Cambricon: A Bet on AI’s Narrowest Edge

Cambricon’s profits dazzled investors, but the risks are just as sharp.

Editor’s note: Flashpoint is our premium quick-strike column on market-moving China tech events. Today’s focus: Cambricon’s explosive earnings and the policy tailwind from Beijing’s “AI+” plan. In under 700 words, we explain what the market reaction really means–and what investors may be overlooking. For readers who want the full backstory–from its eight years of losses to its sudden “good enough” moment–see yesterday’s premium deep dive: Good Enough to Matter.

Chinese equity markets do not lack enthusiasm for artificial intelligence. But few moves were as dramatic as the surge in Cambricon Technologies’ shares on August 27, when the stock briefly crossed Rmb1,400, giving the AI chip designer a market capitalisation above Rmb580bn. The trigger was a combination of two catalysts: a blowout interim earnings report and the State Council’s release of a sweeping “AI+” policy framework designed to accelerate the integration of artificial intelligence into the economy.

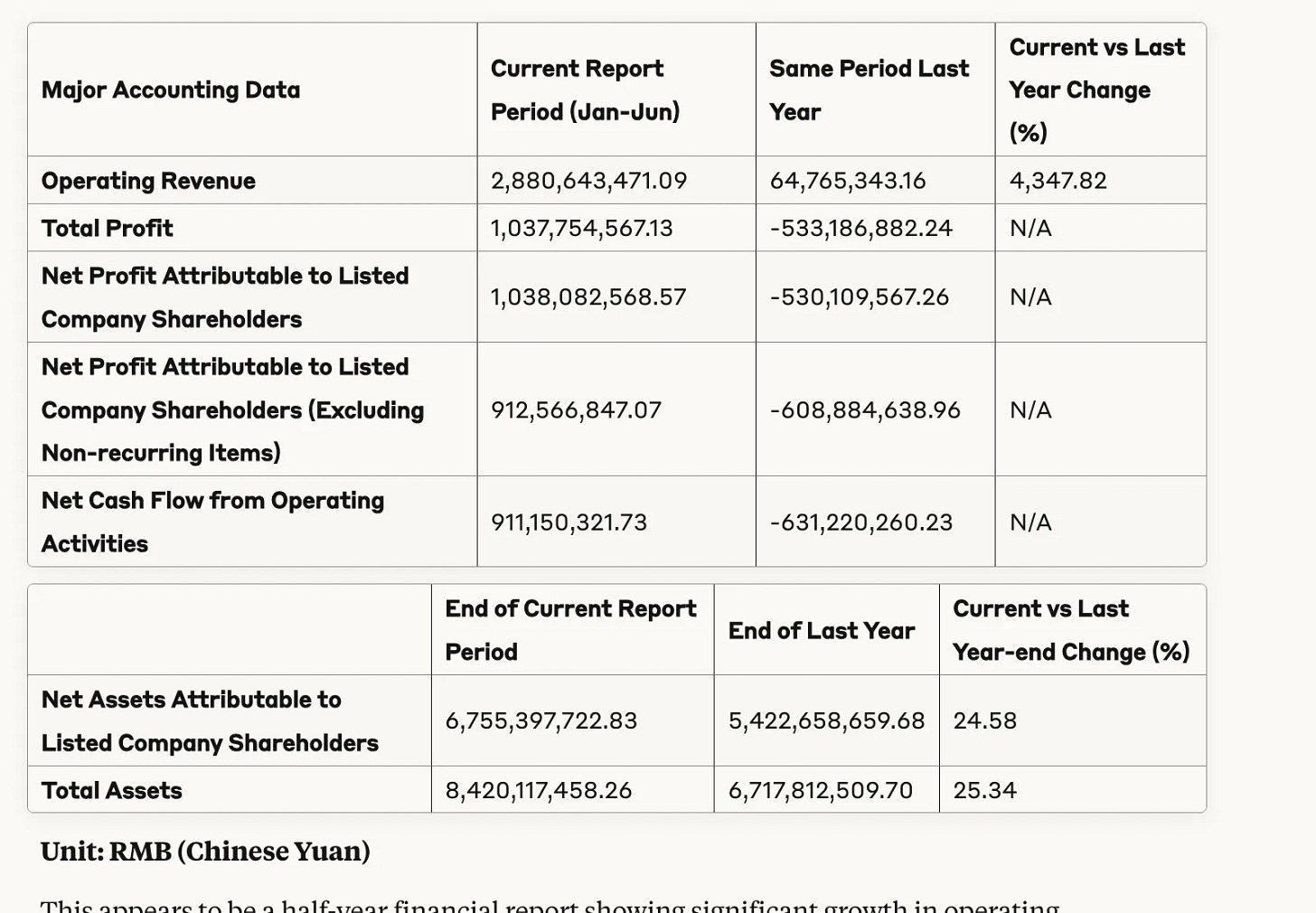

The numbers startled. Revenue for the first half of 2025 jumped 43-fold year on year, from just Rmb65mn to Rmb2.88bn. Net profit flipped from a Rmb530mn loss a year earlier to Rmb1.04bn, implying margins of 36 per cent. Operating cash flow turned positive to Rmb911mn, ending years of reliance on external financing. Cambricon’s cloud-oriented chips accounted for virtually all sales, at 99.6 per cent of revenue. A company long dismissed as a PowerPoint stock has abruptly become a profit machine.

Investors rewarded that concentration. The company has positioned itself as the indispensable local supplier of compute capacity for training and inference of large language models, aligning tightly with national priorities. Deployment is reported in telecoms, finance and internet groups. Crucially, customers are paying: cash collection has kept pace with shipment volumes, defying the industry’s norm of slow or partial settlement.

The policy backdrop reinforced the rally. The State Council’s “AI+” action plan promises to embed artificial intelligence across industry, consumption, governance and global co-operation. For chipmakers, the most salient passages stress secure compute supply, supercomputing clusters and a national network to deliver scale. Official recognition of compute as national infrastructure creates a powerful narrative tailwind for Cambricon, whose strategy is now indistinguishable from Beijing’s industrial priorities.