Meituan Writes a $717 Million Check to Remove an Option

In China’s instant retail, warehouses are becoming the moat. Meituan just bought a veto.

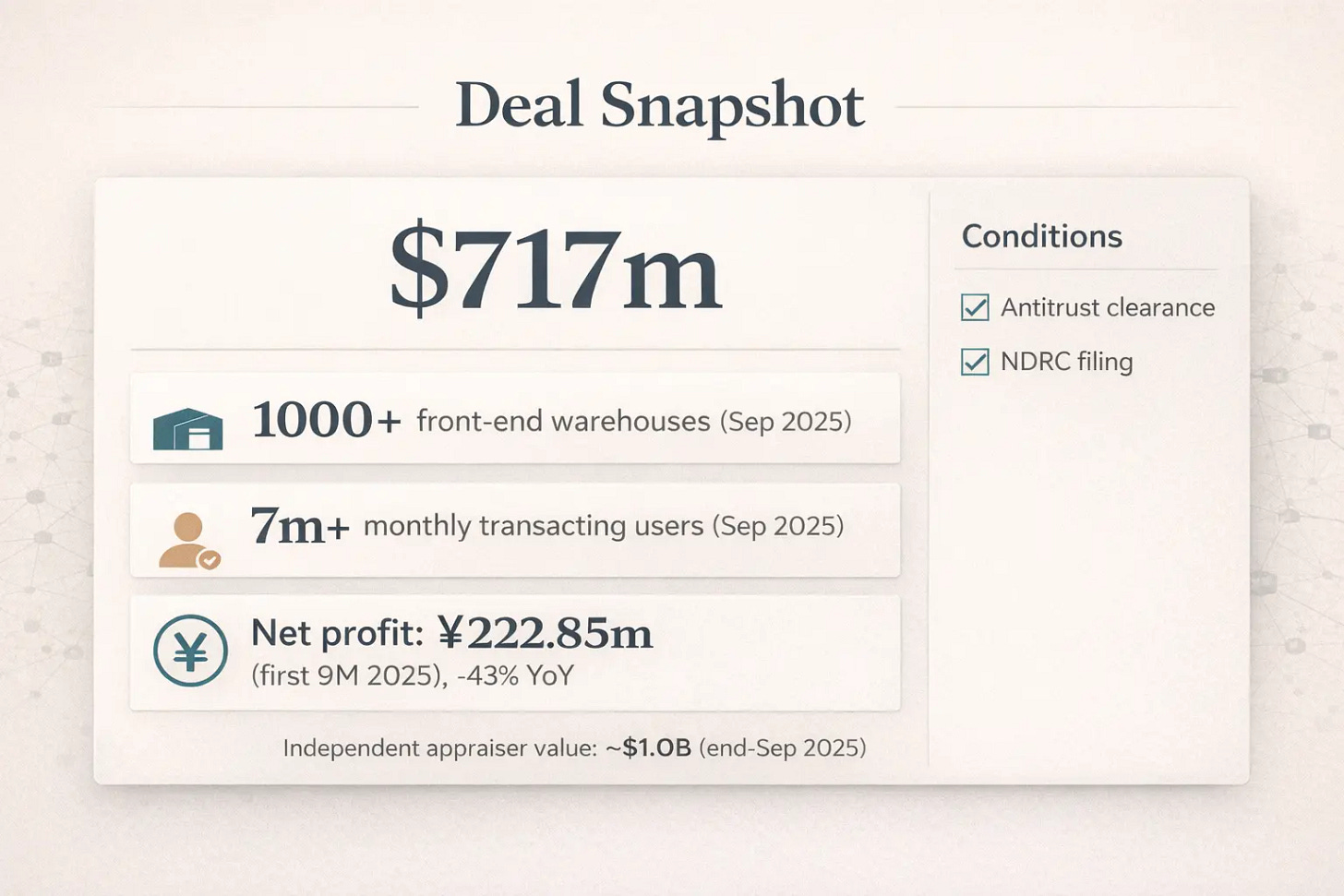

Meituan announced on February 5th that it would acquire Dingdong, one of China’s leading fresh grocery delivery platforms, for $717 million. The deal will bring over 1,000 micro-fulfillment centers and over 7 million monthly transacting users as of September 2025 under Meituan’s control, pending regulatory approval.

The transaction appears straightforward. China’s dominant food delivery company absorbs a profitable competitor. Clean and logical.

But the details suggest something else is happening.

Meituan already operates Xiaoxiang Supermarket, its own network of fulfillment warehouses. Some Meituan employees argued internally that Xiaoxiang already leads in gross merchandise value and warehouse count. They openly questioned the deal. Why spend $717 million on an acquisition when that capital could strengthen their existing operation?

The two businesses do not fit neatly together. Dingdong runs what the industry calls a “small warehouse” model. Each location stocks roughly 3,000 SKUs, mostly fresh produce. Xiaoxiang uses a “large warehouse” model with over 8,000 SKUs spanning groceries and general merchandise. In East China, where Dingdong is strongest, warehouse locations overlap in parts of the region, creating potential redundancy.

And yet Meituan proceeded.

