The Geopolitical Arbitrage Playbook: Inside the High-Stakes IPO Rush of China’s AI Chipmakers

Hello China Tech by Poe Zhao – Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

An unprecedented wave of Initial Public Offerings is sweeping through China’s AI chip sector. This summer, two of the country’s most prominent GPU startups, Moore Threads and MetaX, filed to raise a combined $1.66 billion on Shanghai’s tech-focused STAR Market. At first glance, this appears to be a paradox of staggering proportions. How can an industry under the most severe US technology sanctions in history be experiencing a capital market boom?

The answer is that this is not a traditional tech boom. It is the ultimate test of a new, state-driven model of “Geopolitical Arbitrage”–a paradigm where a company’s primary competitive moat is not superior technology or a disruptive business model, but a protected, captive market created by US foreign policy. These companies are, in effect, arbitraging geopolitical tension for commercial gain.

This wave of IPOs is not a victory lap celebrating technological dominance. For these cash-burning unicorns, going public is not a choice; it is a desperate lifeline. As one Chinese tech publication aptly put it, listing is “not an option, but a required answer” (上市不是可选项,而是必答题). This is a story about survival, state ambition, and a trillion-yuan bet on self-sufficiency. The outcome will define China’s technological trajectory for the next decade.

This article will dissect the Geopolitical Arbitrage model, using the AI chip IPO frenzy as its prime case study. We will explore why listing has become an imperative, and analyze whether this path leads to the creation of world-class companies or simply well-funded national champions with a potentially fatal flaw.

The “Sanctioned Unicorns”–Anatomy of a Geopolitical Arbitrage Play

At the heart of this story are a handful of companies often dubbed the “AI chip little dragons,” led by Moore Threads, MetaX, Biren Technology, and Suiyuan Technology. Their emergence is no accident. Founded largely between 2018 and 2020, their teams boast formidable technical DNA, with founders and key engineers hailing from the very giants they now seek to replace, including NVIDIA, where Moore Threads founder Zhang Jianzhong was a senior executive, and AMD, the alma mater of MetaX’s and Suiyuan’s founders.

Their business model, however, deviates sharply from their Silicon Valley predecessors. It rests on three pillars that define Geopolitical Arbitrage:

The Moat: The US Entity List.

For these firms, being sanctioned is a double-edged sword that cuts decisively in their favor domestically. While it restricts access to American technology and partners, it also serves as a badge of honor and a powerful signal to the Chinese market. It anoints them as national champions, immediately prioritizing them for state support and domestic contracts. Moore Threads, for instance, wasadded to the Entity List in October 2023, an event that, while challenging, solidified its position in the national strategy.

The Customer: A Captive, State-Directed Market.

Their primary revenue stream comes not from a competitive open market, but from “Xinchuang” (信创), or the IT Application Innovation industry. This is a sweeping, state-led initiative to replace foreign hardware and software with domestic alternatives in critical government, finance, and state-owned enterprise (SOE) sectors. These government-mandated intelligent computing centers and SOE contracts provide a guaranteed, predictable market, insulating them from direct competition with global leaders like NVIDIA.

The Financier: A Torrent of “Patient” Capital.

The unicorns have been nurtured by a vast pool of capital from state-backed entities like the “Big Fund” (China’s National Integrated Circuit Industry Investment Fund), strategic corporate investors, and a long list of venture capitalists all betting on Beijing’s national self-sufficiency drive. Tencent, for example, has participated in six of Suiyuan Technology’s ten funding rounds, becoming its largest shareholder and providing a steady stream of orders from within its ecosystem. This firehose of capital has inflated valuations to astronomical levels long before profitability was even on the horizon. As of early 2025, Moore Threads commanded a pre-IPOvaluation of ¥25.5 billion (around $3.5 billion), with Biren Technology not far behind at ¥15.5 billion.

This combination of a protected market, state-directed customers, and nearly unlimited funding has allowed these companies to grow at a blistering pace. But it has also created a generation of companies whose survival is inextricably linked to policy, not necessarily product superiority.

“IPO or Die”–A Lifeline, Not a Victory Lap

The rush to the public markets is a clear signal that the era of easy private money is over. As China’s venture capital market cools, investors are demanding exits. For the AI chip unicorns, this has created a stark ultimatum: “IPO or starve” (要么上市、要么断炊).

The reason is simple: an astonishing burn rate. Chip development is one of the most capital-intensive games in technology, and these companies are bleeding cash. Moore Threads’ recently filed prospectus offers a stunning look at this reality. In 2024, the company posted revenues of ¥438.85 million (about $60 million). Its net loss, however, was a staggering ¥1.49 billion ($205 million), with R&D expenses alone consuming ¥1.36 billion. This level of cash burn is simply unsustainable for private markets to support indefinitely.

This dynamic is not new. The entire sector is haunted by the ghost of Cambricon, China’s “first AI chip stock,” which went public on the STAR Market in 2020. Despite never turning a profit, its stock price soared, fueled by the national drive for chip independence. A dark joke circulated among Chinese investors: “The most effective way to invest in Cambricon is to buy its chips. Even if you spend ¥500 million on chips that just sit in a warehouse, the resulting revenue boost could increase its stock value by ¥2 billion.”

