Alibaba Reunites, Tencent Regroups, SMIC Stumbles: This Week in China Tech

Welcome to your weekly download of China’s tech shifts. Your smartest read on China tech — every Monday, straight to your inbox. Curated insights, strategic signals, and the context that global headlines miss.

Stay informed — and then go deeper.

Headlines move fast. But if you want to see what’s next — and why — upgrade to unlock our weekly deep dives into strategy, power plays, and market shifts behind the news.

This week, legacy giants are quietly reshaping their structures, Chinese AV firms are accelerating global expansion, and a new phase in semiconductor strategy is beginning to take shape. Let’s unpack what matters.

Opening Insight: The Great Re-Aggregation – China’s Tech Giants Seek Value in Unity

A fascinating undercurrent is palpable across China’s tech behemoths: a strategic shift from sprawling diversification back towards core strengths and synergistic operations. Alibaba’s recent moves, effectively rolling back its “1+6+N” restructuring to a more unified “One Alibaba,” are a prime example. This isn’t just an organizational shuffle; it’s a profound re-evaluation of how mature internet platform companies can continue to generate value.

Two years ago, Alibaba’s breakup was seen as a way to unlock value in a challenging regulatory and market environment. Today, the focus is on leveraging the collective strength of its ecosystem to fight key battles in e-commerce, local services, and AI. This mirrors a broader trend in the Chinese internet industry: a transition from a land-grab, growth-at-all-costs era to one focused on sustainable, profitable operations within existing user bases and a deeper excavation of value from integrated services. As growth in new users slows, the new frontier is efficiency, synergy, and innovation that compounds existing strengths, rather than diluting focus. Tencent’s AI restructuring also hints at this, aiming to consolidate resources for a more focused technological push.

Top Developments This Week

Alibaba’s U-Turn: From “1+6+N” to “One Alibaba” to Win Core Battles Two years after its “1+6+N” split, Alibaba is reversing course towards a unified “One Alibaba” under CEO Wu Yongming. With a focus on “saturated investment” in core battles—e-commerce, AI, and instant retail—the move largely unwinds the previous breakup. Key changes include halting the cloud unit’s full spin-off and consolidating e-commerce operations under Jiang Fan. The surprising success of “Taobao Flash” (its instant retail service) and the revitalization of Ele.meappear to be catalysts. The goal: break down internal silos and pool resources for group-wide synergy and value.(source:Nikkei,English)

Tencent Restructures Hunyuan AI for a Technology-Driven Future Tencent is significantly overhauling its Hunyuan AI division, creating dedicated large language and multi-modal model departments, and consolidating data and machine learning support units. This marks a strategic shift from a fragmented “horse-racing” approach to a centralized, technology-driven one, aiming to improve efficiency and build a stronger technical foundation. The move is spurred by intense competition from rivals like Alibaba and Baidu, indicating Tencent’s deeper commitment to advancing its core AI capabilities beyond current app integrations like WeChat’s Yuanbao. (source: jiemian,Chinese)

SMIC’s Mixed Q1 Signals Strategic Squeeze Amidst Weak Outlook China’s top chip foundry, SMIC, reported mixed Q1 2025 results: revenue hit $2.247 billion (missing guidance), while gross margin at 22.5% (beating guidance) benefited from advance 8-inch wafer orders. However, a “dismal” Q2 outlook forecasts revenue falling 4–6% and gross margins tightening to 18–20%, signaling weak underlying demand. While SMIC’s strategic role in China’s chip self-sufficiency provides some valuation support, ongoing high capital expenditure (over $7 billion annually) will continue to pressure profitability if demand doesn’t pick up.(source: Dolphin Research,Chinese)

Huawei Unveils First HarmonyOS Laptop as Windows Era Ends Following the March expiration of its Microsoft Windows license, Huawei launched its first laptop running its self-developed HarmonyOS Next. The new device features HarmonyOS 5 and AI capabilities via its Celia assistant (for tasks like slide creation and summarization). It supports key software like WPS and DingTalk, alongside a growing ecosystem of HarmonyOS mobile apps, with Huawei aiming for over 2,000 compatible apps by year-end—a significant stride towards OS independence for its devices.(source:SCMP,English)

