China's AI Startups Enter Their Darwin Moment

Squeezed by deep-pocketed giants and brutal economics, Chinese AI companies discover that survival means choosing what you can actually defend.

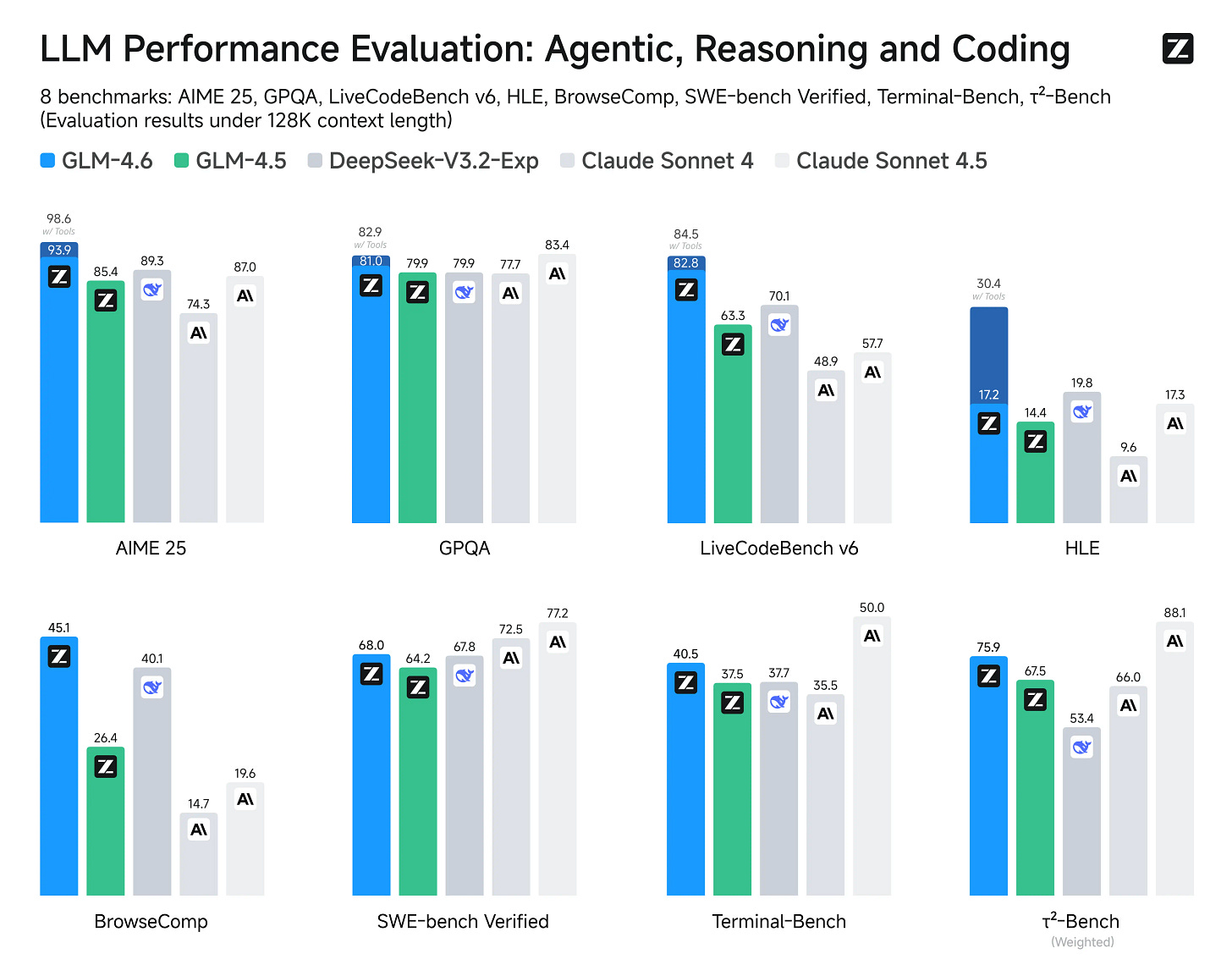

The past week delivered two stories that seemed to chart different survival paths for Chinese AI startups. On November 4th, Zhipu AI announced a tenfold surge in overseas paid users over the past two months. China’s state-backed AI champion appeared to be breaking free from its domestic cage, going global to compete with OpenAI and Anthropic. The Beijing-based company now serves around 100,000 monthly API users and 3 million free chatbot users overseas following the launch of its flagship GLM-4.6 model. International business growth was reportedly exceeding domestic expansion.

