From Browsers to Agent OS: How China's Tech Giants Are Racing to Redefine the Consumer AI Interface

While Google reimagines search with AI and Meta integrates chatbots into messaging, China’s tech giants are pursuing a more radical vision: transforming legacy browsers into AI-native “super frames” that could define the next generation of human-computer interaction.

A fundamental transformation is reshaping China’s consumer tech landscape. Chinese tech giants are converting traditional browser products into intelligent “super frames”–unified interfaces that bundle search, productivity tools, data storage, and task automation into a single, adaptive layer. These products are evolving beyond traditional search engines or apps into operating systems for the agent era.

While all major players–Alibaba, Tencent, Baidu, and ByteDance–share this vision, they’re taking distinctly different paths, each shaped by the constraints of their existing business models, organizational structures, and leadership philosophies. What emerges is a fascinating case study in strategic divergence that may preview the future of post-app consumer internet.

1. The Browser Strikes Back

For years, the mobile-first internet relegated browsers to the sidelines as users engaged with services through dedicated apps rather than open URLs. But in the AI-native world, browsers are staging a dramatic comeback–not as neutral gateways, but as central control systems for human-agent interaction.

This transformation is already visible. Alibaba’s Quark, Tencent’s QQ Browser, and Baidu’s Wenku are now positioned as consumer AI “OS hubs.” These platforms go far beyond ChatGPT-style interfaces, embedding everything from AI search and image generation to note-taking and personal knowledge management–all organized around a core UX principle: the “AI superframe.”

2. Alibaba’s Quark: Full Stack, Full Send

Alibaba’s Quark represents the most aggressive reimagining of the browser-as-agent concept. Originally the e-commerce giant’s minimalist search and content reader, Quark has been completely replatformed as the company’s flagship consumer AI product. It now integrates Alibaba’s Tongyi Qianwenmodel and features a deliberately ad-free architecture–unusual in China’s advertising-driven internet ecosystem.

Quark’s strategy is ambitious on multiple fronts. First, it positions itself as a “pure AI” interface, replacing traditional content feeds with task-driven, agent-mediated experiences. Second, it abandons the typical B2B advertising model entirely, instead monetizing through bundled premium services–including novel reading, document tools, and cloud storage memberships–creating a subscription ecosystem that supports the AI frontend.

However, challenges remain. A 2023 regulatory incident involving inappropriate search results brought government scrutiny. Additionally, while the ad-free approach enhances user experience, it creates financial pressure in an AI environment where inference and data hosting costs continue to rise.

Despite these hurdles, Quark’s design philosophy–AI-first, tool-rich, user-focused–offers the clearest vision of what an AI-native consumer OS might become.