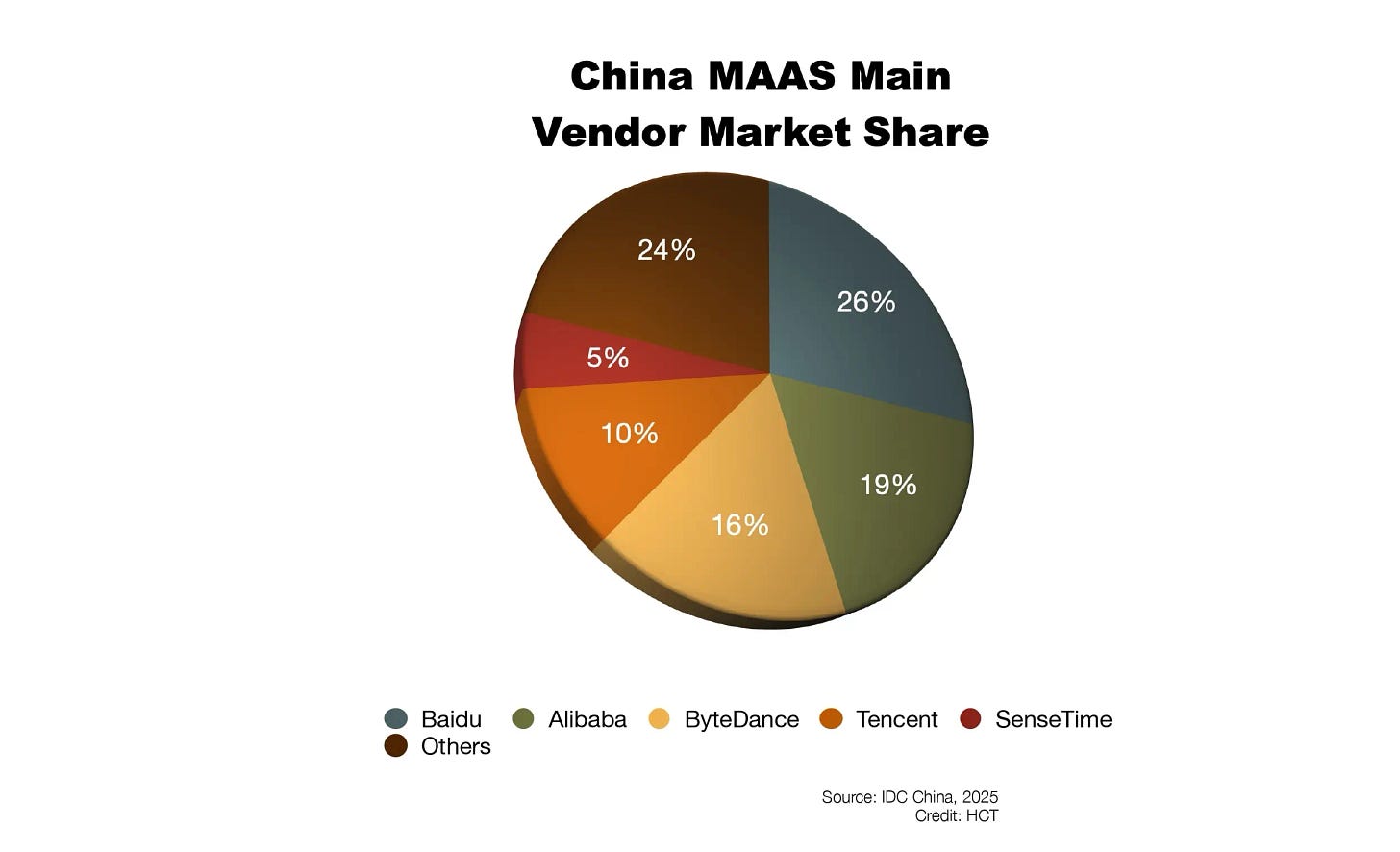

Chart of the Week: China’s MaaS Market Growth

According to IDC’s latest “China Model-as-a-Service (MaaS) and AI Large Model Solutions Market Tracker, 2024H2,” China’s MaaS market exploded in 2024, reaching 710 million RMB – a 215.7% year-over-year jump from 2023. The second half of the year (H2 2024) contributed 460 million RMB to this total.

Market concentration was notable in H2 2024, with the top five providers holding 76% share. Baidu led the field with 26%, followed by Alibaba and ByteDance.

