China's Robotics Paradox: Why Imperfection Might Be the Perfect Strategy

How Chinese companies are rewriting the playbook for commercializing emerging technologies—and what it means for global investors.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

In April 2025, a peculiar scene unfolded in Beijing’s Yizhuang district: 20 humanoid robots stumbled through what was billed as humanity’s first robotic marathon. Robots swayed, suffered mechanical failures, and required constant human intervention. Yet within weeks, one participating company, Songyan Dynamics, transformed this imperfect performance into remarkable commercial success—their valuation surged from 500 million to 2 billion yuan, securing over 50 million yuan in new orders.

This striking contradiction reveals a fascinating paradox at the heart of China’s robotics boom: technical imperfection paired with commercial triumph. While Western companies typically perfect technology before commercialization, Chinese firms are proving that strategic imperfection might be the more effective path to market dominance.

The Paradox Defined

Traditional business wisdom dictates a linear progression: perfect the technology, then commercialize it. Boston Dynamics exemplifies this approach—decades of technical refinement before serious commercial attempts. Their robots demonstrate superior capabilities, yet the company has struggled to find sustainable markets.

Chinese robotics companies are inverting this logic entirely. They’re commercializing openly flawed technology while simultaneously improving it through market feedback. The results challenge conventional wisdom about innovation timing and risk management.

Consider the May 2025 robot boxing match that captivated global audiences. Unitree’s G1 humanoid robots, equipped with 29 degrees of freedom and sophisticated hardware, engaged in what was marketed as the world’s first humanoid fighting competition. The robots executed complex movements and even performed taunting gestures—yet frequently fell over, attacked empty air, and required constant remote control.

The technical limitations were stark. Industry experts acknowledged the robots operated primarily through remote control because voice control suffered excessive latency and autonomous systems remained unreliable. Leading Chinese AI researchers were remarkably candid: “The ‘embodied’ and ‘intelligent’ aspects haven’t truly collaborated yet,” admitted Professor Hu Liang from Tongji University.

The underlying AI models were characterized as being at a “GPT-2 level”—functional but primitive. Experts estimated it would take one year for robot AI to reach “usable” status and three years to become “user-friendly.”

Commercial Success Despite Technical Gaps

Yet the market response was extraordinary. During China’s 618 shopping festival, humanoid robots flooded e-commerce platforms with remarkable results. JD.com established a dedicated robotics category, attracting manufacturers across a 40,000 to 400,000 yuan price spectrum.

The sales figures were striking. Unitree’s G1 showed “1000+” units sold with over 1,000 customer reviews. Songyan Dynamics’ robot, priced at 50,000 yuan, achieved rapid market penetration. Companies like Cyan Qingxin Yichuang launched premium models at 298,000–348,000 yuan during the festival.

Most significantly, these weren’t showcase products but genuine commercial transactions. Lingbao CASBOT’s 328,800 yuan humanoid robot recorded actual online sales despite targeting niche applications in commercial services and education.

The “arena economy” proved remarkably effective. The robot fighting competition drew 50,000 live spectators and over 200 million online viewers—exposure worth millions in traditional advertising costs. This spectacle-to-sales conversion represents a new model for hardware technology marketing.