3. Baidu Wenku: Incremental Evolution with Platform Leverage

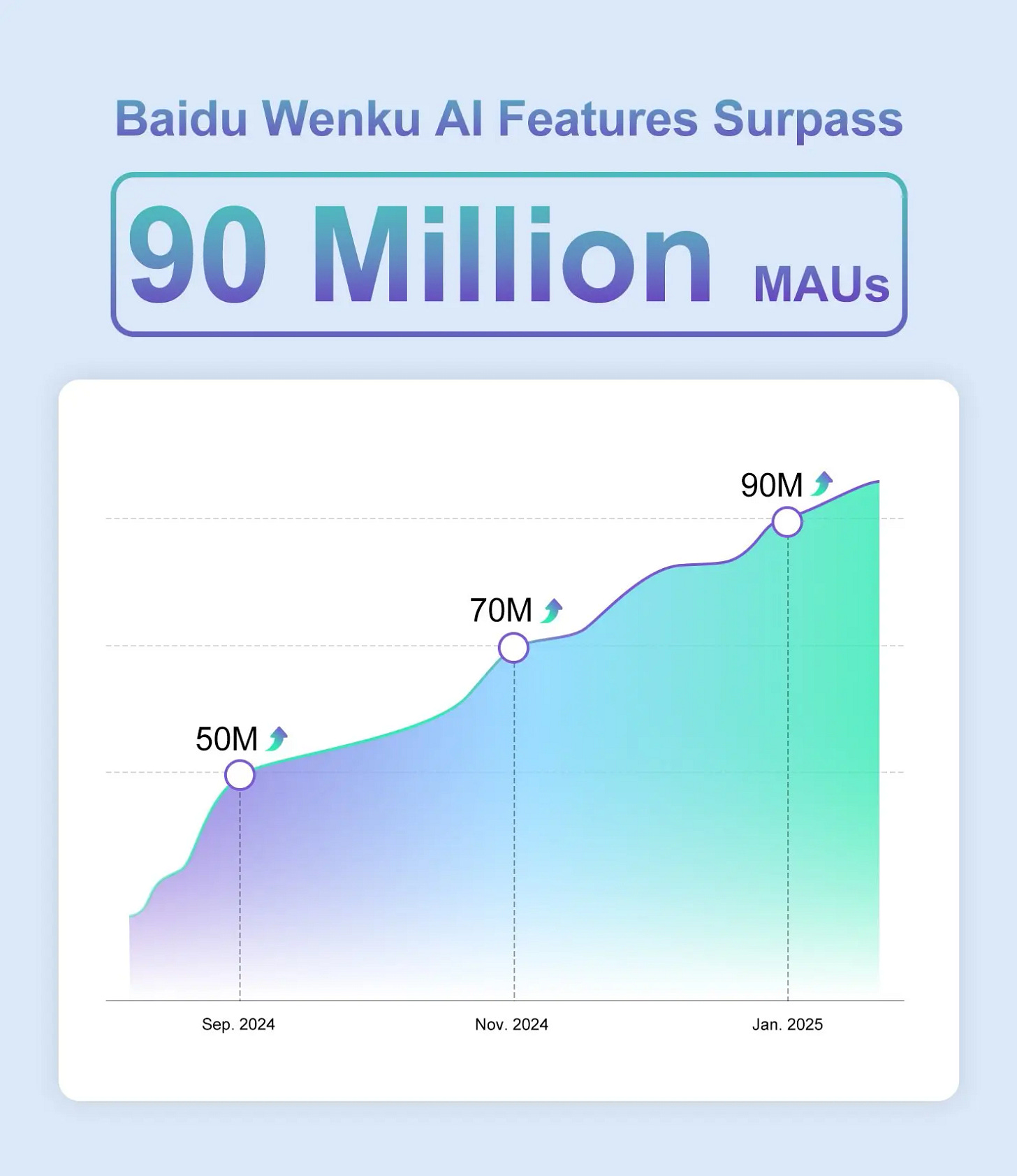

Baidu’s Wenku (Document Library) has chosen a more conservative approach. Originally a repository for academic papers and PDFs–often criticized for intrusive advertising and low-quality user content–Wenku is being systematically refactored as a comprehensive AI agent hub. Its recent integration with Baidu’s Netdisk creates a vertically integrated workflow spanning content creation, storage, and task execution.

Wenku’s technical centerpiece is the Cangzhou OS, a backend orchestration system that coordinates AI agents across document editing, presentation generation, mind mapping, and image design. While technically sophisticated, the platform struggles with perception: most users still view Wenku as an outdated document site rather than an AI platform.

Where Quark reset user expectations with clean UX and integrated services, Wenku battles legacy perceptions. It monetizes more effectively–its 40M+ paid subscribers represent significant AI revenue generation–but suffers from interface clutter and over-commercialization that diminishes its technical capabilities’ impact.

Nonetheless, Wenku benefits from substantial platform advantages: Baidu’s Ernie Bot foundation model, extensive SEO reach, and deep integration with search and cloud infrastructure. It’s executing a patient strategy–gradually transforming a document repository into a general-purpose agent platform.

4. Tencent’s QQ Browser and Yuanbao: The Retrofit Strategy

If Alibaba rebuilt and Baidu evolved, Tencent chose to retrofit.

