Moore Threads’ Record IPO: Blueprint or Gamble?

An 88-day IPO approval signals Beijing’s tech ambitions. But the real battle is just beginning.

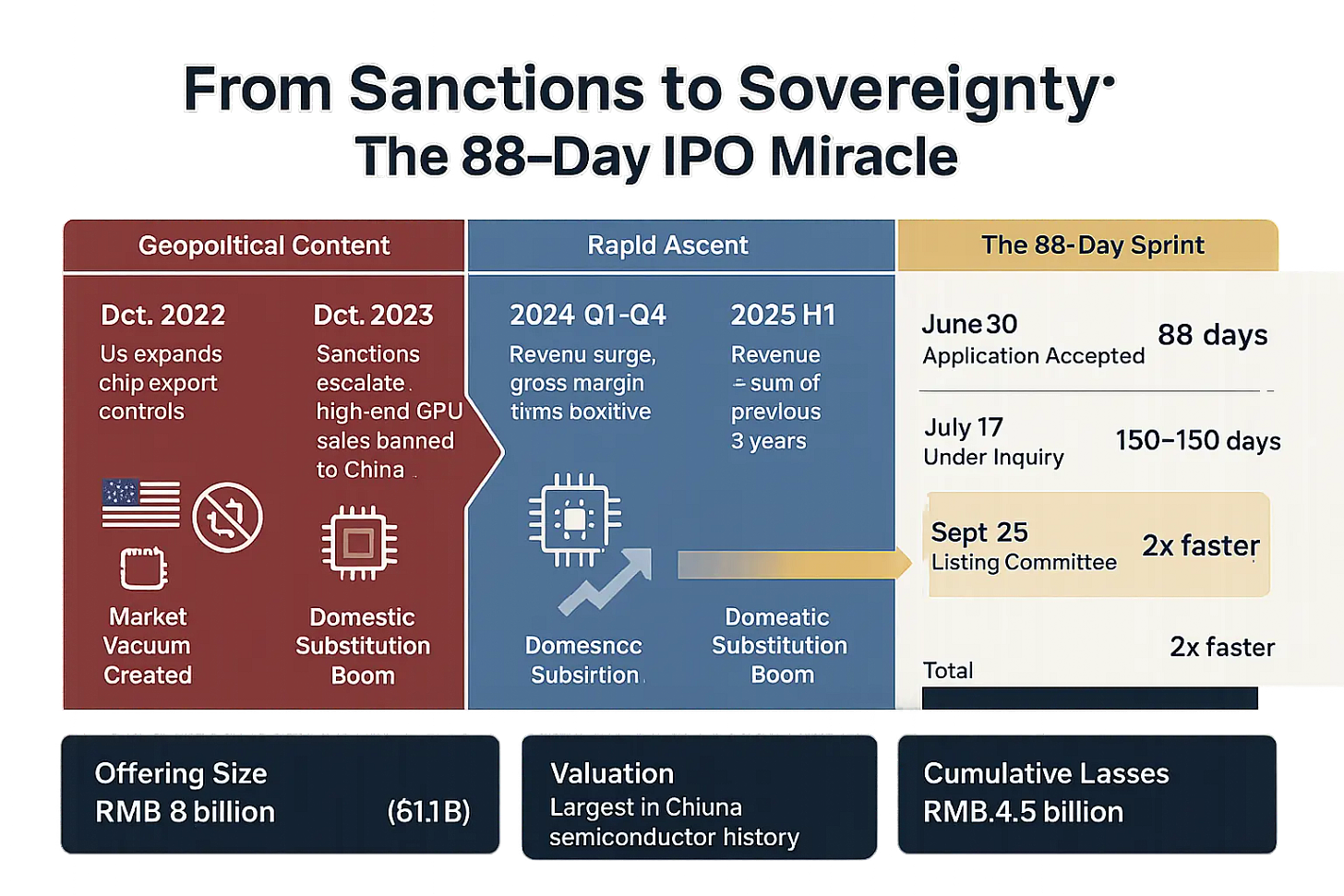

On September 26, 2025, Moore Threads (摩尔线程), a four-year-old Chinese GPU startup, achieved what many considered impossible: it won approval for a landmark IPO on Shanghai’s STAR Market in a record-shattering 88 days. The proposed 8 billion RMB ($1.1 billion) offering, the largest in China’s semiconductor sector this year, wasn’t just a financial milestone; it was a powerful state signal broadcast to the world.

