There Are No Small Deals Anymore

What Qualcomm’s $80M acquisition reveals about China’s new approach to tech M&A.

On June 5, 2025, Qualcomm quietly announced it had completed the acquisition of Autotalks, an Israeli semiconductor company most industry observers had never heard of. The deal was small–less than $100 million, down from an initially reported $350 million valuation. The press release was brief. No fanfare, no analyst calls.

For most tech M&A watchers, it barely registered. A minor acquisition of a niche chipmaker, already abandoned once after regulatory pushback, now closed at a steep discount. Nothing to see here.

But on October 10, China’s State Administration for Market Regulation (SAMR) announced it had opened an antitrust investigation into the transaction. Qualcomm’s stock dropped more than 7% in a single trading session. Suddenly, this forgotten Israeli startup was at the center of a geopolitical storm that reveals more about the future of tech regulation than any policy paper ever could.

This wasn’t about patents. It wasn’t about pricing. It was about something far more fundamental: who controls the nervous system of the connected car.

The V2X Chokepoint

To understand why Beijing reacted so forcefully, you need to understand what V2X technology is–and why there are so few companies that can actually deliver it.

V2X stands for “vehicle-to-everything” communication. Think of it as the real-time dialogue system that allows cars to talk to each other, to traffic infrastructure, to pedestrians’ phones. A car approaching an intersection can warn others about black ice. A traffic light can tell approaching vehicles it’s about to turn red. A pedestrian’s phone can alert a self-driving car to their presence.

This isn’t a nice-to-have feature. In any serious autonomous driving scenario, V2X is foundational safety infrastructure. It’s the difference between a car that can see what’s directly in front of it and one that can anticipate what’s around the corner.

And here’s the critical detail: Autotalks is one of the very few companies globally that can deliver chips supporting both major V2X protocols–DSRC (the WiFi-based standard) and C-V2X (the cellular network-based approach). That dual-protocol capability matters because the global market hasn’t settled on a single standard yet. Autotalks could work with whoever wins.

For Qualcomm, this wasn’t just about buying a supplier. It was about plugging the last major gap in its Snapdragon Digital Chassis platform–a comprehensive suite covering in-car connectivity, infotainment, autonomous driving systems, and now, vehicle-to-everything communication.

With smartphone revenue growth stalling, Qualcomm has bet heavily on automotive as its “second act.” Its automotive business generated close to $3 billion in fiscal 2024, marking five consecutive quarters of record automotive revenues with 68% year-over-year growth. V2X is central to the next phase of that growth strategy.

But what looked like a strategic masterstroke in San Diego looked very different in Beijing.

Why This Crossed China’s Red Line

China didn’t just wake up one day and decide to investigate Qualcomm. This case has a timeline–and reading it reveals exactly how Beijing’s regulatory thinking has evolved.

