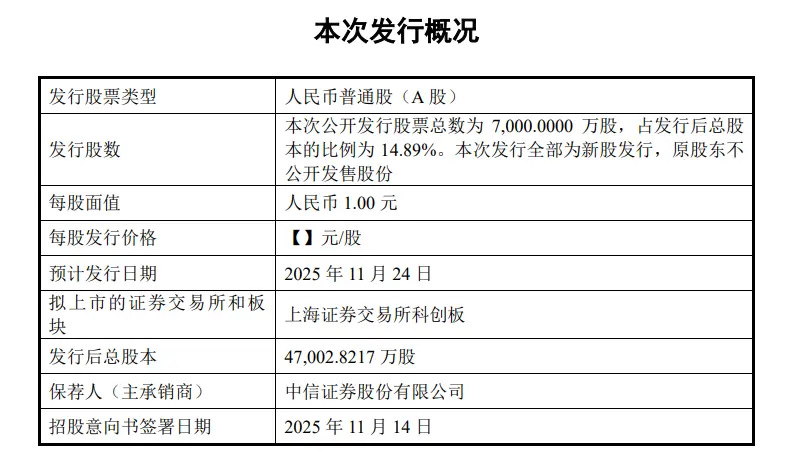

Moore Threads issued its prospectus this week and formally launched offering procedures for a Shanghai STAR Market listing. The company has secured its ticker symbol–688795–and set a timetable: preliminary inquiry November 19, subscription November 24. MetaX filed earlier but remains steps behind. Biren and other Chinese AI chip startups are preparing Hong Kong applications. The synchronized rush toward public markets carries an unambiguous message: venture capital has closed its wallet.

These startups frame listings as validation. The reality is desperation. Moore Threads spent Rmb3.8bn on R&D over three years while booking Rmb1.3bn in revenue. MetaX burned Rmb2.5bn developing chips that generated Rmb1.1bn in sales. Neither covers operating costs from customer payments. Cash reserves look substantial–Rmb4.9bn and Rmb5.7bn respectively–until measured against burn rates that demand another product cycle. Even Cambricon, already public and once feted as China’s chip champion, needed Rmb4bn in September to fund its next design.

The pivot to exchanges follows predictable logic. Dollar funds are retreating. Renminbi investors remain active but increasingly selective. Venture capitalists who backed these startups now face a choice: fund losses indefinitely or push portfolio companies toward liquidity events before markdowns accelerate. Public markets offer the only remaining source of patient capital willing to finance cumulative losses exceeding development timelines.