This anecdote, while cynical, perfectly captures the market logic: these stocks are valued not on their current business fundamentals, but as a proxy for China’s geopolitical ambitions. The IPO candidates are hoping to replicate this playbook. They are not going public from a position of strength; they are doing so because they have no other choice to fund their long-term R&D and quest for market share. Listing is the only way to tap into the deep pockets of public market investors who are willing to buy the national story.

The Achilles’ Heel–The Two Walls They Cannot Scale

Despite the IPO fanfare and patriotic fervor, these companies face two fundamental, perhaps insurmountable, obstacles that even billions in public funding may not be able to solve.

First is the “Manufacturing Wall.” This is their most immediate and tangible handicap. US sanctions have effectively cut them off from the world’s most advanced semiconductor fabrication nodes, such as those operated by TSMC in Taiwan. High-performance AI chips are exquisitely sensitive to the manufacturing process; they require cutting-edge nodes to achieve competitive performance and power efficiency. Chinese foundries like SMIC are years behind.

This means Chinese GPU designers are trapped in a frustrating cycle: they can design powerful chips on paper, but they cannot get them manufactured at a level that can truly compete with NVIDIA or AMD’s latest offerings. According to industry insiders, some firms have even been forced to “downgrade” their chip designs to use less advanced, and thus accessible, manufacturing processes to comply with US restrictions. This is a fundamental bottleneck that no amount of clever design work can fully circumvent.

Second, and arguably more formidable, is the “Ecosystem Wall.” Hardware is only half the battle. NVIDIA’s true, enduring moat is not its silicon, but its software ecosystem, CUDA. For over 15 years, NVIDIA has cultivated a vast community of developers, researchers, and companies who build applications on top of its proprietary platform. This ecosystem creates immense switching costs and a powerful network effect.

Building a competitive software stack from scratch is a monumental undertaking, a multi-billion-dollar, decade-long effort. Without a robust and easy-to-use software ecosystem, even the most powerful chip is just a piece of silicon with limited utility. While all Chinese contenders claim to be building a “full-stack” solution, they are starting from a massive deficit.

The harsh market reality is reflected in the data. According to IDC, in 2024, NVIDIA still commanded an estimated 70% of China’s AI accelerator market. The dominant domestic player was not one of the startups, but the established tech giant Huawei, whose Ascend chips captured about 23% of the market. The IPO candidates are left to fight fiercely over the remaining sliver, each holding a market share in the low single digits.

Strategic Gambles and New Variables

Facing these walls, the AI chip unicorns are making strategic gambles to secure their future. The most immediate is the choice of where to list.

The A-shares market in Shanghai is the ultimate prize. It promises higher valuations and access to a fervent base of domestic investors. However, the regulatory review process has become notoriously strict. This has led to a strategic dilemma, forcing companies to prepare a dual-track “A+H” plan, considering a listing in Hong Kong as a pragmatic alternative. Biren Technology is reportedly prioritizing a Hong Kong IPO for its speed and higher certainty, a move that reveals the intense pressure for a quick capital infusion.

Just as the outlook seemed constrained, a new variable has emerged: the rise of highly efficient AI models like the open-source DeepSeek. These models, particularly their “Mixture-of-Experts” (MoE) architecture, have significantly lowered the computational barrier for high-quality AI inference(the process of running a trained model). This is a crucial development. While Chinese chips still lag far behind in the demanding task of training large models, they are becoming “good enough” for inference. This has opened up a viable, large-scale market where domestic GPUs can genuinely compete, giving their business cases a much-needed glimmer of hope. According to some testers, the new Moore Threads MTT S5000 is a “perfect match” for running MoE models like DeepSeek-V3.

This catalyst, however, is a double-edged sword. While it creates a market for the current unicorns, it also lowers the barrier to entry for a new wave of even younger, more agile startups, further intensifying the domestic competition.

Conclusion: A Framework for Investors & What to Watch

The Chinese AI chip IPO boom is the culmination of the Geopolitical Arbitrage strategy. It is a high-stakes, state-sponsored experiment to bootstrap a strategic industry by turning a geopolitical weakness into a commercial advantage. The public markets will now deliver the ultimate verdict on this model.

