Good Enough to Matter: How Cambricon Redefined China’s AI Chip Game

From 4,230% revenue growth to ecosystem alignment, Cambricon’s ascent shows how “good enough” hardware changes the balance of power.

Hello China Tech by Poe Zhao — Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

👉 Final week to lock in Premium early-bird pricing: $10/month ($100/year) before it rises on Sept 1. Upgrade here.

On August 25, Cambricon Technologies surged 11.4% to close at 1,384.93 RMB per share, pushing its market capitalization to 579.4 billion yuan (approximately $80 billion). With Kweichow Moutai trading at 1,490.33 RMB per share, Cambricon came within striking distance of becoming China’s highest-priced stock–a symbolic milestone that underscored its new market stature.

As of August 26, Cambricon shares closed at 1,329 RMB, down 4.04%, giving the company a market capitalization of 556.0 billion yuan (about $77 billion). While a step back from the previous day’s peak, the rally still marks Cambricon’s transition into the ranks of China’s most valuable tech firms.

But the real story isn’t about symbolic barriers. It’s what Cambricon’s transformation reveals about China’s sprint toward AI chip independence and the end of an era defined by dependence on foreign semiconductors.

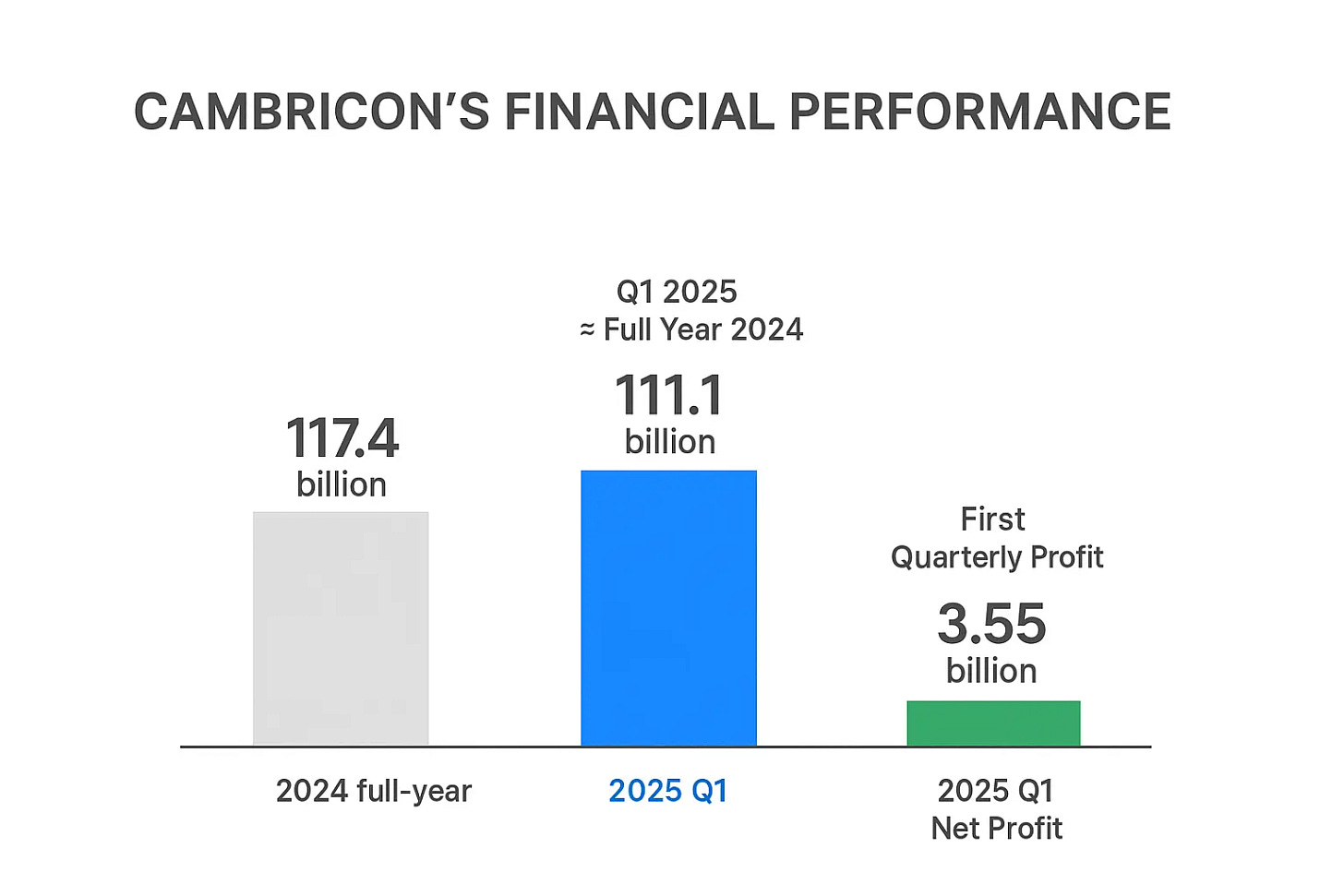

The numbers behind Cambricon’s meteoric rise tell a story of dramatic business transformation that few saw coming. In Q1 2025, the company reported revenue of 11.11 billion RMB ($1.5 billion)–a staggering 4,230% increase compared to the same period last year. More significantly, this quarterly revenue nearly matched Cambricon’s entire 2024 annual revenue of 11.74 billion RMB ($1.6 billion). For a company that lost a cumulative 5.4 billion RMB ($750 million) over eight years of operation, achieving 3.55 billion RMB ($490 million) in net profit in a single quarter represents nothing short of a business miracle.

