When a Supplier Becomes the Platform: Huawei's New Power in China's Auto Industry

Huawei’s role in China’s auto industry has shifted from supplier to platform. The change is redefining who can survive – and why.

Huawei occupied two exhibition spaces at the 2025 Guangzhou Auto Show. The company positioned itself next to CATL, the battery giant. This placement tells a story. CATL spent years convincing consumers that battery brand matters when buying an EV. Huawei is now doing the same for intelligent driving systems.

The comparison goes deeper. Both companies supply critical components. Both market directly to consumers. Both want their brands to influence purchase decisions. The difference is what they control. CATL provides energy storage. Huawei provides the brain.

Huawei now partners with 14 Chinese automakers across 33 vehicle models. The company delivered nearly one million vehicles through its Harmony lntelligent Mobility Alliance network by October 2025. September alone saw 52,916 deliveries. Holiday bookings surged 70% year over year.

Every one of these vehicles runs identical software. The same Qiankun autonomous driving system. The same Harmony cockpit interface. The same over-the-air update schedule. Industry observers call this “standardized Huawei integration.” When technology becomes uniform, something has to give.

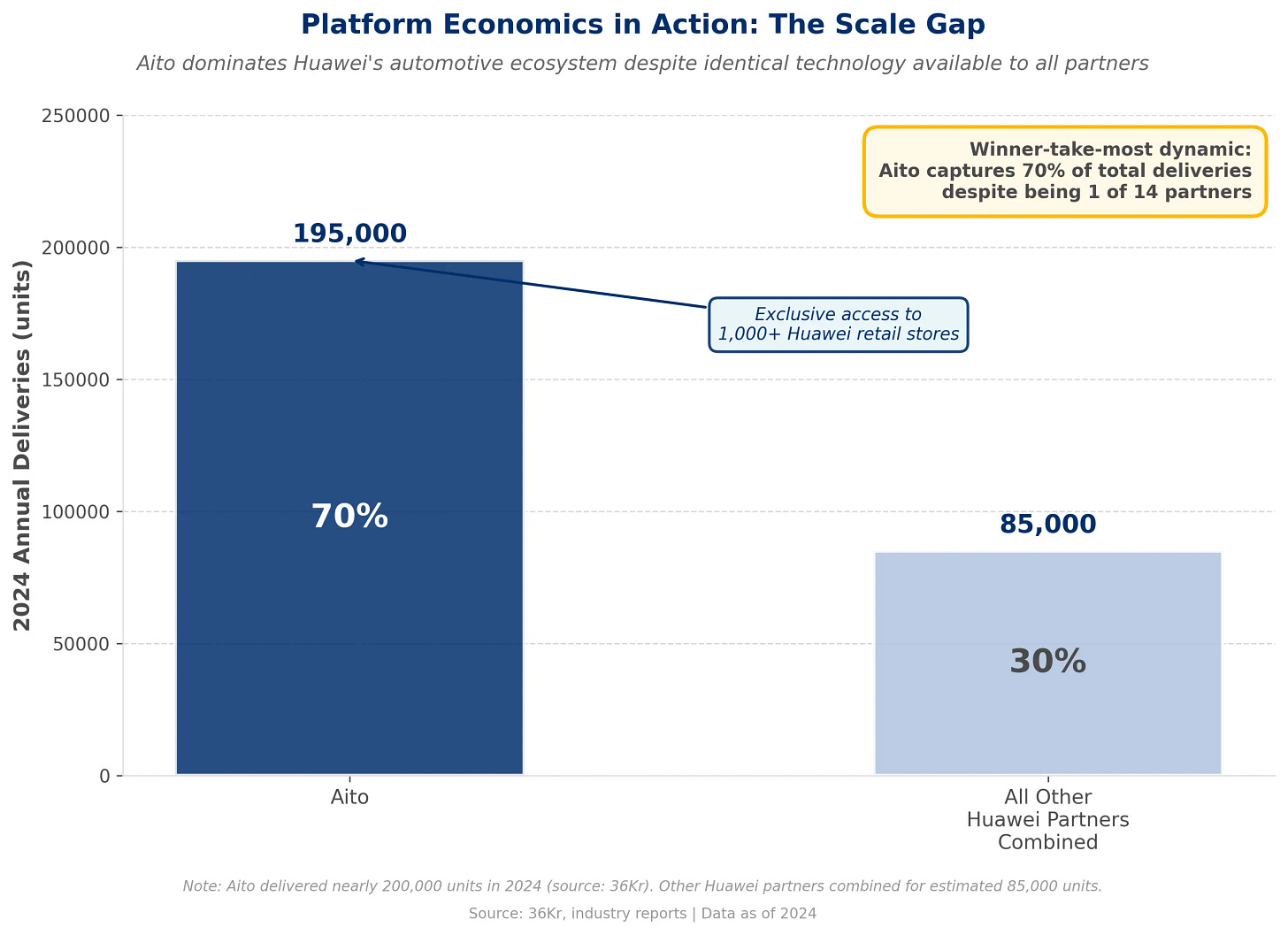

The puzzle is this: 14 automakers compete with the same core product. Only one is winning. The business model appears unstable. Yet money keeps flowing into these partnerships. Executives keep visiting Huawei headquarters. More brands keep launching. Understanding why requires looking past the technology to the underlying economics.

Scale Economics in Action

Huawei’s automotive journey began with connectivity hardware in 2009. The company built vehicle communication modules. By 2019, it had established a dedicated automotive unit with thousands of engineers. The strategy evolved through three distinct partnership tiers.

The loosest arrangement resembles traditional supply. Huawei sells components. Automakers integrate them. Relationships stay transactional. The middle tier, called HI mode, involves deeper collaboration. Huawei provides complete intelligent system architecture. Partners like Avatr and Arcfox fall into this category.