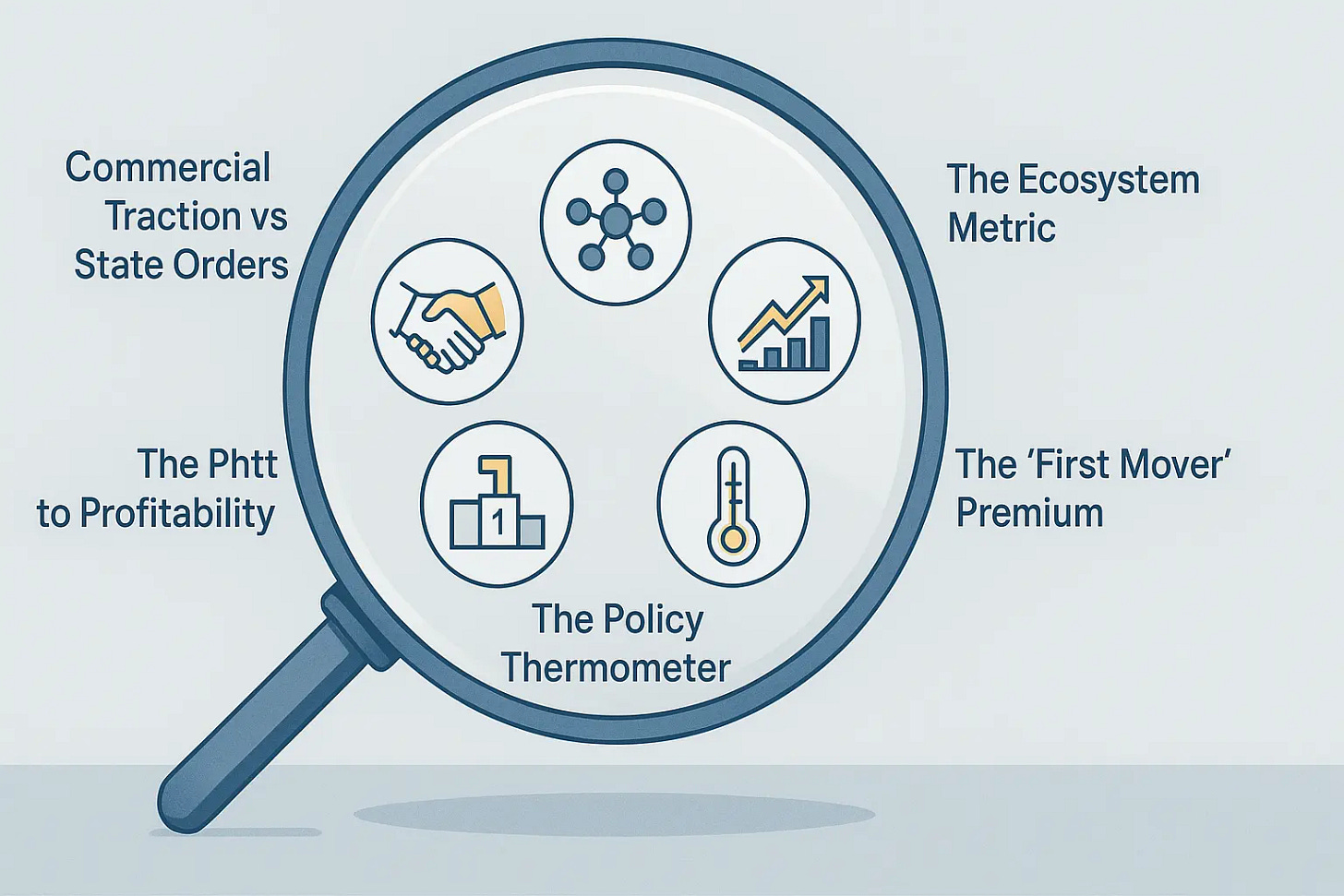

For global investors and executives, understanding this dynamic is critical to navigating China’s tech landscape. This is not a story about which company has the best chip; it’s a story about which company can best navigate the treacherous intersection of technology, policy, and capital markets. To gauge their prospects, one should look beyond the IPO hype and monitor a specific set of signals:

Commercial Traction vs. State Orders: The key test will be their ability to diversify away from the captive “Xinchuang” market. Are contracts with commercial giants like Baidu and JD.com (past customers of Moore Threads)becoming a recurring trend, or are they one-off showcase projects? True success lies in winning over customers who have a choice.

The Ecosystem Metric: Forget raw TeraFLOPs. The most important metric is developer adoption. Track the growth of their software developer communities, the maturity of their SDKs, and their compatibility with major AI frameworks like PyTorch and TensorFlow. Is their “domestic CUDA” gaining any real traction?

The Path to Profitability: Once public, the tyranny of quarterly earnings will begin. How will they balance the immense, long-term R&D burn with market demands for a clear path to profitability? Watch for strategic shifts, such as Moore Threads’ recent move to focus on high-margin AI products while de-emphasizing competitive consumer graphics cards, or cost-cutting measures like the rumored layoffs at Muxi.

The “First Mover” Premium: In a crowded field, timing is everything. The first company to successfully list on the STAR Market will likely set the valuation benchmark and absorb a significant amount of investor attention. As one analyst noted, regulators may have an unspoken limit on how many companies from the same sector can list, meaning later entrants will face much tougher scrutiny.

The Policy Thermometer: Finally, these companies’ fortunes remain tethered to geopolitics. Any significant shift in US export controls or new, aggressive Chinese industrial policies could change the rules of the game overnight. Their greatest strength–the protected market–is also their greatest vulnerability.

Ultimately, the question is whether a company born in a geopolitical greenhouse can develop the resilience to one day compete in the wild. The IPOs of Moore Threads, MetaX, and their peers will provide the capital to continue the experiment, but the answer remains far from certain.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.