Alibaba & Tencent Double Down, Huawei's OS Arrives, Xiaomi's Silicon Bet: This Week in China Tech

Welcome to your weekly download of China’s tech shifts.Your smartest read on China tech — every Monday, straight to your inbox. Curated insights, strategic signals, and the context that global headlines miss.

Stay informed — and then go deeper.

Headlines move fast. But if you want to see what’s next — and why — upgrade to unlock our weekly deep dives into strategy, power plays, and market shifts behind the news.

This week, China’s tech landscape is characterized by a dual thrust: a relentless push into Artificial Intelligence monetization and practical application by its giants, and a determined drive towards foundational technology self-sufficiency, evident in new operating systems and domestically designed advanced chips. This signals a maturing ecosystem increasingly shaping its own technological destiny amidst global complexities. Let’s unpack what matters.

🔹 1. Alibaba & Tencent: Diverging Paths to AI Profit

Both Alibaba and Tencent delivered strong earnings—and made one thing clear: AI is no longer an R/D line item. It’s now driving revenue(Source: Sina Finance).

Alibaba Cloud grew 18% YoY, fueled by AI-related product sales—up triple digits for a seventh straight quarter. It’s evolving into a “B2B AI infrastructure” provider, serving enterprises across sectors like finance and auto.

Tencent, by contrast, is weaving AI into its massive consumer ecosystem. Its “Yuanbao” assistant is gaining traction, and AI is now embedded in ads, gaming, and productivity apps.

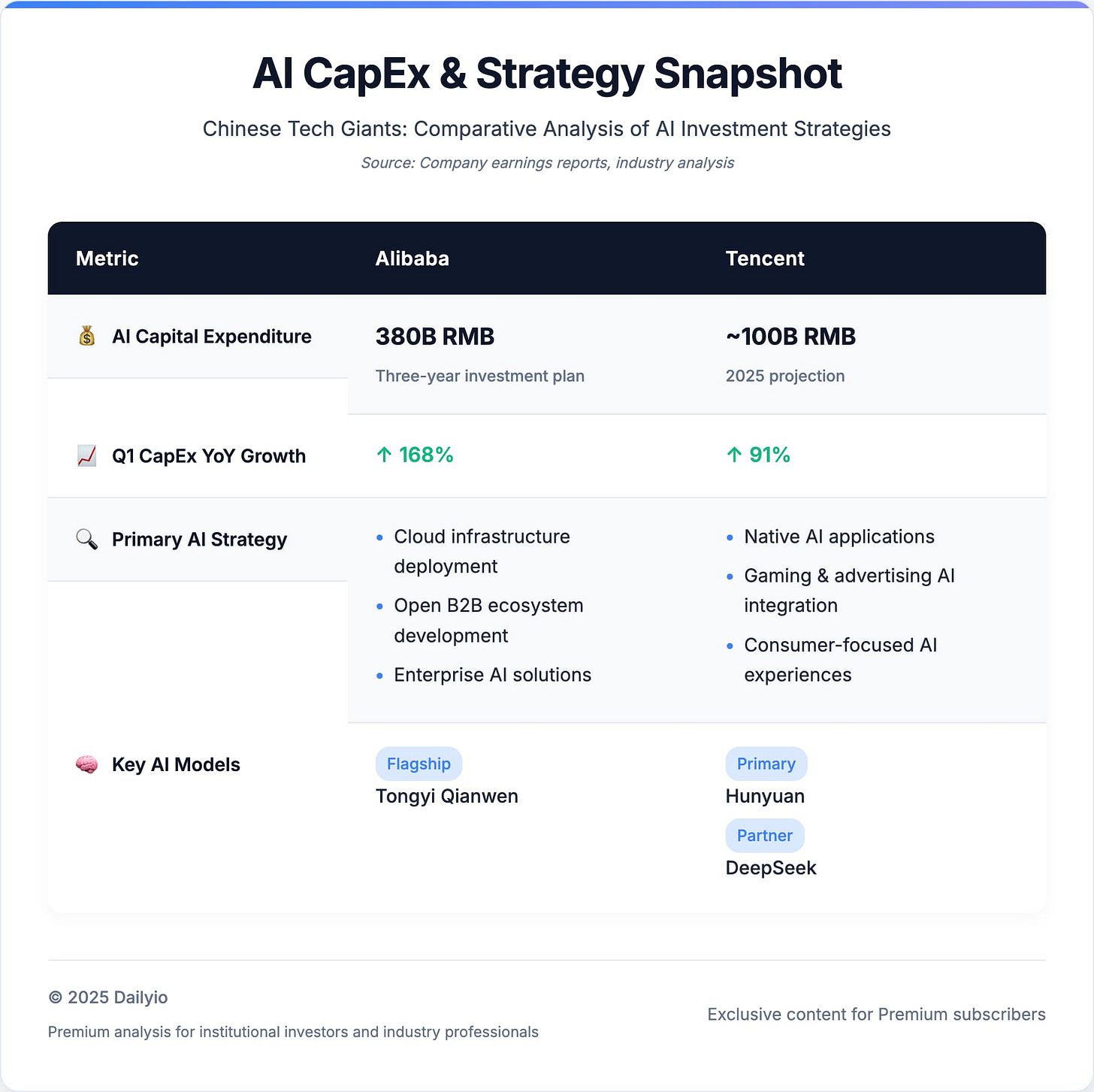

Big picture: Alibaba is betting on an industrial, platform-centric model (380B RMB in CapEx over three years), while Tencent plays the consumer stickiness game, with FY2025 AI CapEx potentially nearing 100B RMB.