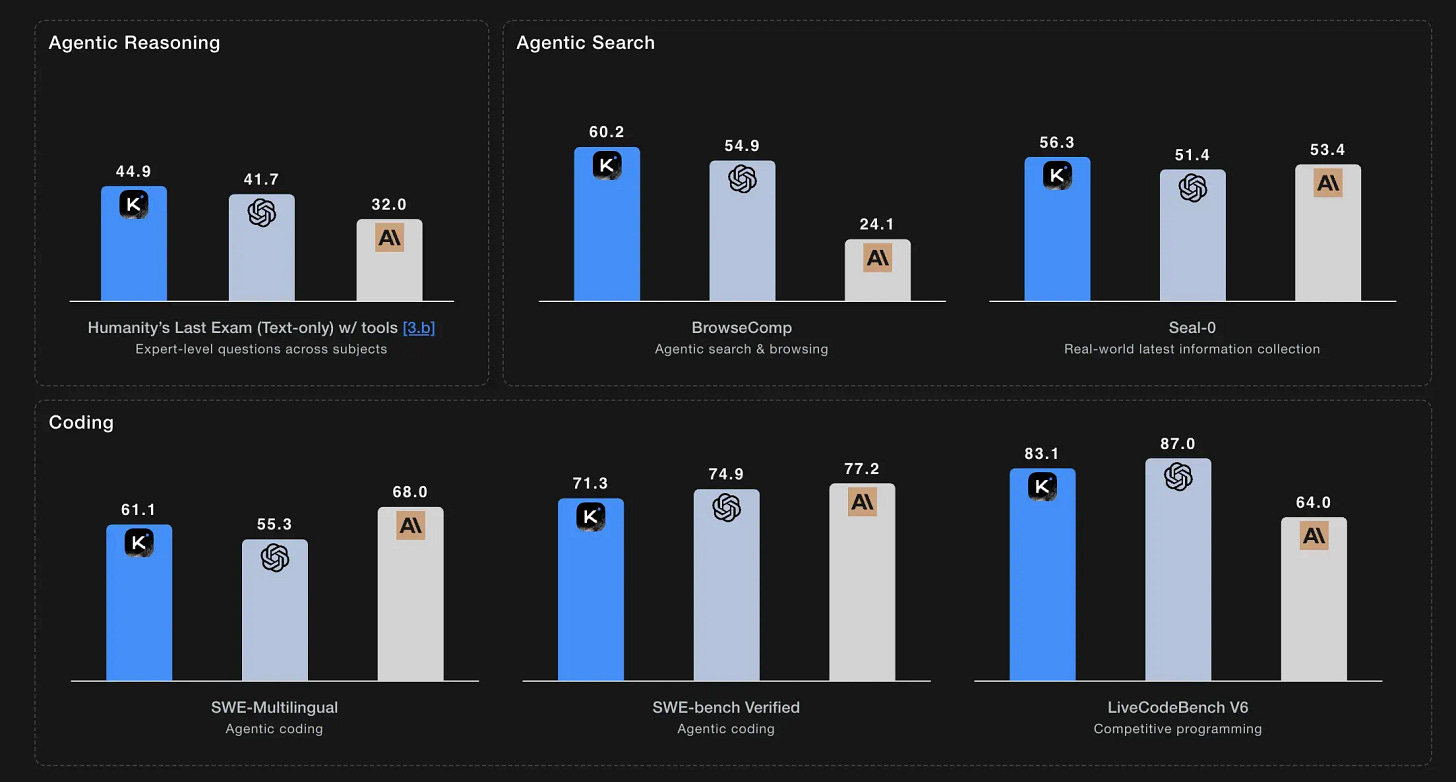

Two days later on November 6th, Alibaba-backed Moonshot released Kimi K2 Thinking, claiming to beat ChatGPT in “agentic” capabilities. The model can automatically select 200 to 300 tools to complete tasks on its own, reducing human intervention. Two strategies appeared to emerge within the same week: one company escaping through internationalization, another doubling down on technical superiority.

