Xiaomi’s Profit Peak Isn’t a Breakthrough. It’s a Warning

Backlogs are fading, subsidies expire in 2026 and safety rules tighten. Xiaomi’s EV miracle is entering its pressure test.

The headline numbers are seductive. On November 18, Xiaomi Group released a third-quarter financial report that sent shockwaves through the global automotive industry. Less than one year after entering the market, the Chinese consumer electronics giant has achieved a milestone that eluded Tesla for years and continues to frustrate domestic rivals like NIO.

Xiaomi Auto is profitable.

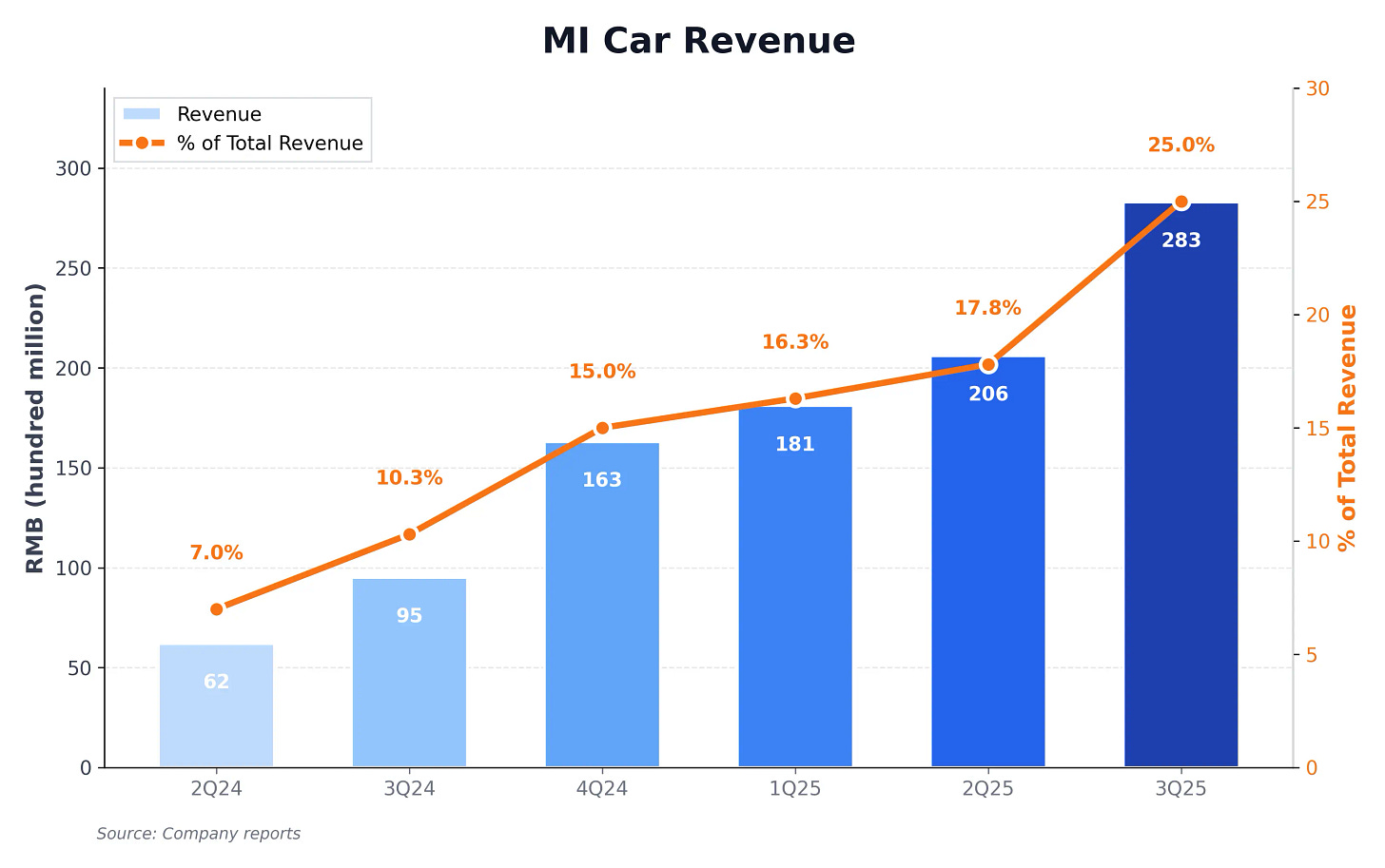

In the third quarter of 2025, the company’s smart electric vehicle division generated revenue of RMB 29 billion. It posted an adjusted net profit of roughly RMB 680 million. Most surprisingly, it achieved a gross margin of 25.5 percent. This figure statistically places a newcomer in the same tier as legacy luxury manufacturers like BMW and Mercedes-Benz.

Investors are rightfully impressed. The data validates Lei Jun’s execution capabilities. It proves that Xiaomi can translate its supply chain mastery from smartphones to smart cars.

However, a granular analysis of the earnings report and the broader market context reveals a different story. The current profitability is likely a temporary peak rather than a sustainable baseline. It is the result of a unique alignment of forces: a premium product mix, a massive backlog of early orders, and a favorable policy environment that is about to expire.

We are witnessing the formation of a strategic “Air Pocket.” Approaching in 2026, this phase represents a sudden loss of economic lift. It will test the true resilience of Xiaomi’s automotive ambitions as the company faces the simultaneous depletion of its order book, the end of government subsidies, and a regulatory crackdown on vehicle safety.

