Robotics +220%, Chips -17%, Here’s the real signal

China’s 2025 rebound masked a shift in who allocates capital, and how exits are built.

In 2025, China’s venture market delivered a puzzle that headline deal counts cannot explain. Robotics funding jumped 220.1%, yet integrated circuits saw funding decline 17.5%. At the same time, overall VC/PE investment activity climbed back above 11,000 deals and moved close to a ten year average.

The key is capital allocation: who allocates, and what tools they use. The allocator is changing, and its toolkit now extends beyond writing checks. In 2025, state-backed investors made 5,444 direct investments and committed capital into more than 4,100 sub-funds, deploying over RMB 600 billion and reaching more than 10,000 companies. They also leaned harder into exits through M&A, and into building control positions in listed companies.

That shift changes how to read every number that follows.

The rebound is real, but it is not evenly distributed

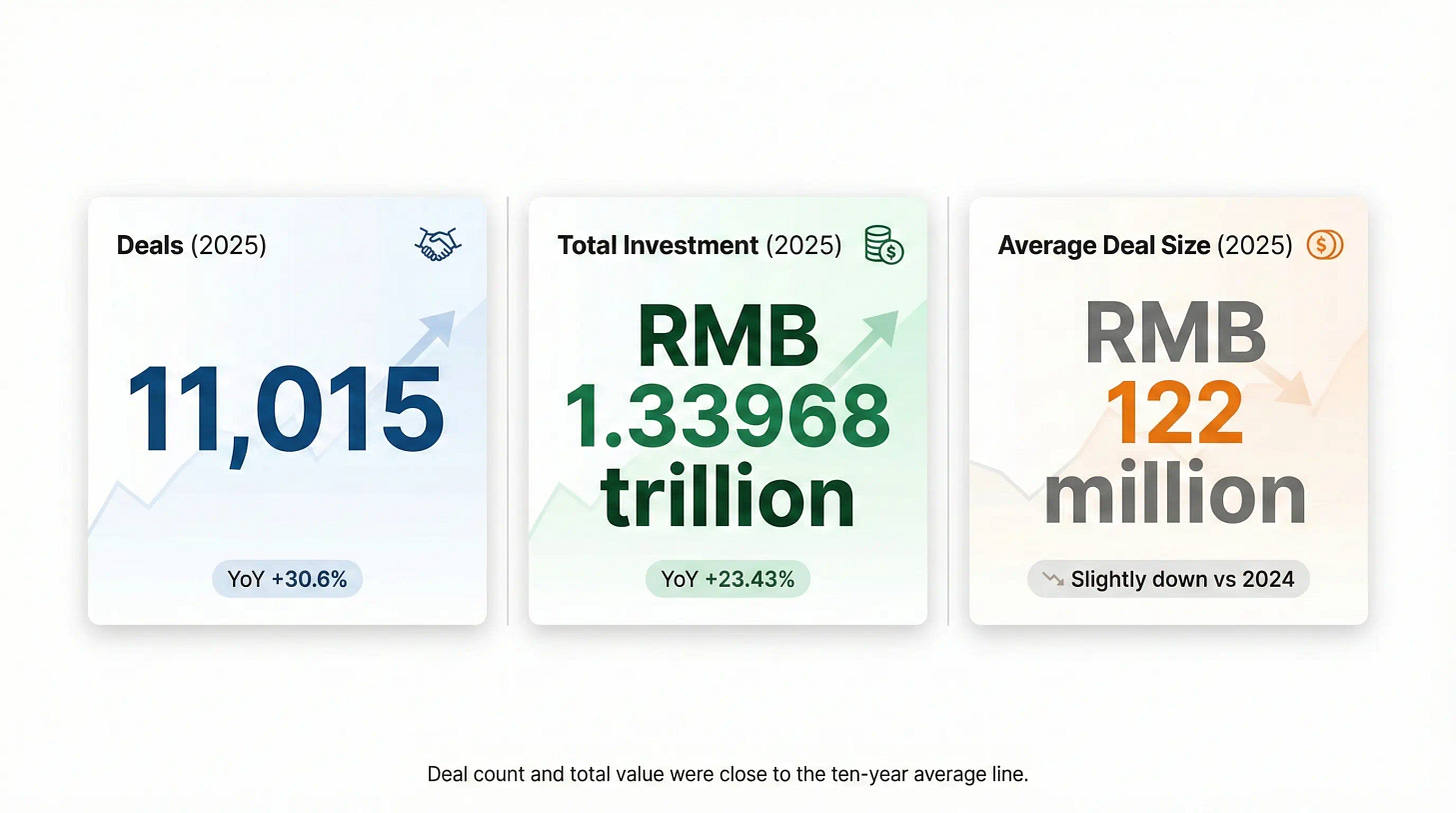

The market did warm up. China recorded 11,015 VC/PE investment deals in 2025, with total investment of roughly RMB 1.34 trillion, and an average deal size of about RMB 122 million. Those totals sit near a decade-long baseline, which matters because it signals normalization rather than a one-off spike.

What matters more is the shape of the rebound.

By deal count, Jiangsu led the country with 1,972 financings, followed by Guangdong with 1,737. By total invested amount, Shanghai ranked first at RMB 192.7 billion, while Beijing stood out because large-ticket transactions were unusually concentrated there, lifting it to RMB 153.8 billion.

