Chips, Clinics, and Driverless Cars: Last Week in China Tech

From AI doctors in Saudi Arabia to robotaxis hitting 15,000 rides a day, Chinese tech is scaling up—and heading out.

Welcome to your weekly download of China’s tech shifts.

Xiaomi’s high-profile chip debut, Alibaba’s strategic stake in Meitu, and Baidu’s turbulent earnings week reveal a shared anxiety—and ambition—among China’s top tech firms: the search for durable moats in an increasingly AI-native world. The subtext? Hardware independence, global relevance, and consumer applications. Even as startup collapses (like the Shenzhen-based robot maker Senhe) signal overheating, regional governments in Beijing and Hangzhou are doubling down on their AI agendas. China is pivoting from hype cycles to strategic long games—one chip, clinic, and city at a time.

Stay informed — and then go deeper.

Headlines move fast. But if you want to see what’s next — and why — upgrade to unlock our weekly deep dives into strategy, power plays, and market shifts behind the news.

Top 5 Headlines

Xiaomi Unveils Homegrown 3nm Chip and New EV SUV

Lei Jun showcased Xiaomi’s latest flagship SUV, the YU7, alongside its first self-developed 3nm mobile chip, the Xring O1. The chip will power the new Tablet 7 Ultra and aims to rival Apple and Qualcomm, though Lei admitted it still lags on raw performance. Xiaomi also pledged $28B in R\&D over the next five years, signaling long-term ambitions across chips and AI models.

Why it matters: In-house chip development marks a deeper push for supply chain autonomy and tech sovereignty.

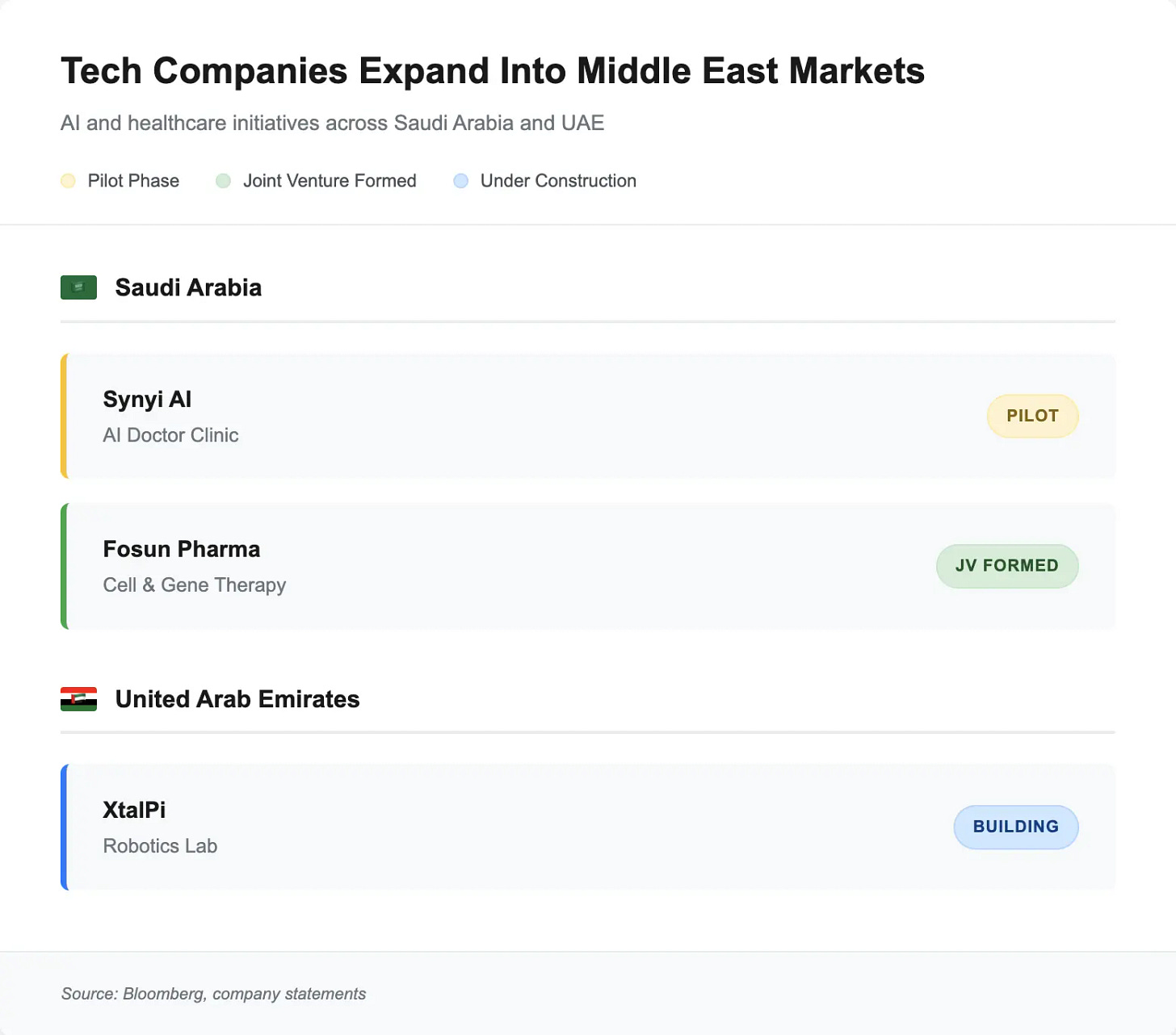

China’s First AI-Doctor Clinic Launches Pilot in Saudi Arabia

Synyi AI, a Shanghai-based startup, opened an AI-powered diagnostic clinic in Al-Ahsa, Saudi Arabia. The virtual doctor “Dr. Hua” can assess respiratory illnesses and generate prescriptions, reviewed only afterward by a human physician. Backed by Tencent and GGV Capital, Synyi is betting on overseas traction before tackling China’s low-margin public healthcare system.