This “rocket approval” is far more than a story of a fast-growing company. It’s a masterclass in China’s evolving grand strategy for technological self-reliance, revealing a sophisticated playbook for how the nation intends to build a parallel, state-accelerated tech ecosystem in the face of immense geopolitical pressure. To understand the Moore Threads IPO is to understand the core logic driving China’s tech ambitions today. It provides a blueprint for how a nation can leverage sanctions as a catalyst, weaponize its capital markets as industrial policy, and marshal a “national team” to challenge a deeply entrenched global technology leader.

This analysis will deconstruct the Moore Threads phenomenon, not as an investment opportunity, but as a framework for understanding China’s quest for GPU sovereignty. Part I explores the state’s strategic hand, the company’s “NVIDIA playbook with Chinese characteristics,” and the monumental battle to build a viable alternative to the most powerful moat in modern technology: NVIDIA’s CUDA ecosystem. Part II, available to Premium subscribers, draws from deep prospectus analysis to examine four critical risks–from strategic trade-offs to supply chain vulnerabilities–that will determine whether this blueprint for technological sovereignty can actually be built.

How Sanctions Created a Market—and Beijing Weaponized Capital

The story of Moore Threads’ IPO cannot be told without first understanding its political and economic context. The company’s meteoric rise is a direct consequence of escalating US-China tech friction. US sanctions restricting the sale of high-end GPUs to China, intended to kneecap its AI development, paradoxically became the single most powerful market-creating event for domestic challengers. This friction created two essential conditions for Moore Threads’ success: a protected market and a flood of state-directed capital.

First, the sanctions effectively restricted NVIDIA and AMD from selling their highest-end GPUs in China, creating a massive, state-supported vacuum. Suddenly, China’s tech giants, cloud providers, and research institutions had no choice but to seriously consider domestic alternatives–including GPU vendors such as Metax (沐曦) (our earlier deep-dive: The Metax Paradox: China’s AI Chips Under Forced Transparency)–transforming them from hesitant experimenters into motivated, high-volume customers.

Second, the IPO’s 88-day sprint through the regulatory process is a testament to the strategic function of its listing venue, the STAR Market (科创板).

China Context: The STAR Market (科创板)