The tightest integration comes through Harmony lntelligent Mobility Alliance. This umbrella includes five brand collaborations: Aito with Seres, Stelato with BAIC, Maextro with JAC, Luxeed with Chery, and Shumate with SAIC. Huawei helps define products, manages marketing, and shares retail channels.

Sales figures reveal brutal hierarchy within this ecosystem. Aito delivered nearly 200,000 vehicles in 2024. The M7 model alone achieved what Chinese automakers dream about: outselling German luxury brands in its segment. Other Harmony partners show modest traction at best. Stelato and Maextro struggle to reach five-digit monthly volumes.

This disparity traces to resource allocation. Aito products sell through more than 1,000 Huawei retail stores nationwide. These stores already exist for phones and laptops. Adding cars requires minimal incremental investment. Other brands lack this distribution advantage. They rely on traditional dealership networks or build their own retail presence from scratch.

First-mover benefits compound these advantages. Aito launched in 2021. Consumers now associate the brand with Huawei technology. Later entrants fight for attention in a crowded field. They promise the same intelligent features but lack comparable brand recognition.

The economics of partnering with Huawei make sense on paper. Building proprietary autonomous driving requires five to seven years. Development costs run into billions of dollars. Technical risk is high. Many companies try and fail. Huawei offers a shortcut: proven technology, immediate deployment, brand association with China’s premier tech company.

(AITO M5, the first HarmonyOS vehicle Photo: VCG)

But costs accumulate in less obvious ways. When multiple brands deploy identical systems, competition shifts entirely to price, design, and brand perception. Margins compress. Software and intelligence were supposed to create new revenue streams. Instead they become commoditized inputs. Automakers end up competing on traditional manufacturing efficiency.

Dependency creates another problem. Huawei controls the technology roadmap. Partners receive updates on Huawei’s schedule. New features arrive when Huawei prioritizes them. This dynamic resembles Android phone manufacturers waiting for Google’s next OS release. Some companies thrive in this environment. Many struggle to differentiate.