The Metric is the Message: ByteDance vs. Alibaba and the Battle for China's AI Economy

How competing definitions of success--tokens vs. revenue--reveal two irreconcilable visions for the future of enterprise AI.

In China’s technology sector, market share is not merely measured; it is declared. A carefully chosen metric, broadcast from the digital billboards of the country’s busiest transport hubs, serves as a declaration of strategic intent–a tool to shape perception and rally an ecosystem. The current war for dominance in China’s AI cloud is a case in point, but to see it as a simple contest for the top spot is to miss the profound economic schism it represents.

This is a battle fought with competing definitions of value. ByteDance’s proclaimed leadership in token consumption (processing over 30 trillion tokens daily as of September 2025) and Alibaba’s in total AI revenue (commanding a 33% share of China’s cloud market in Q1 2025) are not just different measurements; they are the public faces of two fundamentally divergent business models. The former represents a high-velocity, utility-based approach aimed at commoditizing AI access and capturing the developer ecosystem. The latter is an incumbent’s defense, leveraging a deeply integrated, full-stack solution to maximize value from an entrenched enterprise client base.

This is more than a rivalry. It is a conflict over the foundational economic architecture of China’s AI industry. The outcome will determine whether AI evolves as a centralized, integrated solution sold to large organizations, or as a decentralized, commoditized utility consumed by millions of developers. For global investors and strategists, understanding the calculus behind each company’s chosen metric is the only way to navigate the immense opportunities and risks taking shape.

The Utility Playbook: How ByteDance Weaponizes Price to Build Platform Lock-In

ByteDance’s AI strategy is a direct application of internet-era disruption principles to the enterprise market. Its chosen unit of account–the token–is the most granular measure of computational work. By centering its narrative on processing over 30 trillion tokens monthly, ByteDance is making a deliberate argument: the most important metric in a nascent technological revolution is adoption and usage, not immediate revenue. This strategy is predicated on a few core analytical pillars.

Price-Led Commoditization as a Moat

The 99.3% price cut on its Doubao model in May 2024 was not a simple promotion; it was a strategic act of market redefinition. ByteDance slashed pricing from the industry average of 0.12 yuan to just 0.0008 yuan per 1,000 tokens–making its service 99.8% cheaper than OpenAI’s GPT-4. By driving the price of AI inference to near-zero, ByteDance transformed the purchasing decision for a vast segment of the market. It shifted the value proposition from complex, feature-based comparisons to a straightforward utility calculation. This maneuver effectively neutralizes competitors who compete on model sophistication alone and establishes a new competitive battlefield based on operational efficiency and scale–a domain where ByteDance, hardened by the demands of its billion-user consumer apps, excels. The analytical insight here is that ByteDance is not just selling a cheaper product; it is attempting to render its competitors’ business models economically unviable.