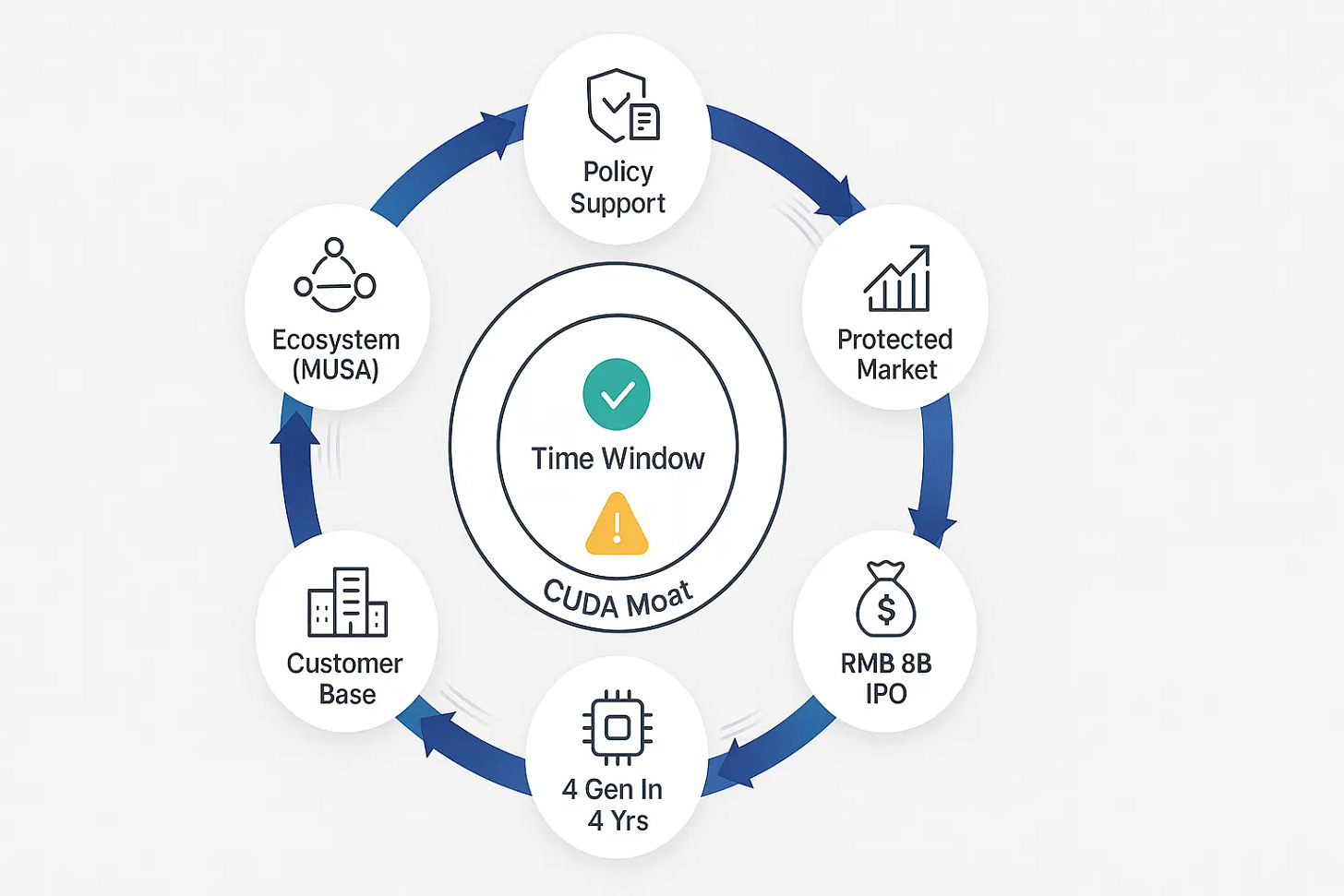

Launched in 2019, the Shanghai Stock Exchange’s STAR Market is China’s answer to the NASDAQ, but with a distinct political mandate. It was designed specifically to channel capital into companies in strategic sectors like semiconductors and AI–even if they are years from profitability. It operates with a streamlined registration system, allowing regulators to fast-track companies deemed critical to national strategic goals.

Moore Threads, with cumulative net losses of approximately 4.6 billion RMB from 2022 to 2024, is a perfect fit for the STAR Market’s mission. Its rapid approval is a clear demonstration of the market acting as an instrument of industrial policy. The financial results reflect this state-forged opportunity. Moore Threads’ revenue in the first half of 2025 alone reached 702 million RMB, more than the previous three years combined. Even more revealing is its gross margin, which flipped from a staggering -70.08% in 2022 to a robust +70.71% in 2024, according to its IPO filings This dramatic turnaround is not just a sign of better products; it’s a sign of immense pricing power within a supply-constrained, policy-driven domestic market where performance-per-dollar is secondary to availability and strategic alignment.