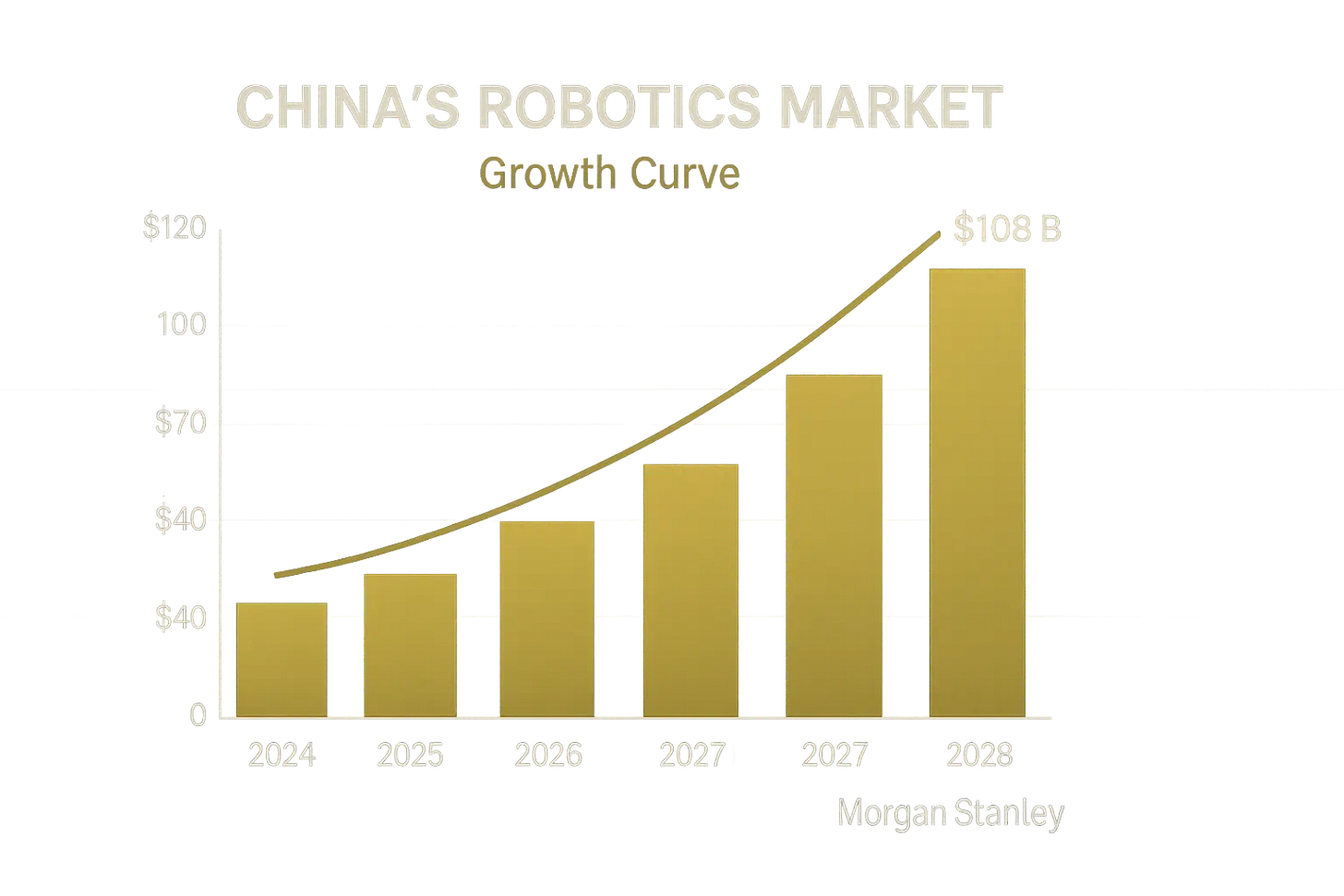

Morgan Stanley’s analysts took notice, projecting China’s robotics market will grow 23% annually from $47 billion in 2024 to $108 billion in 2028. More dramatically, they predict 63% annual growth in humanoid robots, from $300 million in 2025 to $3.4 billion in 2030.

The Western Alternative: Perfection’s Price

The contrast with Western approaches is instructive. Boston Dynamics has spent over two decades perfecting robotic locomotion and manipulation, producing technically superior products that struggle commercially. Their Atlas robot demonstrates capabilities that make Chinese robots appear primitive, yet it remains primarily a research platform.

Similarly, Western AI companies typically emphasize technical benchmarks over market readiness. OpenAI spent years refining GPT models before releasing consumer products, while Chinese companies often deploy “good enough” technology and iterate publicly.

This divergence reflects different philosophies about innovation risk. Western venture capital typically emphasizes technical milestones and proven capabilities before major investments. Chinese investors appear more willing to bet on market potential and commercialization ability, as evidenced by valuations based on competition performance rather than pure technical metrics.

The Strategic Logic—and Its Limits

China’s approach offers several advantages that become clear when viewed through the lens of the country’s broader technological development patterns. Early commercialization democratizes innovation—with 741,700 robotics-related companies in China, the distributed R&D effort exceeds what any single corporation could achieve.

Commercial deployment also generates real-world data that laboratory testing cannot replicate. Robots encountering unexpected scenarios provide invaluable feedback for improving both hardware and AI algorithms, creating a feedback loop where commercial imperfection drives technical improvement.

However, this strategy carries significant risks that merit careful consideration. The technical foundations remain fundamentally shaky. Current AI architectures, according to Chinese researchers, are poorly suited for embodied intelligence. The “compute-storage integration” characteristic of Transformer models creates particular vulnerabilities—updating knowledge can break existing capabilities, and models require enormous resources even for simple tasks.

Consumer tolerance for imperfection has limits. Early adopters may accept flawed technology, but mainstream markets demand reliability. Safety concerns could trigger regulatory backlash, particularly as robots enter homes and workplaces. The gap between marketing promises and delivered capabilities risks market disillusionment.

Furthermore, technical debt accumulates. Companies prioritizing commercialization over fundamental research may find themselves outpaced when breakthrough innovations emerge elsewhere. The current approach works while the technology landscape remains fluid, but crystallization around superior architectures could leave early commercializers stranded.

Investment Implications and Strategic Choices

For international investors, China’s robotics paradox presents both opportunity and warning. The traditional metrics of technology maturity before investment may be obsolete in rapidly evolving sectors. However, distinguishing between productive imperfection and premature commercialization requires sophisticated analysis.

Key indicators for evaluating Chinese robotics investments include commercial traction beyond early adopters, technical roadmaps addressing fundamental limitations, and management teams balancing market pressure with research investment. Companies showing real revenue growth while simultaneously advancing core capabilities represent the sweet spot.

The broader lesson extends beyond robotics. This commercialization-first approach could apply to other emerging technologies—autonomous vehicles, brain-computer interfaces, quantum applications—where laboratory capabilities diverge significantly from real-world utility.

However, success requires specific conditions: market tolerance for imperfection, supportive infrastructure, patient capital, and rapid iteration capabilities. Not all markets or technologies will support this approach, making context crucial for strategic decisions.

The Verdict on Imperfect Innovation

China’s robotics industry is conducting a real-time experiment in alternative innovation strategies. Early results suggest that strategic imperfection—commercializing flawed technology while improving it through market feedback—can be more effective than pursuing technical perfection in isolation.

Yet this approach’s ultimate success remains unproven. The technical challenges are formidable, market tolerance is finite, and competitive responses are inevitable. The companies mastering this balance—maintaining commercial momentum while achieving technical breakthroughs—will likely emerge as long-term winners.

For global investors and competitors, the lesson is nuanced: in rapidly evolving technology sectors, the optimal commercialization timing may arrive before technical perfection. However, this window requires careful management of customer expectations, continuous technical investment, and realistic assessment of competitive positioning.

China’s robotics paradox challenges fundamental assumptions about innovation and market timing. Whether this represents a sustainable competitive advantage or a risky deviation from proven principles will likely determine not just the fate of Chinese robotics companies, but the broader direction of technology commercialization in the 21st century.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.