QQ Browser–already China’s most widely used browser with 400M monthly active users–has been enhanced with an embedded AI assistant, QBot, and specialized agent features like AI High School Assistant and Financial Briefing Tool. It operates on both Tencent’s Hunyuan and DeepSeek models, providing flexibility and comprehensive content access, including WeChat public content.

However, QQ Browser’s approach is layered rather than transformative. Its AI superframe functions essentially as a sophisticated plugin within a traditional, advertising-supported browser experience. On mobile, the platform defaults to conventional search and feeds; AI interfaces require user activation.

This reflects a classic innovator’s dilemma. Tencent cannot aggressively disrupt its search advertising revenue or its WeChat-centric ecosystem while simultaneously hedging against missing the agent-OS opportunity. The result is a hybrid solution: cautious, technically capable, but potentially slower to shift user behavior and expectations.

Organizationally, Tencent is showing greater alignment. Both Yuanbao (its standalone AI app) and QQ Browser now operate under the CSIG unit, led by AI product leader Wu Zurong. This consolidation signals a tactical push to streamline AI investments and leverage cross-product synergies.

The critical question: can Tencent translate its massive reach into AI-native user experiences without undermining the business models that sustain its current success?

5. Path Dependency and Platform Identity

Each company’s AI strategy ultimately reflects the constraints and advantages of what made them successful initially.

Alibaba, facing pressure in e-commerce, needs Quark to demonstrate high-growth user engagement in new categories. It can afford to abandon advertising revenue in favor of premium subscription models. Baidu, dependent on search-driven monetization, cannot completely restructure its interface without existential business risk. Tencent, having built its empire on messaging and gaming, views AI as an enhancement layer rather than a replacement for existing competitive advantages.

These historical foundations dictate their consumer AI strategies, influencing product development pace, design philosophy, and risk tolerance. Even leadership approaches matter: Alibaba’s Wu Jia essentially rebuilt Quark as an internal startup, while Tencent’s Wu Zurong carefully orchestrates existing search assets.

This strategic divergence reflects deeper questions about AI’s role: Should AI replace the traditional browser, or extend it? Should users adapt to agent-mediated experiences, or should agents seamlessly integrate into existing workflows?

6. The Coming Agent OS Era

The AI browser is rapidly evolving beyond user interface into a coordination layer–a control surface for agents, data management, and decision-making processes. Control of this layer may determine not just user attention, but ecosystem influence.

Quark is betting on a pure AI-native approach that could establish the first mainstream consumer agent OS. Wenku is systematically building capabilities atop proven infrastructure, choosing evolution over revolution. QQ Browser is attempting to bridge legacy and innovation, maintaining optionality while avoiding decisive commitment.

Meanwhile, challengers like ByteDance’s Doubao or Kimi face a rapidly closing window to claim agent OS leadership. Despite their organizational inertia, established players are now moving with both urgency and substantial capital backing.

7.Conclusion

The browser wars in China offer a preview of larger questions that every tech company will soon face. As AI capabilities become ubiquitous, the real value shifts from the intelligence itself to the interfaces that make that intelligence useful.

Google understood this early, which is why it’s experimenting with AI-powered search interfaces despite the risk to its advertising model. Microsoft saw it too, leading to its aggressive integration of AI throughout Office and Windows. But both companies are constrained by their existing products and business models in ways that make dramatic changes difficult.

China’s approach–rebuilding browsers as AI-native platforms–suggests one possible future. Whether it’s the right future depends on questions we’re all still figuring out: Do users want unified AI interfaces, or do they prefer specialized tools for different tasks? Can subscription models support the high costs of AI inference at consumer scale? Will regulatory oversight limit how autonomous these AI platforms can become?

The answers matter because they’ll shape how we interact with computers for the next decade. The companies that get the interface right won’t just capture user attention–they’ll define the relationship between humans and AI.

Right now, that future is being written in Chinese browsers that most of the world isn’t paying attention to. But probably should be.