Focus: China’s Autonomous Vehicles Hit the Global Highway via Platform Power

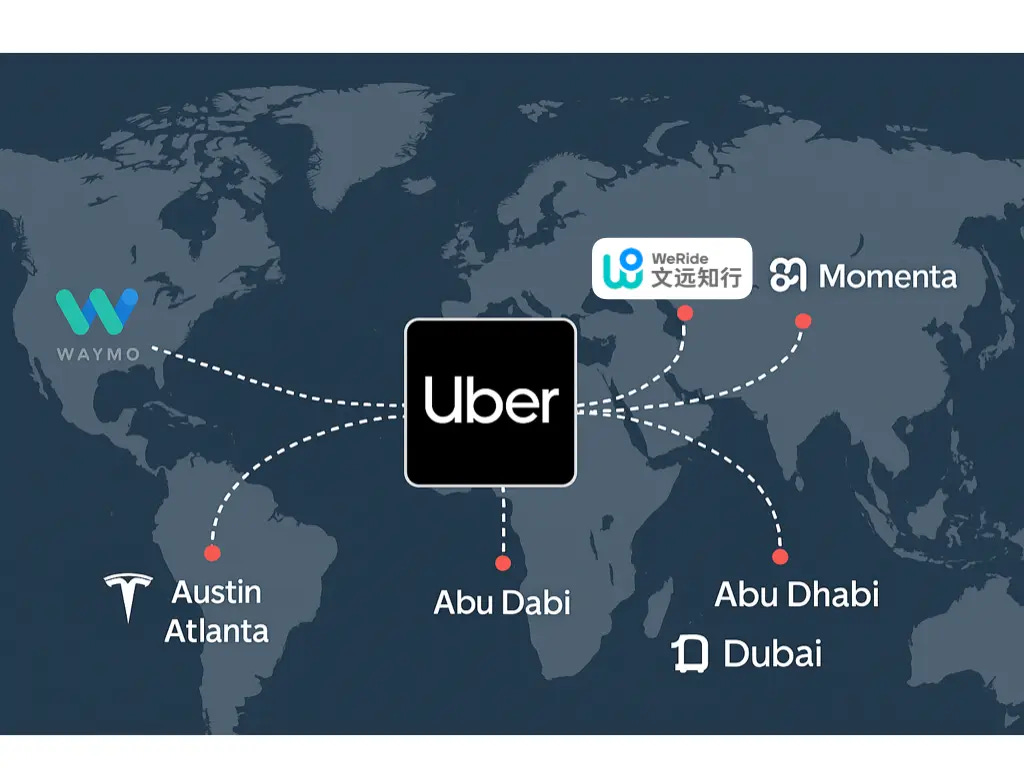

The race for autonomous vehicle (AV) supremacy is no longer confined to domestic testbeds; Chinese AV companies are increasingly looking overseas for growth and commercial viability, and platform giants like Uber are paving the way. Uber’s recent $100 million top-up investment in WeRide(source:thecapital,Chinese), alongside partnerships with Pony.ai and Momenta, underscores a potent strategy: Uber provides the global demand platform, while Chinese firms offer mature AV technology.

This symbiotic relationship is crucial. For Chinese AV companies like WeRide, Pony.ai, and Momenta, who have spent years and billions on R&D, international markets represent a vital path to scale and, eventually, profitability. The domestic Chinese market, while large, is intensely competitive, and the timeline to widespread, profitable deployment is still uncertain. High R&D costs continue to burn cash; WeRide, for example, reported cumulative losses of around 5 billion RMB (~$690 million) from 2021 to H1 2024.

Uber, having divested its own costly AV development arm (ATG) in 2020, has pivoted to become an AV aggregator – the “picks and shovels” provider in the Robotaxi gold rush. By integrating various AV fleets onto its ubiquitous app, Uber minimizes its R&D risk while positioning itself at the center of the future of mobility. Users call an Uber, and the backend decides if a Waymo (in the US), WeRide, or Pony.ai vehicle (in partnered international markets) serves the ride.

This global push is timely. Pony.ai recently launched Robotaxi services between Guangzhou city center and its major transport hubs. WeRide gained approval for fully driverless paid services in Beijing. However, true monetization requires broader operational domains. Partnerships with Uber offer access to established ride-hailing networks in Europe, the Middle East, and potentially other regions, accelerating the commercialization journey far quicker than going it alone in new, unfamiliar markets. While companies like Baidu’s Apollo are also pursuing AV deployment, including a recent partnership with car rental firm Shenzhou Zuche (CAR Inc.) for AV rentals in tourist spots(source:Sina,Chinese), the Uber model provides a more direct line to global ride-hailing users.

The road ahead isn’t without bumps. Regulatory hurdles vary significantly by country, and public acceptance is still developing. But for Chinese AV leaders, going global isn’t just an option; it’s becoming a necessity. And for Uber, these partnerships are key to realizing its vision of a multi-modal, autonomous transportation network.

Quote of the Week

“All great companies are born in winter. The AI e-commerce era has just begun, it’s an opportunity and a challenge for everyone.”

– Jack Ma, Co-founder of Alibaba Group, reportedly said in an internal forum post in April, reflecting on the challenges and opportunities ahead.