Copying NVIDIA—With Chinese Modifications

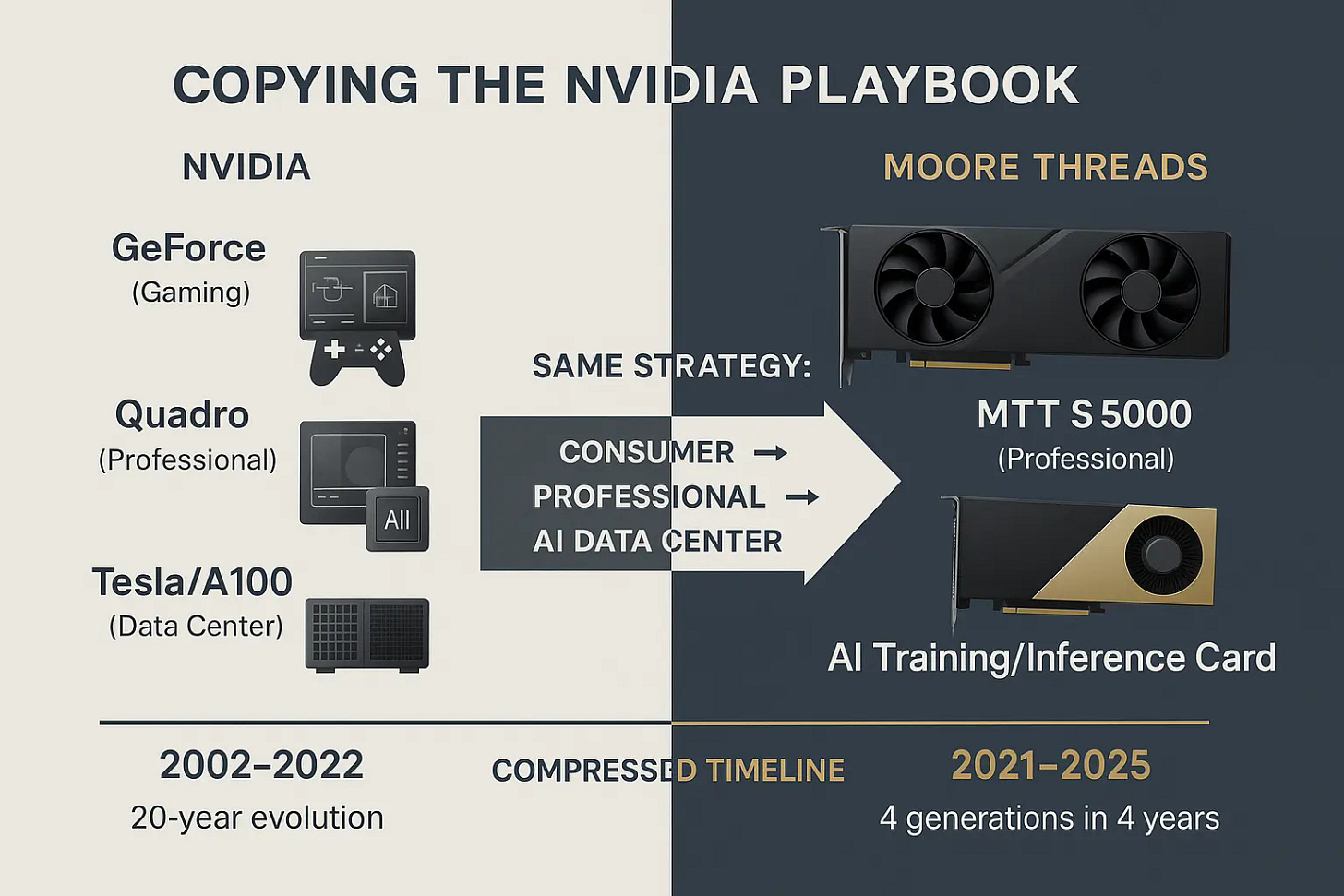

If the state set the stage, Moore Threads’ corporate strategy has been to execute the NVIDIA playbook, but adapted for China’s unique context. This pattern is rooted in the company’s very DNA. The founder, Zhang Jianzhong, is the former Global Vice President of NVIDIA and General Manager for Greater China, and the core technical team is heavily staffed with ex-NVIDIA talent. This represents a critical pattern of knowledge transferwhere talent trained at the global frontier returns to build domestic alternatives.

This “NVIDIA DNA” is evident in their strategic trajectory. Just as NVIDIA built its empire from the foundations of consumer gaming graphics, Moore Threads’ first major product was the MTT S80 GPU, a consumer-grade card. Once this technical foundation was laid, the company pivoted aggressively toward the far more lucrative and strategically vital AI compute market, with AI-related products constituting nearly 80% of their revenue in H1 2025. The company has maintained a relentless development pace, pushing products into the market, gathering real-world feedback from their now-captive customer base, and feeding those lessons into the next generation.

The Real Battle: Cracking CUDA’s Moat

While hardware specifications grab headlines, any seasoned observer knows the true source of NVIDIA’s power is not its silicon, but its software. The CUDA (Compute Unified Device Architecture) platform is a sprawling ecosystem built over nearly two decades. It is the language of AI development, and its deep integration makes switching to a competitor an expensive and painful proposition. This is the deepest, widest moat in all of technology.

Moore Threads’ long-term survival hinges on its ability to build a credible alternative. The centerpiece of their strategy is MUSA (Moore Threads Unified System Architecture), a full-stack platform explicitly designed as an “all-function” alternative to CUDA. Recognizing the immense inertia of the incumbent, they also developed “Musify”, designed to help developers automatically migrate CUDA code to their platform. This pragmatic solution is essential to lowering the barrier to entry.

Yet, this battle is not being fought alone. In a uniquely Chinese approach, Moore Threads is a key ecosystem player in efforts such as the Open Interconnect Standard for AI (OISA), an alliance led by China Mobile. The goal of OISA is to create a national, open standard for high-speed GPU interconnects–a direct challenge to NVIDIA’s proprietary NVLink technology. This is a concerted, top-down effort to align the supply side (Moore Threads), the demand side (China Mobile), and the application layer (AI model developers like DeepSeek) to bootstrap a domestic standard. This ecosystem-centric battle, more than any single chip’s performance, will determine the ultimate success of China’s GPU ambitions.

The public narrative celebrates the birth of China’s GPU champion, pointing to impressive revenue growth and state backing as signs of inevitable success. But for strategists and investors, the real story lies beneath the surface. This is not a story of inevitable triumph. It is a story of a company making critical, and often risky, trade-offs in its quest to challenge NVIDIA’s global dominance–trade-offs that will determine whether this blueprint for technological sovereignty can truly be built.