China’s Robotaxi IPOs Fund a Demographic Bet, Not a Business

L4 specialists burn billions while automakers and platforms wait to capture the value.

Editor’s Note: This is FlashPoint, Hello China Tech’s premium quick-strike column. In about 700 words, we cut through the noise to unpack one market-moving China tech event and why it matters. FlashPoint drops whenever the story demands it, weekdays or weekends.

Today’s column reveals why China’s robotaxi IPOs are funding a demographic bet, not a business. Pony.ai and WeRide just raised $1 billion combined. Both broke their issue prices on day one. The market spotted what the founders know: These companies burn 300%+ of revenue on R&D, racing to survive until Chinese taxi drivers retire in 2035. The real question is whether the companies taking the risk will be the ones to capture the value. For the FlashPoint overview, see our introduction here.

China’s Robotaxi sector is posting impressive, if conflicting, metrics. Baidu’s Apollo Go unit claims it is now running 250,000 fully driverless rides per week. This figure, a vital sign of operational scale, puts it on par with Alphabet’s Waymo in the US as of April.

This milestone was immediately followed by a different kind of validation: the Hong Kong IPOs of rivals Pony.ai and WeRide. The listings, however, were less a coronation than a funding dash. Pony.ai raised a substantial HK$6.71B billion (US$860 million) in net proceeds, while WeRide secured HK$2.39 billion.

Investors in the public markets seem to agree. This so-called golden window for autonomous driving looks suspiciously like a dash for cash before the burn rate catches up. Both Pony.ai and WeRide, after achieving coveted dual-listings in the US and Hong Kong, broke their issue prices on the first day of trading. The stocks continued to slide, WeRide falling over 13% on its second day.

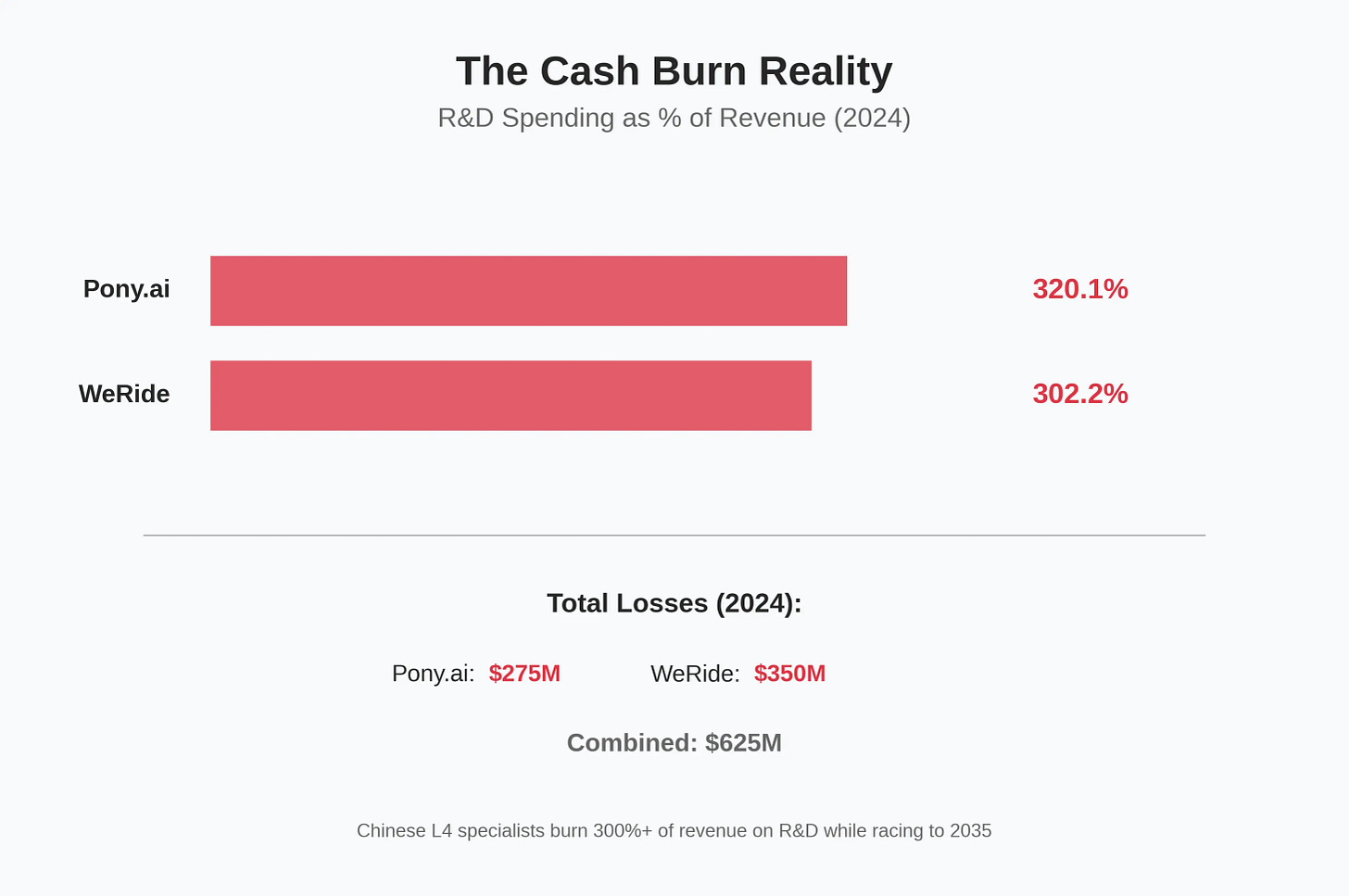

The market has looked under the hood. The financials are alarming. This is not a business; it is a science experiment funded by capital markets. Both companies concede they are in the “early stages of commercialization”. The cash burn is startling. In 2024, Pony.ai’s R&D spend was an astonishing 320.1% of its revenue. WeRide’s was 302.2%. Pony.ai’s losses hit $275 million in 2024, while WeRide’s topped $350 million.

Baidu’s 250,000 rides are not profit centers; they are R&D costs. The strategic game for Chinese players is therefore not about near-term domestic profits, but about three distinct battles.