But then came the contradiction. Recent reports revealed that Zhipu had quietly dismantled its entire standardized product center, the division responsible for creating intelligent agent and Model-as-a-Service platforms. Staff were reassigned to “delivery” roles within vertical units focused on government and state-owned enterprise projects. In May 2025, the company secured a 61.28 million yuan contract to power city projects in Hangzhou.

Why would a company touting global API growth simultaneously eliminate the team building those API products? The answer reveals something fundamental about Chinese AI startups in 2025. The paths to survival are neither clean nor mutually exclusive. And the gap between strategic storytelling and economic reality has never been wider.

When Dreams Meet Economics

The consolidation is brutal. Companies once celebrated as the “Six Small Dragons” now face divergent fates shaped by cash burn and market pressure.

Zhipu’s financial picture tells the story. The company reportedly generated 300 million yuan in revenue during 2024 while posting a 2 billion yuan loss. This burn rate pushes toward an IPO, likely in 2026, with a valuation at approximately 40 billion yuan (roughly $5.5 billion). The disconnect between software-level valuation and actual economics grows harder to ignore.

Moonshot experienced its own drama. Early in 2025, reports surfaced that the company sought to sell shares to Alibaba. The deal collapsed after Alibaba had already committed its consumer AI strategy to Quark. Months later, Moonshot secured new funding worth hundreds of millions of dollars.

Zero One (01.AI) made the most explicit retreat. The company abandoned superscale model training entirely, choosing instead to have Alibaba train its models. The move acknowledged what had become obvious: only big tech possesses the resources to sustain foundation model development at the frontier.

The cost asymmetry explains everything. Moonshot’s Kimi reportedly burns tens of millions of yuan monthly on inference costs alone. Meanwhile, big tech commitments dwarf startup budgets. ByteDance allocated over $20 billion for AI chips and data centers in 2025. Alibaba announced over 380 billion yuan across three years for cloud and AI infrastructure, exceeding the past decade’s total.

In consumer markets, ByteDance’s Doubao reached 150 million monthly active users by August 2025, compared to DeepSeek’s 143 million. QuestMobile data showed nearly 40 percent of users leaving DeepSeek migrated to Doubao. On the enterprise side, Alibaba Cloud and Baidu Intelligent Cloud combined control over 50 percent of the domestic AI cloud market.

DeepSeek represents a different kind of evolution. The company demonstrated that algorithmic efficiency could challenge raw compute advantages despite US chip restrictions. Its mixture-of-experts architecture and training methodology earned widespread technical recognition, effectively graduating the company from conventional startup status. DeepSeek now occupies a unique position in China’s AI ecosystem, no longer constrained by typical venture economics or commercialization pressures. The company’s technical validation has granted it a form of strategic immunity, allowing continued focus on pushing architectural boundaries rather than immediate market returns.

Three survival paths have emerged for everyone else. But as Zhipu demonstrates, choosing one means accepting contradictions that cannot be resolved through strategy alone.

The Global Escape Route

The international opportunity appears genuine. According to Kilo Code, GLM-4.6 saw the platform’s fastest adoption ever. Token usage increased 94 times within 12 days, driven by lower costs versus US alternatives. The model integrated into popular coding tools including Anthropic-backed Cursor. Overseas developers actually pay monthly subscriptions for enterprise software, a habit less established domestically.

The company addresses geopolitical risks strategically. Despite blacklisting by the Biden administration and OpenAI identifying it as a key competitor exporting “China’s systems and standards,” Zhipu maintains that third-country customers remain comfortable using its services. Data hosting in Singapore with zero retention reduces sovereignty concerns.

But the contradiction deepens. The company dissolved its standardized product center, precisely the unit that would scale API offerings. Staff moved to “delivery” roles customizing solutions for government clients and state-owned enterprises. Substantial revenue flows not from viral API adoption but from contracts like the 61.28 million yuan Hangzhou deal.

Government services have been key revenue sources for Zhipu, but its business with government clients slowed recently. Alibaba and ByteDance overtook Zhipu to join Baidu and iFlytek as the four biggest AI service providers for state-backed customers in the first three quarters of 2025.