The valuation offers another clue. Based on Non-GAAP trailing twelve-month earnings, the acquisition values Dingdong at roughly 13x. Pinduoduo, China’s discount e-commerce giant, trades at approximately 10x on the same basis. Analysts note that fresh grocery is a harder business than general e-commerce, making 13x look elevated. The deal is neither cheap nor expensive. Meituan paid fair value for a business that does not perfectly complement its existing portfolio.

So what is Meituan actually buying?

The answer reveals how competition in China’s instant retail sector is evolving. The real value of this deal lies in what it prevents.

What the Check Really Buys

In the lead-up to the announcement, Dingdong had multiple suitors. Alibaba and JD.com were reportedly among potential buyers. This context transforms the deal’s strategic logic entirely.

Consider Meituan’s position. The company leads China’s instant retail market. This sector, known in Chinese as 即时零售 (jíshí língshòu), refers to online orders delivered within 30 to 60 minutes. Think of it as the battleground where food delivery platforms expand into groceries, household goods, and convenience store items.

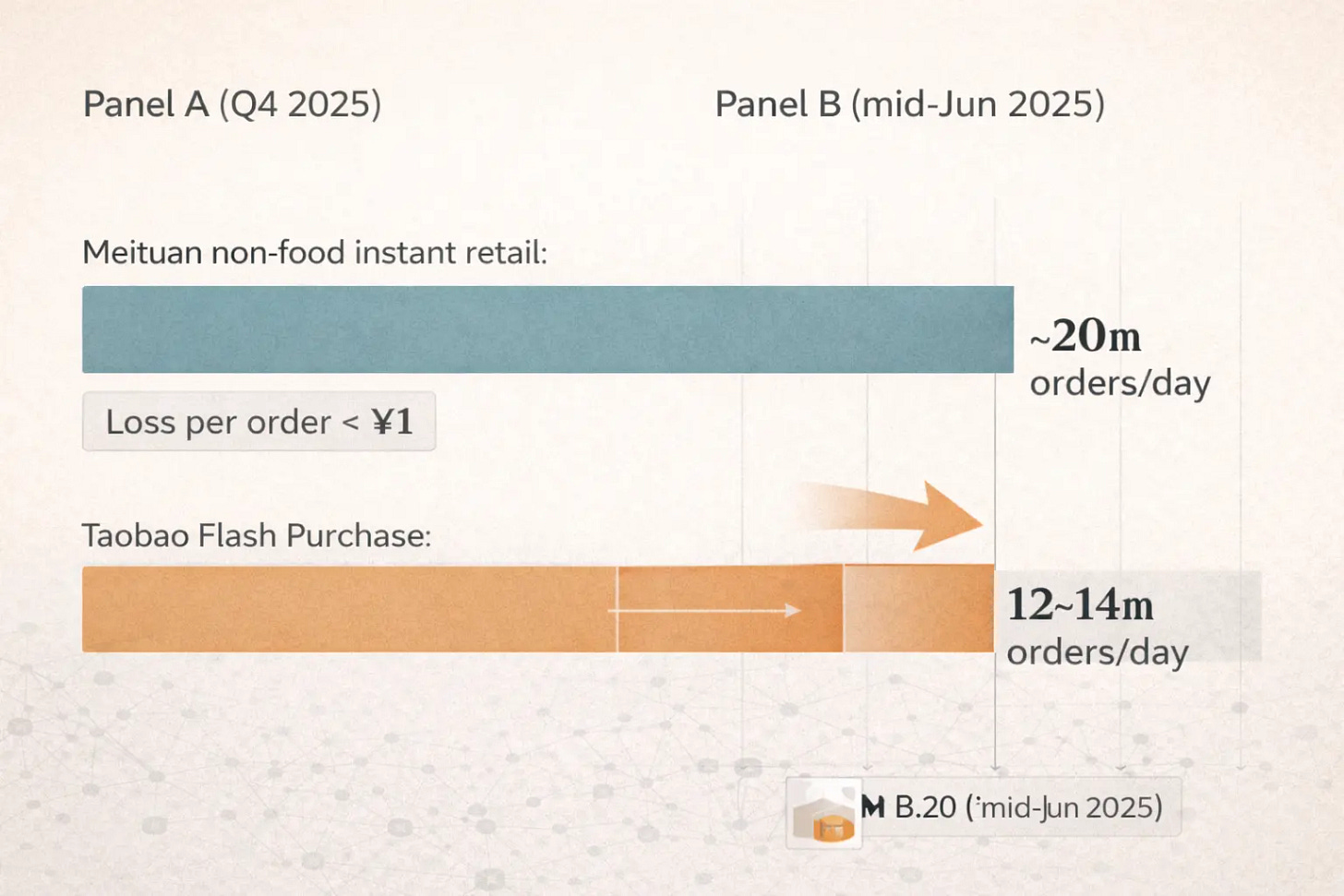

In Q4 2025, Meituan handled roughly 20 million daily non-food instant retail orders. Alibaba’s Taobao Flash Purchase reached 12 to 14 million daily orders. That gap had narrowed dramatically. In mid-June 2025, Taobao Flash Purchase handled only around 5 million daily orders . Alibaba had more than doubled its volume in roughly six months.

In this environment, Dingdong represents something dangerous if acquired by a competitor. Over 1,000 warehouses. Proven logistics operations. A functional supply chain for fresh produce. Years of operational refinement.

Building this infrastructure from scratch takes time. Acquiring it takes a checkbook and a signature.