The Killer App for China’s AI Glasses Was Built Ten Years Ago

Why a decade of unique digital infrastructure gives China a surprising, and risky, head start in the next hardware race.

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

Limited-time offer: Upgrade to premium for 3x weekly strategic insights and market analysis. Regular pricing is $15/month, but subscribe before September 1st to lock in permanent discount pricing at just $10/month or $100/year.

In the chaotic frenzy of China’s tech market, a new battleground is emerging. Dubbed the “百镜大战” (Hundred Glasses War), a wave of companies from giants like Xiaomi and Huawei to upstarts like Rokid and XREAL are flooding the market with AI-powered smart glasses. Xiaomi’s first model sold 10,000 units in 12 hours. The conventional narrative is one of another brutal hardware race, a story of involution where supply chain mastery and aggressive pricing will determine the winner.

This narrative is not wrong, but it misses the point entirely.

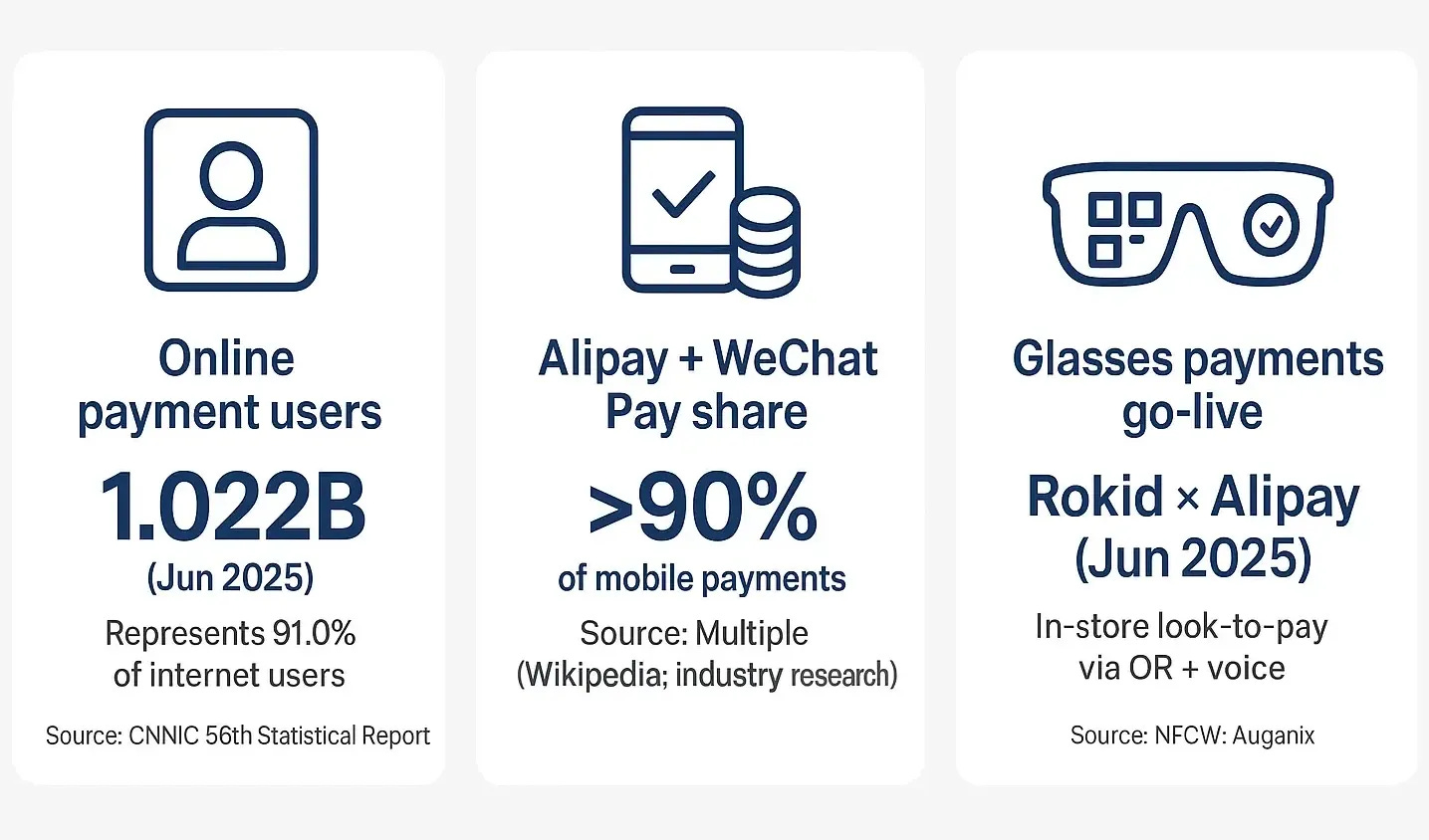

The sudden viability of AI glasses in China is not the story of a product breakthrough. It isn’t about superior optics, lighter frames, or even more intelligent AI. The real story is one of strategic inheritance. China’s tech players have stumbled upon a killer app that doesn’t require building a new ecosystem from scratch, because the foundation for it was laid a decade ago. That foundation is the country’s ubiquitous QR‑code mobile payments infrastructure (see updated: CNNIC 56th report, June 2025: 1.022B online payment users, 91.0%).

This “infrastructure dividend” gives Chinese firms a non-obvious head start in the race for the next personal computing device. But it also creates a powerful path dependency that could lock them into a local maximum, optimizing for today’s utility at the expense of tomorrow’s platform revolution. To understand the future of wearable tech, you have to understand how a simple, blocky square is shaping two fundamentally different paths to the face.

The Opportunity: An Infrastructure Dividend

To grasp China’s advantage, one must first appreciate how fundamentally different its digital payment landscape is. While the West built its mobile payment systems on top of an existing credit card and NFC terminal infrastructure, China leapfrogged it entirely. Driven by low credit card penetration and the rise of mobile‑first super‑apps, Alipay and WeChat Pay blanketed the country with a vision‑based system: the QR code.

From street vendors to subway turnstiles, this system became the default transactional layer of the economy (Beijing official guidance: QR transit codes; Shanghai Metro QR instructions). This wasn’t just a technological choice; it was the curation of a national habit. This decade‑long conditioning has created the perfect, pre‑built sandbox for AI glasses.

While Meta is trying to make its Ray‑Ban glasses a portal to its social graph, and Apple will inevitably try to make its glasses a seamless extension of its OS, Chinese firms have found a far more direct path to daily utility: “look‑to‑pay” (Alipay × Rokid smart‑glasses payments, June 2025).

The user experience is deceptively simple and powerful. A user glances at a merchant’s QR code, verbally confirms the amount, and the transaction is complete. In a high‑density urban environment—juggling groceries, holding onto a subway handle, or rushing to grab coffee—the friction removed is palpable. It transforms the glasses from a novelty gadget into a high‑frequency tool. Xiaomi’s launch coverage also cites support for 视觉扫码支付 (visual QR payments) at a RMB 1,999 entry price.

This is the infrastructure dividend in action. Chinese companies don’t need to solve the cold‑start problem that plagues all new hardware platforms—the chicken‑and‑egg dilemma of needing users to attract developers, and developers to attract users. Instead, they are plugging directly into the most powerful and entrenched digital ecosystem in the country. By integrating with Alipay, they are borrowing its trust, its user base, and its ubiquity to provide an immediate, undeniable reason for a consumer to wear their product out the door every single day.

Inside: the risk flywheel, Utility‑First vs Platform‑First KPIs, and a four‑signal investor watchlist.