The company’s stated logic for API focus emphasizes organic growth and higher return on investment compared to building project teams for hand-delivered solutions. Yet operations move in exactly the opposite direction: building those project teams for customized delivery.

These two identities demand opposing capabilities. A global API platform requires standardized products, seamless developer experience, scalable architecture, and viral adoption. Domestic government contracts require heavy customization, private on-premise deployment, regulatory compliance expertise, and relationship management. Resource allocation between these models is zero-sum. Engineering hours spent integrating legacy systems cannot simultaneously build global platform features.

As my previous analysis detailed, Zhipu is morphing from “China’s OpenAI” into “China’s Palantir,” becoming a state-backed consultancy serving domestic power structures through bespoke implementations. The company absorbed over 3 billion yuan in funding in the past year, almost exclusively from state-backed entities including municipal governments of Hangzhou, Shanghai, Chengdu, and Beijing. This creates a semi-closed ecosystem where government functions simultaneously as lead investor, primary regulator, and largest customer.

The arrangement provides privileges private competitors cannot match. But it also dictates business model evolution. The company cannot freely pursue the most commercially scalable approach. Strategic alignment with backer priorities becomes non-negotiable.

The 40 billion yuan valuation assumes software economics. If operations show services delivery margins, the disconnect becomes untenable.

Racing Against Commoditization

The technical bet rests on building moats through continuous innovation. Moonshot’s K2 Thinking exemplifies this approach, emphasizing agentic capabilities where models understand user intent without explicit instructions. The model’s ability to autonomously select hundreds of tools represents a bet that capability differentiation still matters.

But advantage windows collapse with stunning speed. The Manus intelligent agent sparked immediate industry attention in early 2025 for its autonomous capabilities. MetaGPT open-sourced “Open Manus” within three hours. What once provided six months of lead time now offers weeks or days.

Big tech closes gaps relentlessly.Baidu committed to open-sourcing its ERNIE 4.5 model by June 2025, making all models free. Tencent open-sourced image-to-video models in March. Baidu’s leadership, once firm believers that closed source enabled better commercialization, now embrace open source as a mechanism to accelerate adoption and spur application-layer innovation.

The technical path narrows to teams with exceptional capabilities and patient capital. The bar for what constitutes defensible technical advantage rises continuously as foundation capabilities commoditize. For venture-backed startups racing against big tech’s resource advantages and open-source commoditization, the window to establish durable technical moats shrinks monthly.

Depth Over Breadth

The pragmatic path abandons AGI dreams. Companies go deep into specific industries where domain expertise creates defensibility pure technical superiority cannot match.

DeepXi(滴普)’s October 2025 Hong Kong IPO crystallizes this strategy’s viability. Positioned as “China’s Palantir” and “the first enterprise-level large model AI application stock,” the company surged over 150 percent on its first day, reaching 21.8 billion Hong Kong dollars market capitalization. Capital delivered a clear verdict: investors pay premiums for demonstrated enterprise AI execution over AGI potential.

Zhipu’s government contracts follow similar logic, though with different execution shaped by state backing. The positioning becomes the “trusted, state-aligned independent” choice for sensitive deployments. But this integration dictates business model constraints, transforming the company from potential platform into strategic technology supplier for the state.

The vertical strategy’s core logic is straightforward. Large model capabilities solve perhaps 20 percent of enterprise needs. The remaining 80 percent involves industry-specific data integration, legacy system compatibility, regulatory compliance, and on-premise deployment. Big tech lacks the specialized know-how and patience for this implementation work. Industry insiders acknowledge an unspoken principle: markets above 1 billion yuan attract big tech attention, so survival means finding strategic insignificance in smaller verticals.

The trade-offs are explicit. Companies give up unicorn valuations, global scale, and technology prestige. They accept heavy sales, bespoke delivery, and industry knowledge accumulation. In return: sustainable cash flow, defensible moats, and realistic profitability paths.

The three survival paths define the strategic choices available to Chinese AI startups. But understanding these paths is only the beginning. The harder questions remain: How do you compete when big tech controls every advantage? What specific signals separate viable investments from value traps? And what does realistic success actually look like in this consolidating market?