📊 Chart: AI CapEx & Strategy Snapshot

Why it matters: China’s AI leaders are no longer just building—they’re commercializing. Their divergent strategies reflect differing bets on where the real monetization lies: backend platforms vs. frontend engagement.

🔹 2. Huawei’s HarmonyOS PC: A Post-Windows China?

Huawei has launched its first PC running HarmonyOS 5, a homegrown OS rebuilt from the kernel level. It’s part of its “1+8+N” all-scenario strategy: unified OS, full-stack control, AI at the center(Source: IT Home).

Features include the “Xiaoyi” AI assistant (built on Pangu and DeepSeek) and deep integration with Huawei phones/tablets.

Over 1,000 apps are now adapted for HarmonyOS, a major leap from 300 earlier this year.

Why it matters: This isn’t just another PC—it’s a sovereignty play. Huawei is trying to break out of the Windows/Android/Apple orbit and establish a self-contained ecosystem. If it succeeds, it could change the software landscape in China—and maybe beyond.

🔹 3. Xiaomi’s 3nm Chip Push: Betting on the Big Core

Xiaomi is set to debut the “Xuanjie O1”, its first self-developed flagship SoC, built on a 3nm process with a 10-core architecture(Source: Tencent News).

The company has poured 13.5B RMB into chip R\&D since 2021 and pledged another 50B RMB over the next decade.

A 2,500-person chip team is now in place.

Why it matters: After Huawei’s Kirin, Xiaomi is the second major player to enter high-end SoC design. It’s part of a larger trend: China’s tech majors are racing to control their semiconductor supply chains. Success here could push Xiaomi from OEM to full-stack platform player.

🔹 4. Moonshot AI Targets Medicine with “Kimi”

Moonshot AI, creator of long-context assistant Kimi, is building a team to tackle the medical domain(Source: 36Kr).

It’s hiring doctors and domain experts to develop specialized knowledge bases.

The goal is to enhance medical search quality and explore vertical AI agents for healthcare.

Why it matters: As large models seek real-world value, domain-specific depth is the next frontier. If successful, this could differentiate Kimi in China’s crowded AI market and position it for healthcare partnerships and applications.

🔹 5. CATL’s $3.9B Hong Kong IPO: Global Power Play

Battery giant CATL raised nearly US$4B in its Hong Kong debut, the largest IPO globally so far in 2025(Source: 36Kr).

The deal was heavily oversubscribed and backed by strategic investors.

The funds will support global expansion, R/D, and production scaling.

Why it matters: This IPO isn’t just about capital—it’s about global positioning. With rising geopolitical frictions and EV battery demand soaring, CATL is fortifying its war chest to remain dominant on the world stage.

🔍 Deep Dive: The AI Monetization Marathon

China’s AI race is entering its second phase: from hype to revenue.

Alibaba is banking on enterprise AI, embedding models into its cloud to serve clients like BMW and ICBC. It’s building the infrastructure others will run on.

Tencent, with WeChat and QQ, is pushing AI into existing workflows: smarter ads, AI companions in games, and upgrades to productivity tools.

Both are making long-term bets: massive CapEx, talent recruitment, and model refinement. But monetization paths are diverging—Alibaba as platform, Tencent as product enhancer.

Investor takeaway: The race is no longer to build the biggest model. It’s to build the most profitable business.

🎯 Company to Watch: Huawei

The HarmonyOS PC isn’t just a device—it’s Huawei’s clearest step yet toward a post-Western computing stack. If successful, it could become the cornerstone of a closed-loop, sovereign tech ecosystem.

Developer adoption remains the swing factor.

Cross-device seamlessness and real-world performance will determine user buy-in.

This launch sets the tone for China’s broader OS ambitions—and a potential shakeup in global platform dynamics.

💬 Quote of the Week

“We are gradually moving away from the Scaling Law... using smaller scale computing to achieve good results. Our existing high-end AI chips should be enough to train several generations of models.” — Martin Lau, President of Tencent

Why it’s insightful: Facing U.S. chip restrictions, Tencent is rethinking AI’s compute paradigm. Less about brute force, more about optimization. This shift could redefine how Chinese firms build AI in a constrained but resourceful environment.

Subscribe to Hello China Tech for curated insights into the strategies, systems, and signals shaping China’s technology landscape. We decode complexity–so you don’t have to.