Read that distribution as a clue: capital is gravitating toward regions that can combine industrial capacity, dense supply chains, and the institutional machinery needed to organize deals at scale.

Robotics up 220%, chips down 17%. This is a selection mechanism

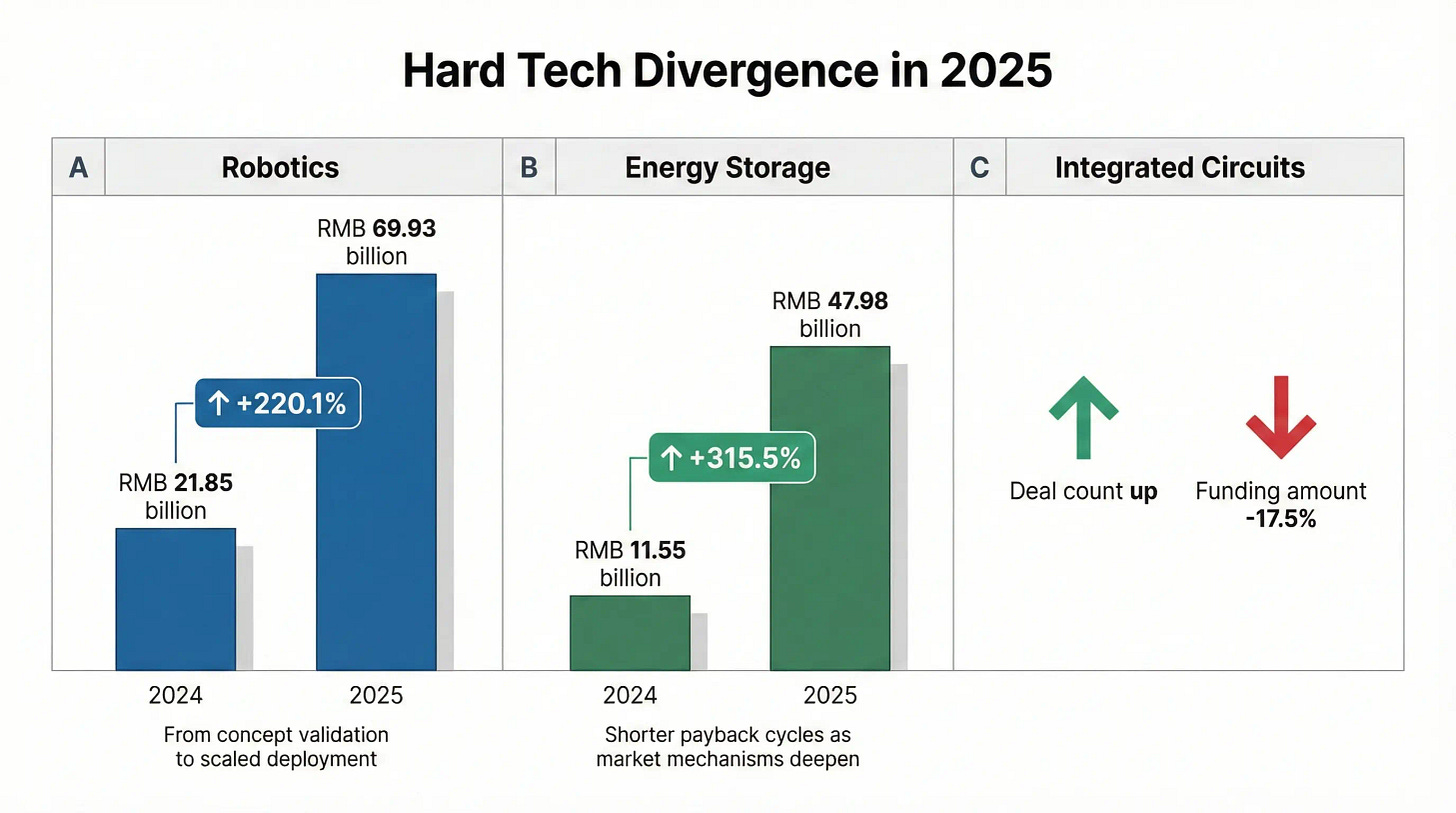

The most revealing signal in 2025 is the divergence inside “hard tech.”

Robotics absorbed RMB 69.93 billion in funding, and its funding amount increased 220.1% year over year. Energy storage attracted RMB 47.98 billion, with funding up 315.5%.

Now contrast that with integrated circuits. The number of financing events rose, but total funding fell 17.5%.

A useful way to interpret this is that China’s market is increasingly pricing “time-to-commercialization” more aggressively. In the same dataset that highlights the robotics surge, the narrative logic is explicit: capital is moving toward technologies and companies that can translate technical progress into tangible value creation, rather than rewarding sectors purely for being “strategic.“

Robotics and energy storage fit this preference because the underwriting story is clearer. The robotics thesis is described as a transition from validation to scaled deployment, including tests in industrial settings and the push toward mass production. The energy storage thesis emphasizes shorter payback cycles as technologies mature and market mechanisms deepen.

Integrated circuits, by contrast, can stay strategically important while the market becomes more disciplined about check size, pacing, and proof points. More deals with less money is what “selective risk capital” looks like in practice.