Yet the transformation runs deeper than financial metrics. Cambricon’s revenue recognition pattern has fundamentally shifted from project-based contracts concentrated in Q4 to consistent quarterly sales–suggesting a move from one-off government projects to recurring commercial demand. This isn’t just growth; it’s the maturation of an entire business model.

From Laboratory Curiosity to Strategic Necessity

The Chen brothers–Chen Tianshi and Chen Yunqi–who founded Cambricon in 2016 after their groundbreaking work at the Chinese Academy of Sciences, couldn’t have anticipated this trajectory. Their initial vision of AI-specific processors was considered almost quixotic when NVIDIA was still primarily a graphics card company. Even after Huawei’s Kirin 970 chips incorporated Cambricon’s IP in 2017, bringing the startup brief fame, the relationship was short-lived and the company struggled to find sustainable revenue streams.

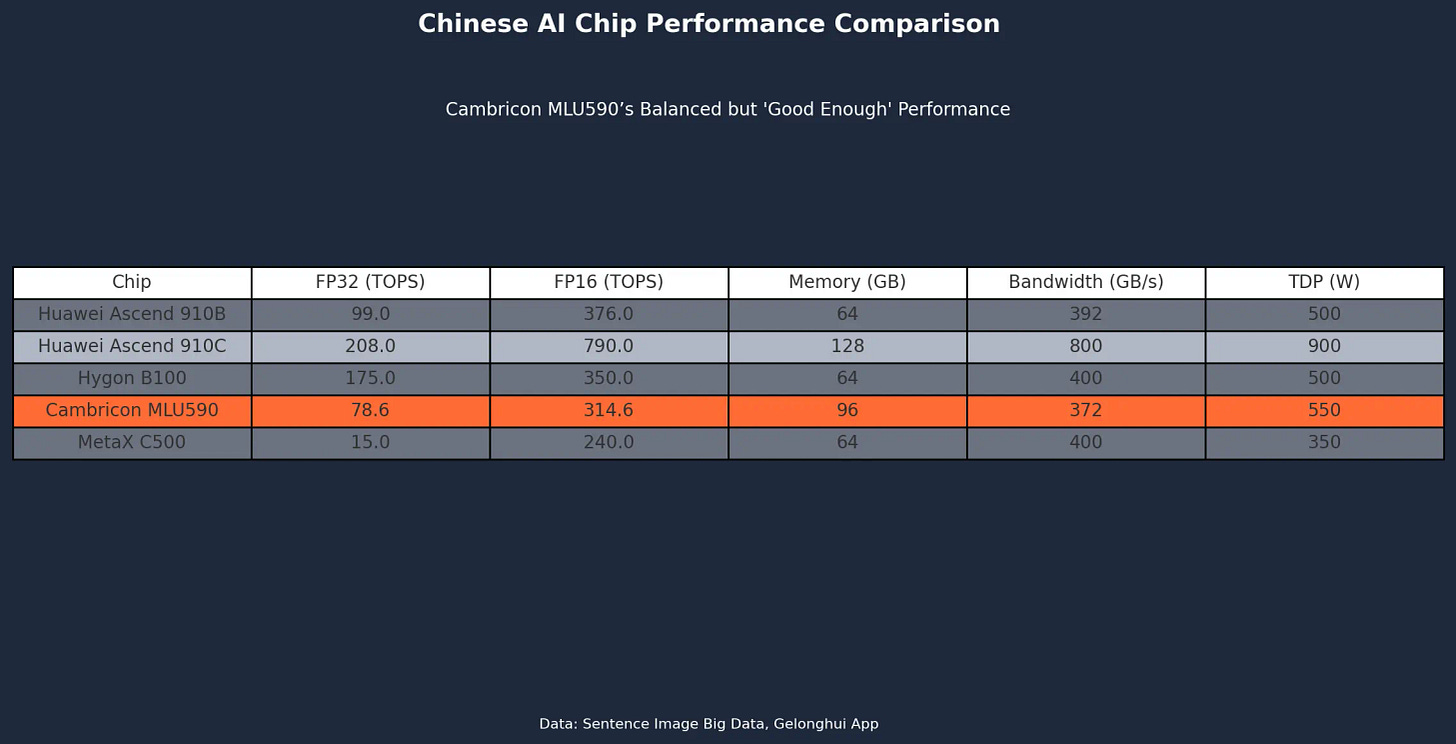

What changed wasn’t just Cambricon’s technology, but the global context in which it operates. The Biden administration’s semiconductor restrictions, which began in earnest in October 2022, created an involuntary market for Chinese AI chips. But policy protection alone doesn’t explain Cambricon’s explosive growth. The company’s Siyuan 590 chips now achieve 80% of NVIDIA A100’s performance while offering 30% lower costs than NVIDIA’s China-specific H20 chips in certain scenarios. This represents a crossing of the “good enough” threshold–the point where domestic alternatives become compelling on merit, not just availability.

The timing of Cambricon’s breakout coincides with a broader shift in China’s AI ecosystem. DeepSeek-V3.1’s recent announcement that it was optimized for “next-generation domestic chips” signals that China’s AI software stack is actively adapting to domestic hardware. This represents a fundamental change from the traditional model where Chinese companies adapted their software to work with foreign chips.

Cambricon’s journey from a niche laboratory project to a national strategic asset explains why its rally has captured such attention. But the real transformation is only visible once you look beneath the headlines–at the company’s revenue structure, capital flows, and how investors are starting to price its “insurance value” for China’s AI ecosystem.

🔒 The following sections are for premium subscribers, covering:

How Cambricon’s revenue model has structurally shifted

Why Goldman Sachs raised its price target by 50%

The hidden “insurance value” behind Cambricon’s valuation

Key metrics to watch in the next 6–12 months