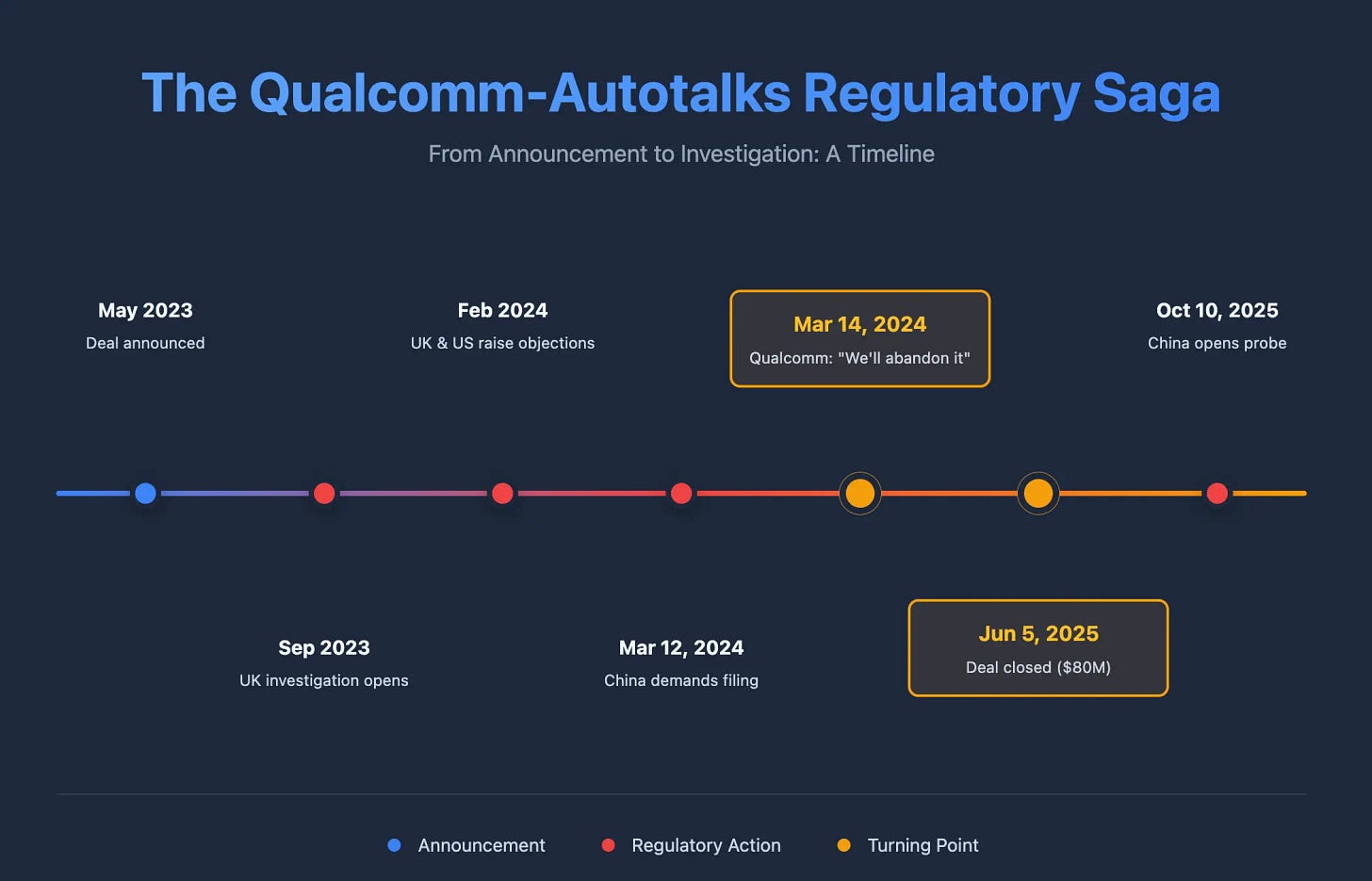

May 2023: Qualcomm announces its intention to acquire Autotalks.

September 2023: The UK’s Competition and Markets Authority opens an investigation, expressing concern the deal “may reduce innovation and increase prices” in the V2X market.

February 2024: The UK CMA escalates to a formal Phase 1 investigation. The US Federal Trade Commission also raises objections.

March 12, 2024: SAMR sends Qualcomm a written notice. The message is clear: this transaction requires regulatory approval under China’s Anti-Monopoly Law, even though it doesn’t meet traditional revenue thresholds. Do not proceed without filing and obtaining clearance.

March 14, 2024: Qualcomm writes back. It says it will abandon the transaction.

June 5, 2025: Qualcomm announces the deal is done. The transaction had been significantly downsized–from an initially reported $350 million valuation to a final price of $80–90 million, reflecting the regulatory headwinds the deal had faced. No prior filing with SAMR. No communication with Chinese regulators. Autotalks CEO Hagai Zyss is now a Qualcomm VP. The integration is complete.

October 10, 2025: SAMR launches a formal investigation. According to the regulator’s statement on October 12, Qualcomm has “acknowledged the facts” of the case.

This is where the story gets interesting–because it reveals a fundamental shift in how China approaches tech mergers.

Under the revised Anti-Monopoly Law that took effect in 2024, Chinese regulators can require merger filings even when deals fall below traditional revenue thresholds if there is evidence the transaction could eliminate or restrict competition. This is the legal mechanism SAMR invoked in March 2024.

But here’s what makes the Qualcomm case distinctive: the concern isn’t really about market share in the traditional sense. Qualcomm and Autotalks weren’t direct competitors. There’s no obvious price-fixing risk. The deal wouldn’t immediately create a monopoly in any clearly defined market.

What it would do is consolidate control over a critical technology layer in China’s most strategic industrial sector.

Why V2X Is National Infrastructure

China isn’t just building electric vehicles. It’s building an entirely new transportation infrastructure–one where vehicles, roads, cities, and cloud systems operate as an integrated network. This vision is embedded in national strategies including the Smart Car Innovation Development Strategy and multiple new infrastructure initiatives.