The Middle East Gambit: Why Chinese Robotaxi Companies Are Betting Big on Gulf States

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

Chinese autonomous vehicle companies are making their largest international bets in Middle Eastern markets, committing thousands of vehicles and hundreds of millions of dollars to regions where they face less regulatory scrutiny than in the US or Europe. The moves come as mounting losses force these companies to seek new revenue sources outside increasingly competitive home markets.

Pony AI, WeRide, and Baidu’s Apollo Go have announced plans to deploy over 2,000 autonomous vehicles across the Gulf states by 2027, representing a significant expansion from China’s current domestic robotaxi operations. The commitments coincide with deteriorating financials: Pony AI posted $275 million in losses on just $75 million in revenue last year, while WeRide’s losses expanded 59.84% to $344.8 million even as revenue declined 10.13%.

Industry analysts question whether these companies are executing a calculated international strategy or making increasingly desperate bets to stave off financial collapse.

The Burn Rate Reality

The numbers driving Chinese companies toward the Middle East are stark. Pony AI’s 2024 net losses dwarfed its revenue by nearly four to one, while WeRide saw adjusted net losses balloon even as revenue fell. Both companies are burning through cash at rates that make profitability a distant prospect without dramatic revenue growth.

The domestic Chinese market isn’t delivering that growth. Despite operating in cities with millions of potential riders, these companies face regulatory constraints that limit expansion and intense competition that pressures margins. China’s established robotaxi operations, while growing, generate insufficient scale to justify the billions invested in research and development.

“These companies need scale desperately, and they need it fast,” said James Liu, Deutsche Bank’s head of diversified industrials group in Asia. “The Middle East offers the possibility of rapid deployment without the regulatory gridlock they face elsewhere.”

The alternative—continuing to burn cash in limited domestic markets—appears increasingly untenable. At current burn rates, several Chinese autonomous vehicle companies face potential funding crunches within 18–24 months without significant revenue growth or fresh capital.

Why the Gulf States Matter

Middle Eastern markets offer three critical advantages that Chinese companies can’t find elsewhere: regulatory speed, government backing, and genuine economic demand for automation.

