China Builds AI Users, Exports AI Founders

When incumbents clone innovations faster than startups can scale, entrepreneurs don’t compete--they relocate.

Editor’s note: This is Flashpoint, Hello China Tech’s premium quick-strike column. In about 700 words, we cut through the noise to unpack one market-moving China tech event and why it matters. Flashpoint drops whenever the story demands it–weekdays or weekends.

Today’s column decodes a paradox: China boasts 270 million AI users–more than ChatGPT–yet 86 per cent of its successful AI startups now target overseas markets. Big tech firms control 70 per cent of the domestic Top 20 and replicate hit products within days. ByteDance launched 11 AI apps in 2024 alone. Startups can’t differentiate long enough to scale. So they leave. This isn’t globalization. It’s market failure–and China is perfecting the art of training its brightest minds to build elsewhere. For the Flashpoint overview, see our introduction here.

Twenty-two Chinese AI applications feature in Andreessen Horowitz’s latest global mobile Top 50. Nineteen of them target overseas users. That 86 per cent exodus rate is no accident. It is a damning verdict on China’s domestic AI market–and a warning about what happens when incumbents capture innovation before it scales.

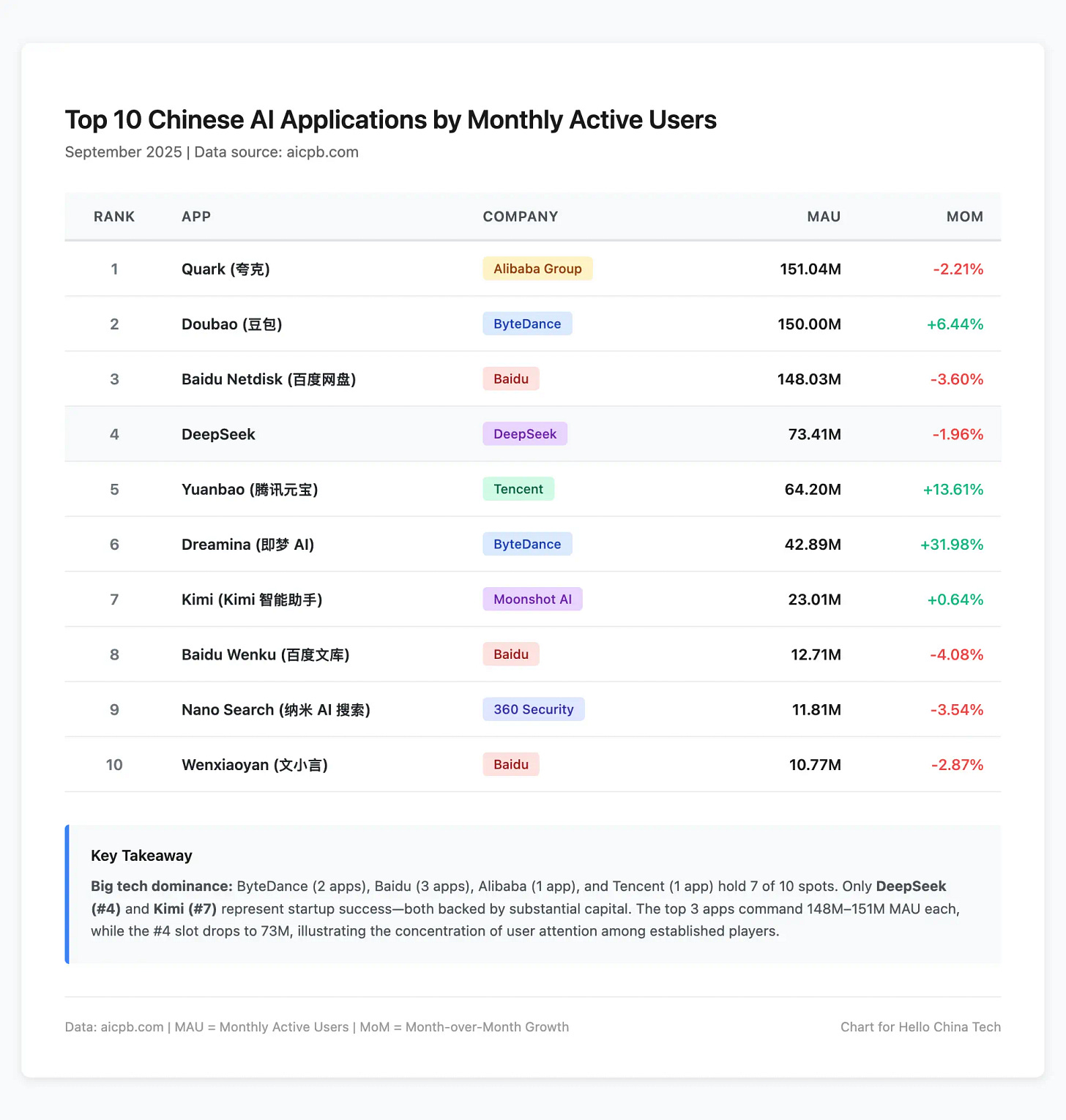

The logic is brutal. In China’s AI application Top 20, big tech firms–those with market capitalisations exceeding Rmb50bn ($7bn)–claim 14 slots, a 70 per cent share. Only DeepSeek and Kimi, both well-funded model developers, crack the top ten. Contrast this with the global landscape: among the 34 non-Chinese products in a16z’s ranking, just five come from established giants like Google or Microsoft. The rest are startups such as Perplexity and PhotoRoom. China’s AI story belongs to ByteDance, Baidu, Alibaba and iFlytek. Everyone else is an extra.

The mechanics are straightforward. ByteDance alone launched 11 AI products in 2024, nearly double its prior-year tally. It does not chase originality; it replicates proven hits. When Kimi’s 2 million-character context window trended on social media, Alibaba and Baidu matched it within five days–with longer limits. When MiniMax’s Starfield app went viral for group roleplay chats, ByteDance rolled out a near-identical product, Catbox, and embedded it in Douyin’s feed. Innovation cycles that once lasted months now compress to weeks.

Resource asymmetry reinforces speed. Big tech firms plug AI features into existing services–Quark’s search, Baidu Library’s documents–slashing customer acquisition costs to one-fifth of standalone apps and boosting retention by 20 per cent, per QuestMobile. Startups must cold-start; incumbents simply upgrade. The result is not competition. It is industrial-scale arbitrage of ideas.