The $21B Bet: Inside China’s Most Successful Government VC Story

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

How one provincial capital built a high-tech empire by acting like a venture capitalist–and created a memory chip champion worth more than most unicorns.

When a Chinese memory chip company you’ve probably never heard of prepares to go public at a $21 billion valuation, it’s worth paying attention. Not because of the company itself, but because of what created it–and what that means for every investor trying to understand China’s tech landscape.

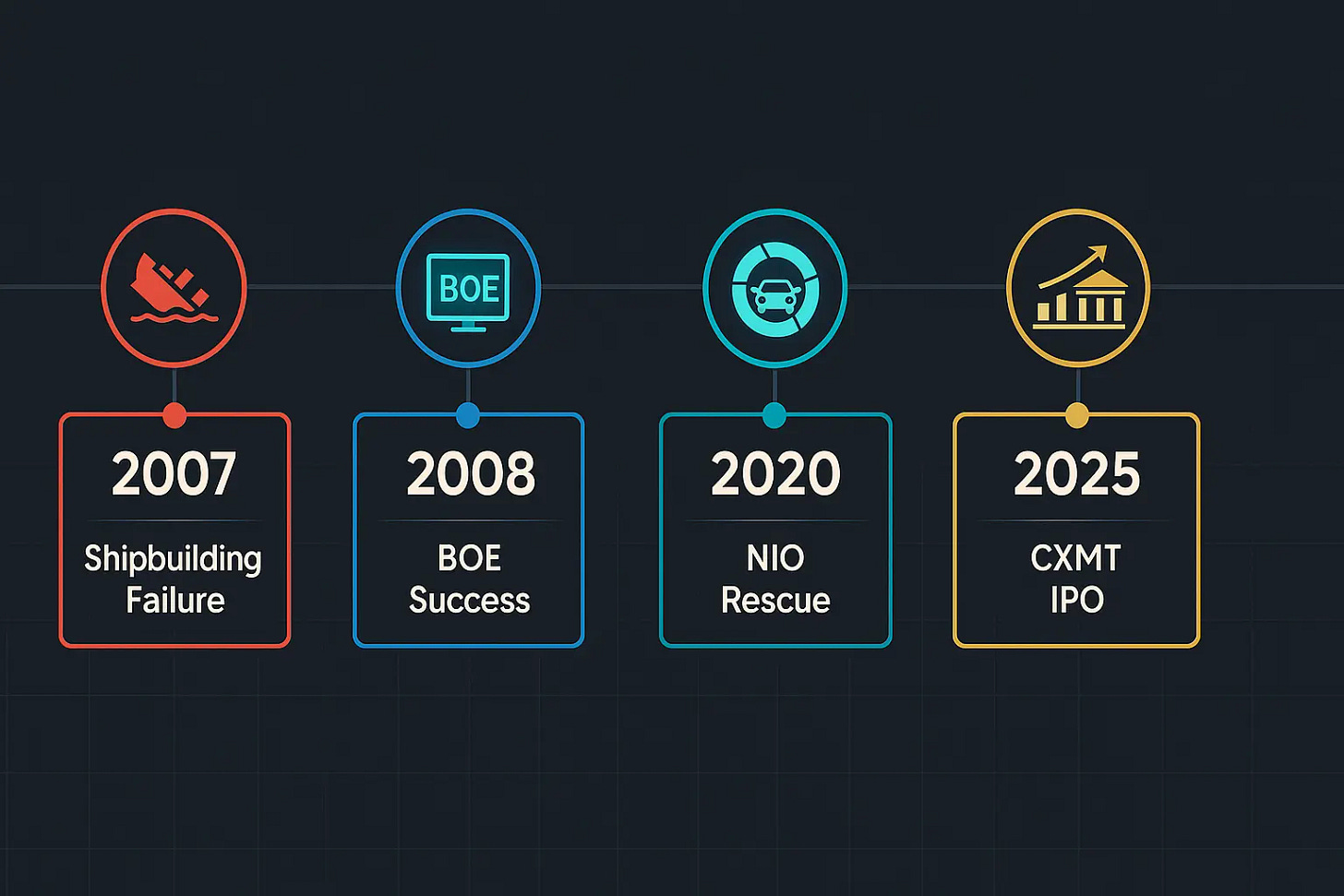

In the coming months, global capital markets will witness a landmark event that encapsulates the ambition, prowess, and immense risk at the heart of China’s technological ascent. Changxin Memory Technologies (CXMT), a company virtually unknown outside of semiconductor circles just a few years ago, is preparing for a domestic initial public offeringthat could value it at an astonishing 150 billion RMB (approximately $21 billion).

This is no ordinary listing. Headquartered in the inland city of Hefei, CXMT is Beijing’s national champion in a brutal, strategically vital industry: the manufacturing of DRAM memory chips. These tiny silicon components are the lifeblood of the digital world, the foundational memory in every smartphone, PC, data center, and AI server. For decades, this technology has been one of China’s most painful “choke points,” with a formidable global oligopoly–South Korea’s Samsung and SK Hynix, alongside America’s Micron Technology–controlling over 95% of the market. CXMT’s emergence is a direct, state-funded assault on this technological fortress.

But the story of this $21 billion IPO is far larger than that of a single company. It is the ultimate product of a unique and audacious experiment in industrial policy known as the “Hefei Model.” Over fifteen years, this strategy has transformed a once-nondescript provincial capital into a high-tech powerhouse, a city where the government acts not as a passive landlord but as an aggressive, hands-on venture capitalist.