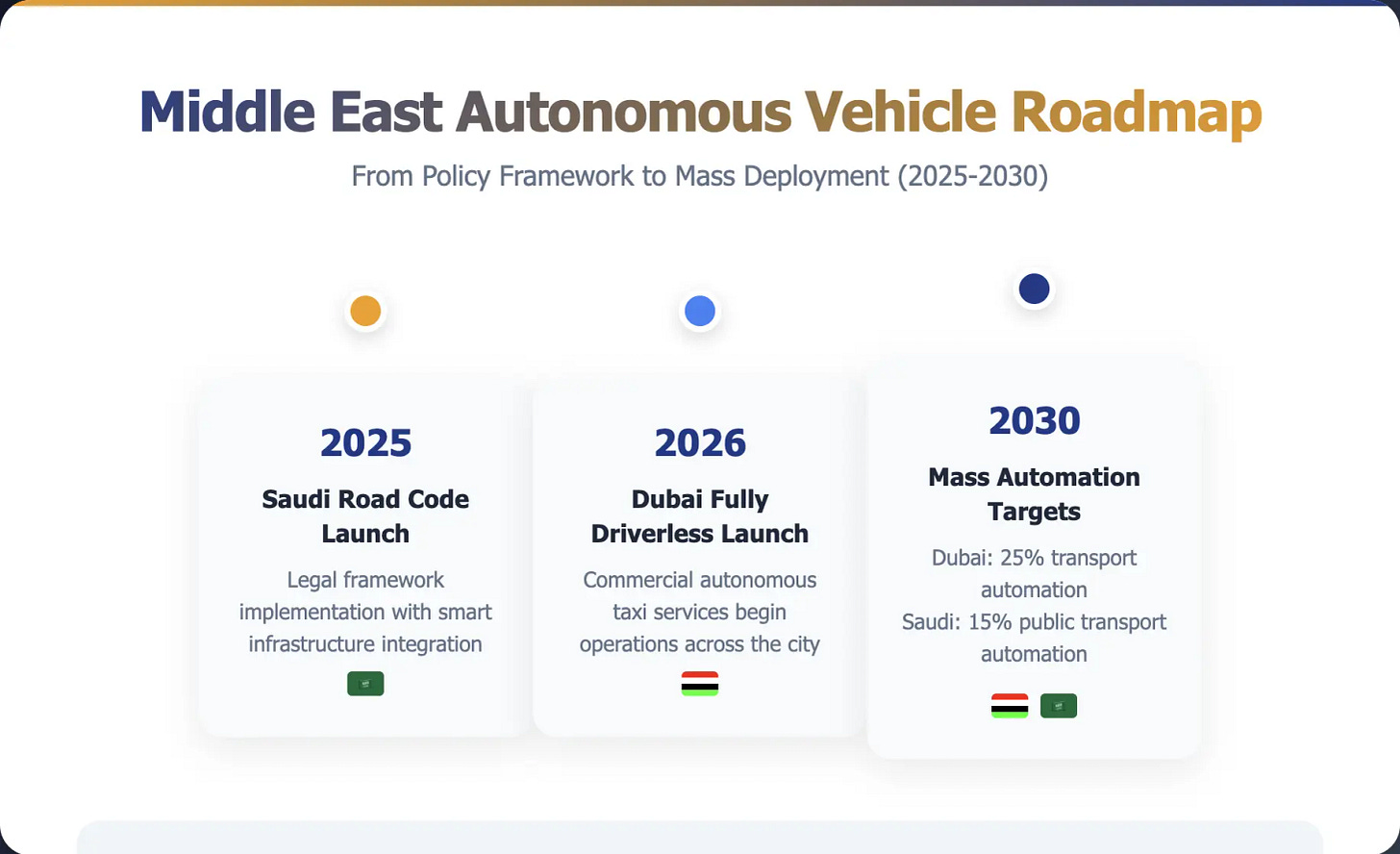

Dubai has committed to making 25% of its transportation autonomous by 2030, while Saudi Arabia targets 15% of public transport automation by the same deadline. More importantly, these aren’t aspirational goals—they come with fast-track regulatory approval processes and substantial government co-investment.

The economic fundamentals also work. Gulf states have labor costs that make autonomous vehicles economically viable today, unlike markets where human drivers remain significantly cheaper, creating clear incentives for automation that don’t exist in many other international markets.

Chinese companies also claim compelling cost advantages. Their robotaxis cost $30,000–50,000 per vehicle, reportedly a fraction of the price of robotaxis from US players like Alphabet’s Waymo, whose vehicles require significantly more expensive sensor and computing equipment.

