China's Trillion-Yuan Venture Gamble

Beijing promises 20-year patience for venture. The real test is whether audits and incentives can tolerate losses.

Editor’s Note: This is FlashPoint, Hello China Tech’s premium quick-strike column on one market-moving China tech event and why it matters.

Today’s column examines Beijing’s new “patient capital” experiment: a ¥100bn national venture guidance fund built to mobilise a trillion-yuan-scale pool with a 20-year horizon and explicit tolerance for failure. The key question is whether capital allocation can stay market-led once audits, incentives, and regional politics assert themselves.

China has launched a ¥100bn ($14bn) state venture fund designed to mobilise a trillion-yuan-scale pool of social capital, with an audacious promise: 20-year patience, no geographic reinvestment quotas, and tolerance for failure. If delivered, it would mark a genuine evolution in state capitalism. More likely, it will test whether Beijing’s industrial policy can overcome its own bureaucratic DNA.

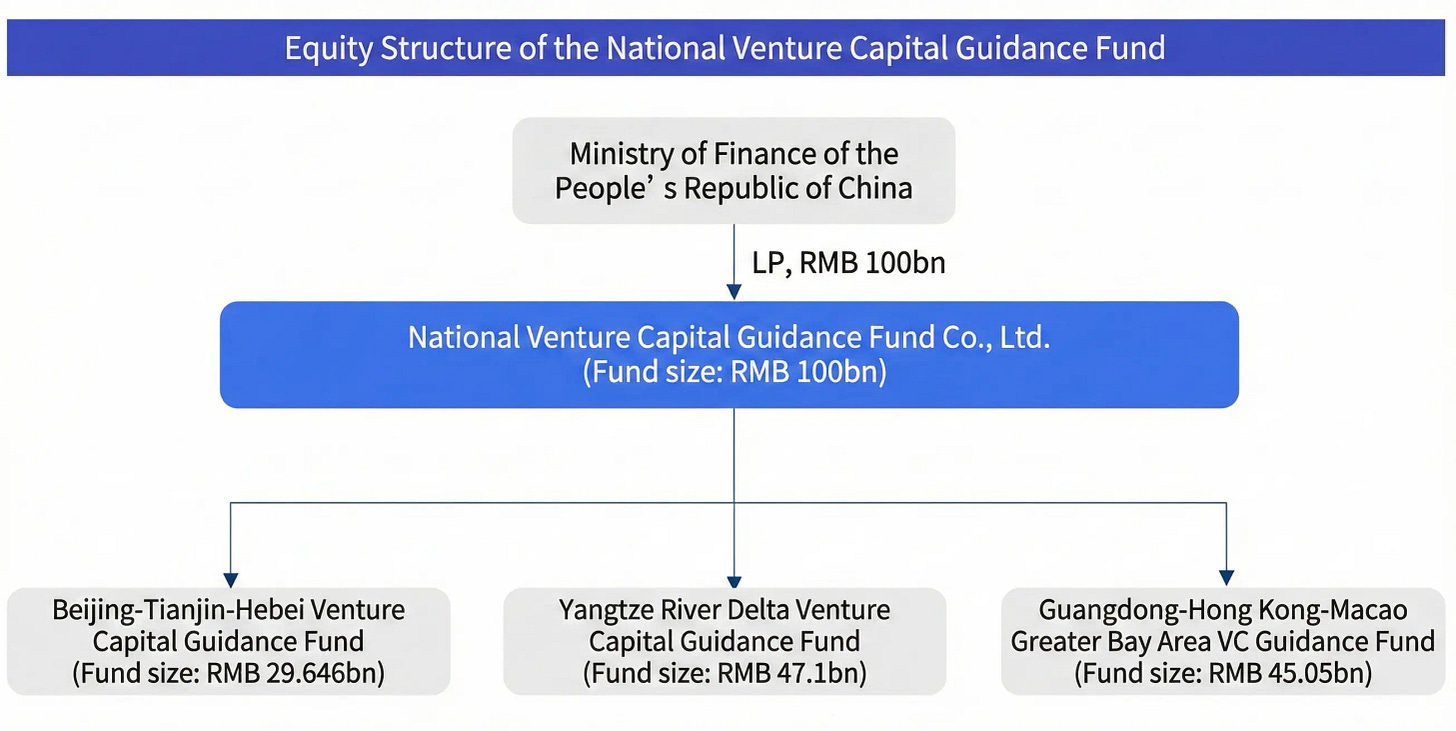

The National Venture Capital Guidance Fund was announced in March 2025, formally established on July 21, and held its inaugural ceremony on December 26. That nine-month sprint from proposal to operation signals urgency. The architecture runs three layers deep. At the top, central government commits ¥100bn. Three regional vehicles beneath it total ¥121.8bn: Beijing-Tianjin-Hebei (¥29.6bn), Yangtze River Delta (¥47.1bn), and Greater Bay Area (¥45.1bn). These will seed hundreds of sub-funds, leveraging state capital to draw in local governments, SOEs, insurers, and private LPs. Officials say the structure is designed to mobilise a trillion-yuan-scale pool of capital through sub-funds and selective direct investments. At the December launch, 49 sub-funds and 27 portfolio companies signed commitments.

The design aims to channel state money without state distortions. Regional funds must allocate at least 80 per cent to sub-funds, and will not be the largest LP or shareholder in those sub-funds. Sub-funds must deploy 70 per cent to seed and early-stage companies valued under ¥500m ($69m), with single cheques capped at ¥50m. The 20-year lifespan (10 invest, 10 exit) breaks the standard 7–10 year cycle that forces premature harvests. Officials insist performance reviews will emphasise “overall effectiveness,” not individual project failures.