Unlike Silicon Valley’s ecosystem where government plays a minimal role, or Israel’s model where military technology drives civilian innovation, Hefei represents something entirely new: government as venture capitalist. For investors, the numbers tell a compelling story: Hefei’s government funds have generated an estimated 300% return on their BOE investment, while their NIO rescue generated profits within 18 months. But these wins raise a crucial question: Is this sustainable alpha, or are we watching a sophisticated bubble in the making?

The Architect and the “Hefei Kid”

The genesis of this IPO lies with a man often described as a legend in China’s semiconductor industry: Zhu Yiming. A product of the nation’s elite academic pipeline, Zhu graduated from the prestigious Tsinghua University before earning a master’s degree in the U.S. and cutting his teeth in Silicon Valley. In 2005, he returned to China to found his first company, GigaDevice, which he successfully built into a major global supplier of a different, less complex type of memory chip, taking it public in 2016.

But for Zhu, and for Beijing, the bigger prize remained elusive: DRAM. This matters because memory chips are the ultimate commodity business–margins live and die on scale and manufacturing efficiency. After a failed attempt to acquire a foreign firm to gain the necessary technology, Zhu resolved to do what many thought impossible: build a domestic DRAM champion from the ground up. This was a monumental undertaking, a path littered with the corporate corpses of those who had tried and failed, burning through billions in the process.

This is where the Hefei government stepped in, demonstrating the proactive core of its model. In 2016, city officials, learning of Zhu’s ambitions, approached him. They offered not just tax breaks or cheap land, but a massive, direct equity partnership. The city government, through its investment vehicles, committed to shouldering the lion’s share–reportedly three-quarters–of the immense initial capital required. In 2017, the project officially broke ground.

The result was a stunning display of what locals call “China speed.” In just ten months, the massive factory complex was built. By 2019, CXMT had produced its first commercially viable DDR4 memory chip, a “from 0 to 1” breakthrough for mainland China. The company is now regarded with fierce local pride. As one resident put it, CXMT is “our Hefei kid.”

This “kid” has since grown into a formidable contender. Its investor list reads like a “who’s who” of Chinese state and private capital: the powerful China Integrated Circuit Industry Investment Fund(the “Big Fund”), tech giants like Alibaba, Tencent, and Xiaomi, and a host of other state-backed entities have poured billions into the company. This is not just a city project; it is a national mission, incubated in Hefei, a testament to a model designed to align local ambition with central government strategy.

The Playbook: Forged in Failure, Perfected in Crisis

Hefei’s ability to nurture a behemoth like CXMT was not a stroke of luck. It was the result of a playbook developed over more than a decade of trial, error, and calculated risk-taking that fundamentally altered the relationship between government and business.

The model’s first, and perhaps most important, lesson came from a humbling public failure. In 2007, in a fit of irrational exuberance, the landlocked city invested heavily to bring a massive shipbuilding company to its shores, a project that defied all economic logic. When the global shipping market collapsed, the venture imploded, leaving behind a trail of debt and a crucial lesson seared into the minds of local officials: you cannot fight market gravity. State intervention must work with, not against, fundamental economic principles.

The first successful application of the refined playbook came a year later, in 2008. China was the world’s factory for electronics, yet it was critically dependent on Japan and South Korea for LCD screens. BOE Technology, a domestic contender, had the ambition to change that but was financially fragile. In a move of staggering boldness, the Hefei government signed an agreement to help BOE build a next-generation production line, committing to a financial framework worth over $1.3 billion–a sum equivalent to nearly half of the city’s entire fiscal revenue that year.

The deal was a masterclass in financial engineering. The government acted as a powerful strategic anchor investor, using its own creditworthiness and a 3 billion RMB initial investment to de-risk the project for private markets. The strategy worked. By June 2009, BOE had successfully raised 12 billion RMB, and by late 2010, the factory was in mass production. The government later exited its initial stake at a significant profit, but the real prize was the creation of a thriving display industry cluster that now numbers over 100 companies and produces 20% of the world’s LCDs.

The model was stress-tested and proven agile in 2020 with the opportunistic rescue of NIO. The premium electric vehicle maker, once a darling of investors, was burning through cash and on the verge of bankruptcy, having reportedly been rejected by 18 other cities. In April 2020, a consortium of Hefei’s state-led investors injected 7 billion RMB ($1 billion). The price was not just a 24% equity stake in NIO’s China operations, but a strategic commitment: NIO had to relocate its headquarters to Hefei.

The bailout was a resounding success. The capital infusion stabilized NIO, and its fortunes soared. Within 18 months, NIO’s parent company bought back a portion of the shares, handing the Hefei investors a quick and substantial profit while they retained a valuable stake. More importantly, NIO’s presence created a powerful gravitational field, attracting auto giants like Volkswagen and BYD to make massive investments. By 2023, Hefei was a national EV powerhouse.

From the foundational bet on BOE, to the agile rescue of NIO, to the national-mission incubation of CXMT, a distinct playbook has emerged. Each case demonstrated a different facet of what locals now call the “Hefei Model”: long-term vision, opportunistic speed, and deep strategic alignment between city ambitions and national priorities.

But behind the success stories lies a complex financial and political machinery that few outsiders understand. As CXMT prepares for its landmark IPO, the bigger question emerges: Is this replicable model a sustainable blueprint for China’s economic future, or a sophisticated gamble that could unravel?

Next week, we’ll decode the financial machinery that makes this possible–and examine why smart money is starting to worry about what happens when the music stops.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.