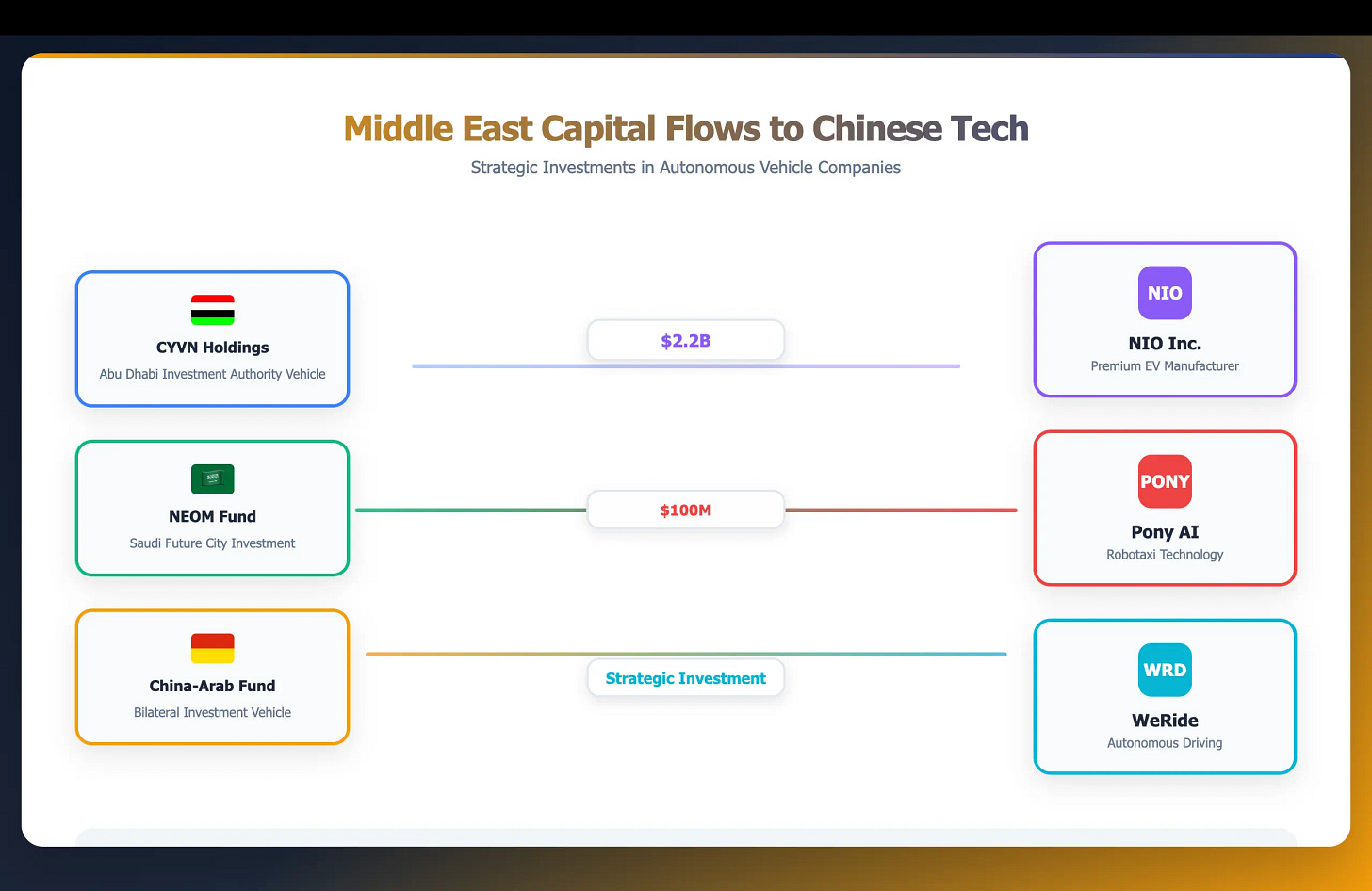

But the financial relationship runs deeper than just market opportunity. Middle Eastern sovereign wealth funds have become crucial investors in Chinese autonomous vehicle companies. Abu Dhabi government-controlled CYVN invested $2.2 billion in NIO in 2023, while Saudi Arabia’s NEOM fund put $100 million into Pony AI. These aren’t passive investments—they’re strategic partnerships that facilitate market access.

The Skeptical View

Not everyone believes the Middle East strategy will work. Transportation experts point to significant execution risks that could undermine Chinese companies’ ambitions.

“The operational complexity of running robotaxi services across multiple Middle Eastern cities is being massively underestimated,” said a former Uber executive who spoke on condition of anonymity. “Each city has different regulations, different traffic patterns, different infrastructure. This isn’t like scaling software.”

Technical challenges also loom large. Chinese autonomous vehicle systems have been trained primarily on Chinese traffic data, which may not translate effectively to Middle Eastern driving behaviors and road conditions. The region’s harsh climate could also stress vehicle systems in ways that haven’t been fully tested.

Geopolitical risks present another concern. If US-China tensions escalate, Middle Eastern governments may face pressure to limit Chinese technology deployments, potentially stranding these investments. The Biden administration has already restricted technology transfers to Chinese autonomous vehicle companies, and a future administration could extend those restrictions to overseas operations.

Local competition is also emerging. Emirates airline has announced plans to develop its own autonomous vehicle capabilities, while Saudi Arabia is courting multiple international partners beyond Chinese companies. Tesla CEO Elon Musk recently expressed interest in deploying the company’s Cybercab autonomous taxi in Saudi Arabia, potentially setting up direct competition with Chinese operators.

American Response

US autonomous vehicle companies are taking notice of Chinese expansion in the Gulf. Waymo has reportedly held preliminary discussions with UAE officials about potential operations, though no formal agreements have been announced. The company’s different technology approach and cost structure could prove challenging in price-sensitive markets.

“The Chinese have a first-mover advantage, but it’s not insurmountable,” said Allen Cheng, Goldman Sachs’s head of Greater China technology research. “The question is whether they can execute at scale before American companies bring their costs down.”

The competitive dynamic reflects broader tensions in the global autonomous vehicle race. Chinese companies have optimized for rapid deployment and cost efficiency, while US companies have prioritized technical perfection and safety validation. The Middle East will test which approach proves more effective in real-world commercial operations.

Market Reality Check

The addressable market in the Gulf states, while growing, remains relatively modest compared to major global cities. Even capturing significant market share in regional cities wouldn’t generate the revenue needed to offset massive research and development expenses without significant expansion beyond the initial deployments.

This raises questions about the scalability of the Middle East strategy. Success in Gulf markets might prove these companies can operate internationally, but it won’t solve their fundamental profitability challenges without expansion into much larger markets.

Industry analysts estimate Chinese companies would need to operate 10,000–15,000 vehicles across multiple international markets to achieve meaningful scale economies. Current Middle East commitments, while substantial, represent only a fraction of that target.

The Real Stakes

The Middle East deployments represent more than market expansion—they’re a test of whether Chinese autonomous vehicle companies can compete effectively outside their protected home markets. Success could provide the credibility and cash flow needed to expand into larger international markets. Failure could leave them trapped in unprofitable domestic operations while better-funded competitors eventually catch up.

For the global autonomous vehicle industry, the Gulf states are becoming a proving ground for different approaches to commercialization. Chinese companies are betting on rapid scale and cost advantages, while American companies focus on technical superiority and safety records.

The outcome will likely determine the global competitive landscape for autonomous vehicles. If Chinese companies succeed in the Middle East, they’ll have validated a model that could work in other emerging markets worldwide. If they fail, it could signal that autonomous vehicle technology remains too complex and expensive for widespread international deployment.

The next 18 months will be crucial. Chinese companies need to demonstrate real commercial traction in the Gulf states while managing their cash burn and preparing for potential geopolitical complications. In an industry where billions have been invested with little commercial success to show for it, the Middle East gambit represents perhaps the highest-stakes bet yet.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.