A Margin Built on Premium Models, Not Market Strength

To understand the fragility of this moment, we must dissect the components of Xiaomi’s third-quarter victory. The 25.5 percent gross margin is the standout metric. It exceeds the market consensus of 25.6 percent slightly but represents a massive leap for a new manufacturer.

This margin is structural rather than operational. The third quarter saw a high concentration of deliveries for the SU7 Ultra and other premium configurations. These high-end models command significantly higher average selling prices. The data shows the average selling price per vehicle rose to RMB 238,000, with the broader category reaching nearly RMB 260,000.

This product mix effectively front-loaded the profitability curve. Early adopters and fans ordered the most expensive versions of the SU7. As Xiaomi fulfills these orders and shifts its production focus to mass-market volume drivers, the average selling price faces inevitable downward pressure. Management acknowledged this reality during the earnings call. Group President Lu Weibing admitted that automotive gross margins would likely decline next year due to competitive factors and the normalization of the product mix.

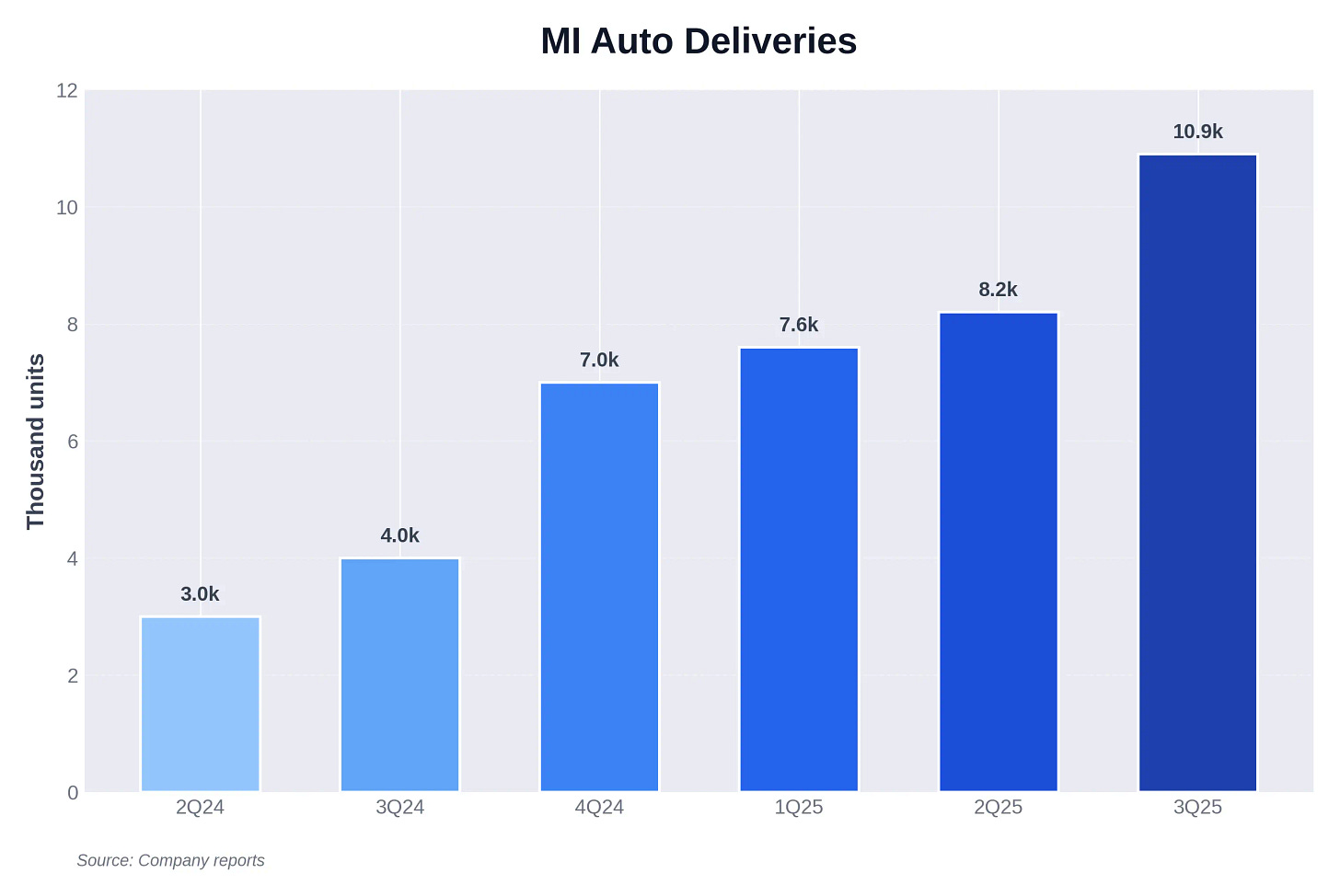

Scale effects also played a critical role. Xiaomi delivered 108,796 vehicles in the third quarter. This rapid throughput allowed the factory to dilute fixed costs significantly. The factory is running at maximum capacity. Efficiency is high.

Yet this efficiency relies on a continuous feed of orders. The current production rate is consuming the order backlog at a pace that far exceeds the rate of replenishment.

Xiaomi Is Delivering Cars Faster Than It Is Selling Them

The most alarming signal for Xiaomi’s future performance lies in the divergence between production velocity and new order intake.