Tencent’s Break From China’s AI Arms Race

Its 65 percent capex cut exposes a deeper split: compute maximalists vs application pragmatists. Tencent believes efficiency is the future. The market hasn’t decided.

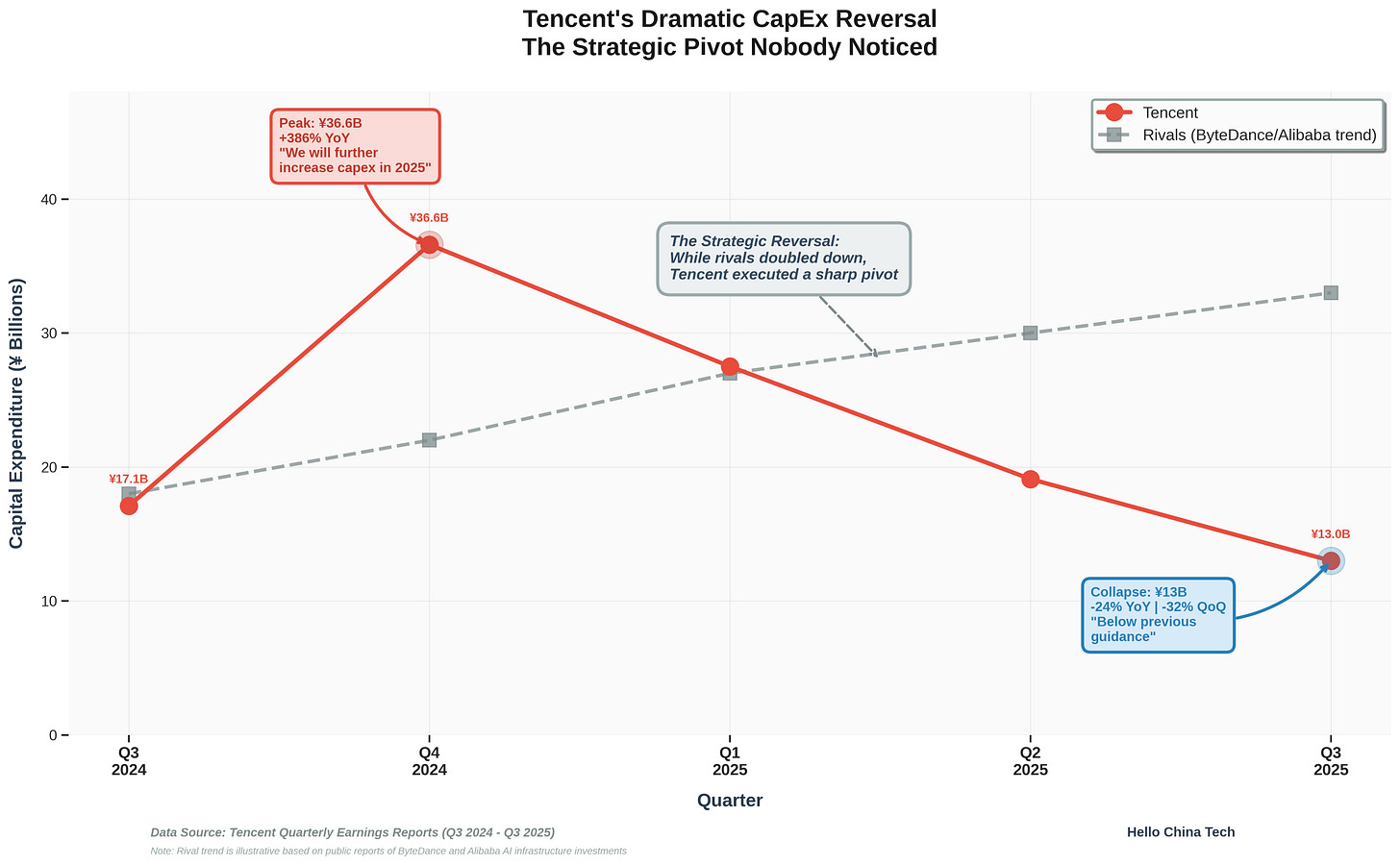

Tencent just executed one of the sharpest strategic reversals in Chinese tech history. Most observers missed it.

In Q4 2024, the company’s capital expenditure surged 386% year-over-year to ¥36.6 billion ($5.1 billion), with President Martin Lau promising to “further increase capex in 2025.” Nine months later, Q3 2025 capex crashed to ¥13 billion–down 32% sequentially and 24% year-over-year. The company now expects full-year spending “below previous guidance.”

What changed? Tencent discovered a different way to win.

The Efficiency Pivot Nobody Noticed

While analysts obsess over Yuanbao’s user deficit against ByteDance’s Doubao–33 million monthly actives versus 172 million–they’re overlooking the transformation happening in Tencent’s core businesses. Q3 revenue hit ¥192.9 billion, up 15% year-over-year. Operating profit reached ¥72.6 billion, up 18%. Net profit grew 19% to ¥63.1 billion. Gross margins expanded from 53% to 56%.

The driver? Backend AI monetization at scale. President Lau revealed that roughly half of the company’s 21% advertising revenue growth came from AI-driven improvements in ECPM (effective cost per thousand impressions). Gaming revenue jumped 23% to ¥63.6 billion, with AI contributing to both user engagement and internal efficiency. International gaming revenue crossed ¥20 billion for the first time, up 43% year-over-year.

Yet even as profits soared, Tencent increased R&D spending 28% year-over-year to ¥22.8 billion in Q3 while slashing infrastructure investment. CFO John Lo explained this as reflecting “AI chip supply chain changes, not a shift in AI strategy.”

That explanation doesn’t hold. ByteDance and Alibaba face the same supply constraints but aren’t pulling back. Alibaba just secretly launched “Project Qianwen” to rebuild its Tongyi Qianwen app as a ChatGPT competitor with full agent capabilities. ByteDance continues aggressive GPU procurement. Only Tencent is zigging while the industry zags.

The real explanation lies in President Lau’s carefully parsed statement during the earnings call: “We don’t believe there exists a decisively better model in China right now. Everyone is competing at roughly similar speeds, and different models may have different use cases.”

This statement demands scrutiny.