The Metax Paradox: Transparency, Deficits, and the Investment Case for China's AI Chips

Shanghai's regulators pried open a rare window into China's semiconductor reality--one where profitability is distant but relevance is secured.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

👉 Final week to lock in Premium early-bird pricing: $10/month ($100/year) before it rises on Sept 1. Upgrade here.

When Shanghai-based AI chip company Metax filed its response to the Shanghai Stock Exchange’s first-round IPO inquiry this week, it did something unprecedented in the typically opaque world of Chinese semiconductors: it answered everything.

Not the carefully crafted responses of typical corporate communications, but a comprehensive 300-page regulatory filing that reads like a semiconductor industry audit. Having submitted their initial IPO prospectus to the STAR Market back in June, Metax now faced the exchange’s detailed follow-up questions about their business model, competitive positioning, and financial projections–questions that demanded specific, verifiable answers rather than marketing speak.

The result is extraordinary transparency. Metax admits to being 1–2 generations behind NVIDIA, details their struggles with software ecosystems, and provides granular data on their commercialization challenges despite shipping 25,000 GPUs. This isn’t voluntary disclosure–it’s regulatory compliance that inadvertently creates the clearest window foreign investors have ever had into China’s semiconductor development reality.

This forced transparency creates what I call the “Metax Paradox”: a Chinese chip company, under regulatory pressure to provide complete and accurate information, inadvertently reveals not just their own challenges but the structural dynamics facing every Chinese semiconductor company attempting to challenge established global players.

The disclosure matters because it gives us a framework for understanding an industry where technical capability and commercial success remain stubbornly disconnected, and where the gap between marketing claims and operational reality has never been clearer.

The Performance Reality Check

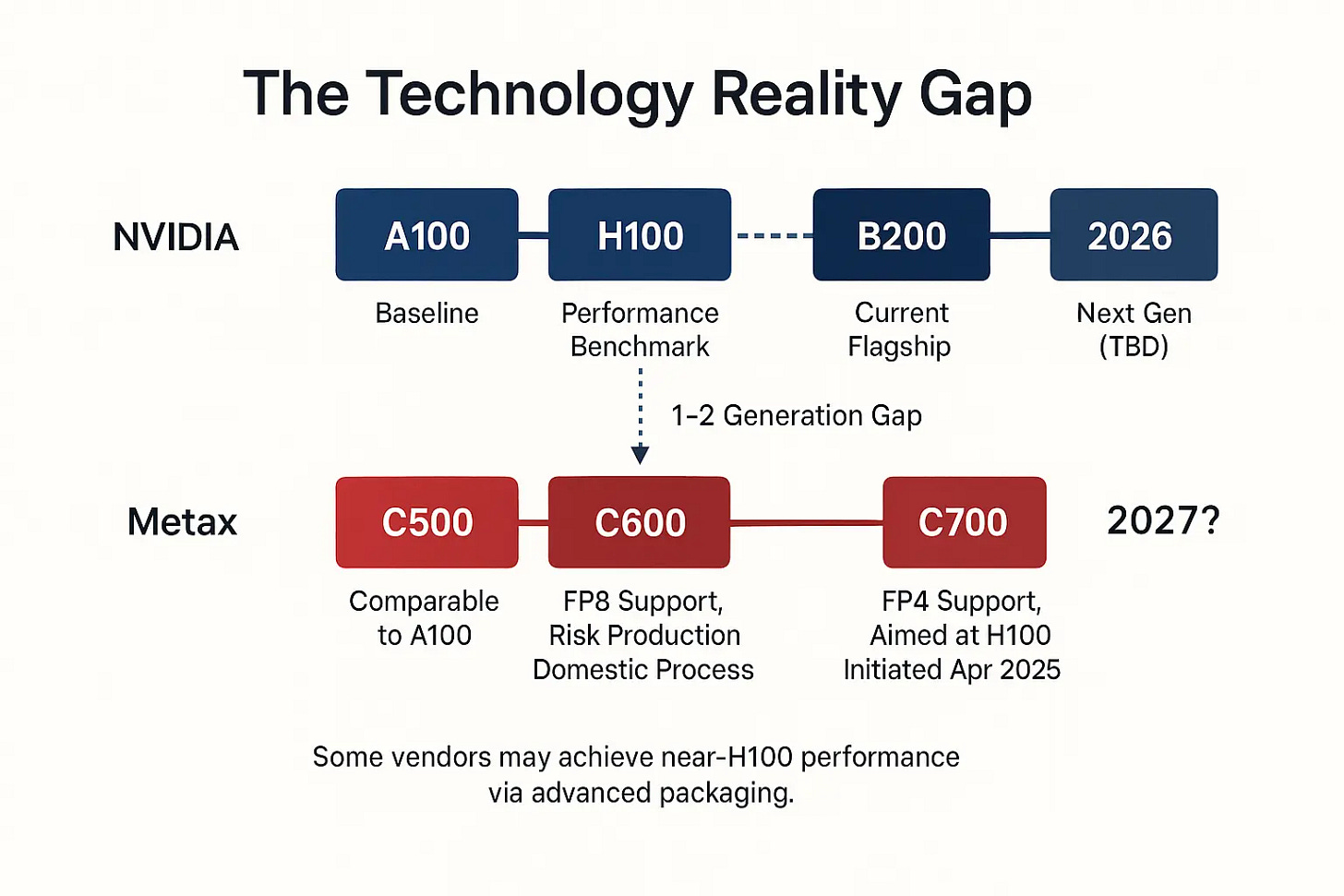

The Shanghai Stock Exchange clearly pressed Metax for specific performance benchmarks, and the company’s responses are revealing. Their flagship C500 series chips benchmark against NVIDIA’s A100–a product released in 2020. Their upcoming C700 series targets H100 performance, representing technology NVIDIA shipped in 2022. This isn’t catching up; it’s maintaining a predictable 2–3 year technological lag.

What makes this disclosure significant is its candor. Rather than the vague “leading performance” claims typical of industry marketing, Metax explicitly states that “包括沐曦在内的绝大部分国内厂商与英伟达最新产品均仍存在一到两代差距” (including Metax, the vast majority of domestic manufacturers still have a 1–2 generation gap with NVIDIA’s latest products).

This regulatory-forced honesty reveals the actual benchmarks Chinese companies measure themselves against. While Silicon Valley debates the architectural advantages of NVIDIA’s next-generation B200 chips, Chinese companies are still working to match 4-year-old technology–a gap that appears structural rather than temporary.

The technical constraints are genuine and specific. Limited access to advanced process nodes forces Chinese companies to pursue performance through architectural innovations and advanced packaging techniques. Metax’s upcoming C600 series, for example, uses “先进封装” (advanced packaging) to boost performance while acknowledging that “功耗有所提升” (power consumption increases) and “卡间互连带宽略有下降” (inter-card interconnect bandwidth slightly decreases).

These engineering trade-offs, detailed in response to exchange inquiries about competitive positioning, illustrate a fundamental challenge: without access to cutting-edge manufacturing processes, Chinese chip companies must optimize for different variables than their global competitors. Where NVIDIA can improve performance, power efficiency, and cost simultaneously, Chinese companies must choose.