Context: AI medical startups are looking abroad to prove models in privatized markets before facing China’s regulatory and cost hurdles.

Baidu’s Revenue Beats but Profit Sinks Amid AI Transition

Despite a surprise 3% revenue rise, Baidu’s stock fell 4% on weak advertising and eroding profit margins. While cloud demand surged, operating income dropped 20%. CEO Robin Li reiterated the company’s pivot to multimodal models and virtual agents—but acknowledged rising pressure from open-source rivals like DeepSeek.

Why it matters: Baidu’s legacy ad business is eroding faster than its AI monetization can scale.

Robot Startup Senhe Shuts Down Amid Crowdfunding Scandal

Once hailed as the “Mowbot of China,” Shenzhen-based「森合创新」abruptly dissolved after failing to deliver its AI-powered Oasa R1 lawn mower. Despite raising $2.3M on Kickstarter and backing from top VCs, the company couldn’t mass-produce the units due to component costs, team churn, and failed logistics.

Context: China’s robot boom is entering a phase of brutal consolidation. The lesson: innovation alone can’t overcome execution risk.

Alibaba Invests $250M in Beauty-Tech Firm Meitu via Convertible Debt

Alibaba agreed to invest $250M in Meitu via convertible bonds and strategic partnerships across cloud, AI design tools, and ecommerce. Meitu’s AI-driven product photo services have already gained traction with Alibaba merchants. The deal includes $80M+ in cloud commitments from Meitu and co-development of vertical AI models.

Why it matters: It’s a rare case of Alibaba trading cash for applied AI leverage in a consumer-facing app with strong monetization.

Chart of the Week

China’s AI Healthcare Push Abroad

China’s AI healthcare startups are quietly going global—often faster than at home. Want to understand which players are scaling, where they’re expanding, and how they plan to monetize? Premium readers get full analysis, funding insights, and exclusive interviews every month.

→ Upgrade to Premium for full access

Focus

How Beijing and Hangzhou Are Betting on AI Cities

China’s AI ambitions are not just about tech firms—they’re embedded in city blueprints. Beijing is staking its future on becoming the world’s “Open Source AI Capital,” while Hangzhou is aligning its policy engine with homegrown giants like Alibaba and DeepSeek.

Beijing: The Open Source Fortress The capital accounted for over 40% of China’s AI-related social financing in 2024. Its AI industry is worth over $480B (3,500B yuan), and local giants like Zhipu AI and MiniCPM are setting global benchmarks in open-source models. Backed by policy and capital, Beijing’s “open first” strategy stands in contrast to the proprietary dominance of OpenAI. The city is also investing in compute infrastructure, talent pipelines, and international developer communities.

Hangzhou: The Commercial Powerhouse Zhejiang province is aiming for $140B in AI revenues by 2027, doubling current national output. Hangzhou is at the center of this push with tax subsidies, talent incentives, and generous grants for foundational models. Alibaba’s own Qwen model and DeepSeek’s recent breakthroughs are part of this localized AI acceleration. The strategy includes consumer subsidies on smart devices and direct VC catalyzation to early-stage startups.

Why it matters: These two models—Beijing’s open-source institutional moat and Hangzhou’s market-first approach—are creating internal competition that may determine the contours of China’s AI ecosystem.

One Company to Watch

Robotaxi by Baidu (Apollo Go)

Baidu’s autonomous ride-hailing platform, Apollo Go (known as Luobo Kuaipao in China), is quietly setting new benchmarks for scale, cost efficiency, and international ambition. In Q1 2025, it completed 1.4 million fully driverless rides—averaging over 15,000 trips per day—without any human safety driver onboard. With over 1,000 vehicles deployed and rapid cost reductions (its sixth-gen car now costs just ~$28,000), Apollo Go claims it’s on a “clear path to profitability.”

Baidu has also begun testing in Dubai and Hong Kong and is reportedly eyeing expansion into Switzerland and Turkey. Its shift to an asset-light model via partnerships with fleet operators like Shenzhou Car Rental hints at a scalable, exportable robotaxi blueprint.

Strategic signal: Apollo Go is not only China’s largest driverless fleet—it may soon be one of its most globally visible mobility platforms.

Quote of the Week

“Do you really want your vacuum cleaner to look like a human? That would scare me. I just want something smart enough to clean the room.”

— Joe Tsai, Chairman of Alibaba, on humanoid robots at BEYOND Expo 2025

Subscribe to Hello China Tech for curated insights into the strategies, systems, and signals shaping China’s technology landscape. We decode complexity–so you don’t have to.