The Economics of Computational Gravity

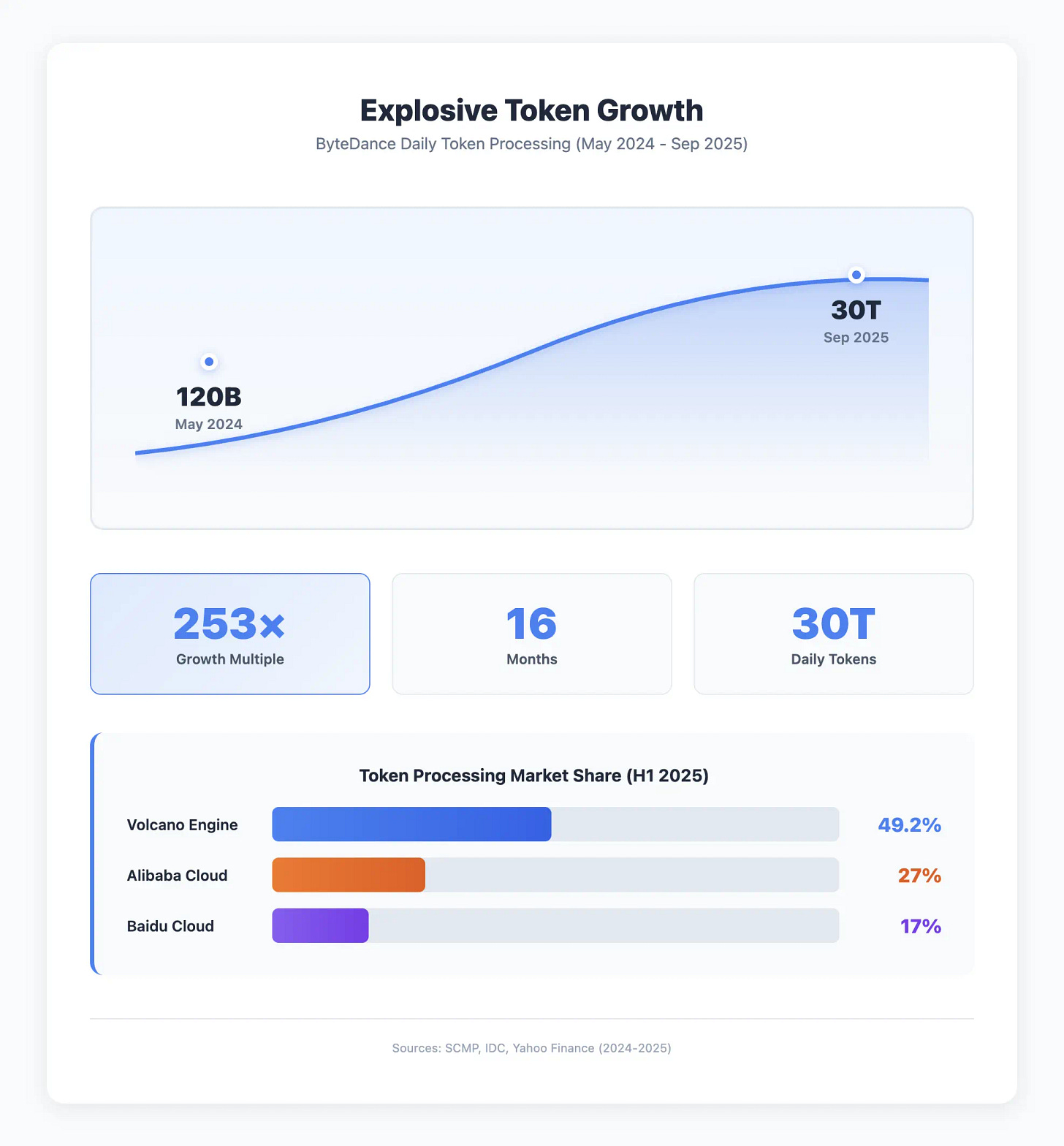

ByteDance’s objective is to achieve “escape velocity” in developer adoption, creating a platform with its own computational gravity. The results are striking: daily token usage surged from 120 billion in May 2024 to 30 trillion by September 2025–a 253-fold increase in just over a year. According to IDC’s analysis of China’s cloud market for token processing in the first half of 2025, Volcano Engine commanded a dominant 49.2% market share, nearly double Alibaba Cloud’s 27% and nearly three times Baidu Cloud’s 17%.

The business model is not based on maximizing the margin per API call, but on maximizing the number of developers and applications locked into its ecosystem. Once an application is built on Volcano Engine’s infrastructure, the costs of migrating–retraining workflows, re-optimizing performance, and managing new APIs–create a powerful form of lock-in. The strategic risk is significant: in its quest for volume, ByteDance could become a permanently low-margin utility, the “dumb pipe” of the AI economy, with value accruing to the application layer above it. However, the potential reward is to become the indispensable OS-level platform for the entire AI-native economy, a position from which it can later layer high-margin, specialized services.

Reshaping the Startup Ecosystem

The flood of cheap tokens is having a profound second-order effect on the venture landscape. It dramatically lowers the barrier to entry for building AI applications, potentially triggering a Cambrian explosion of new companies. However, this also means that a startup’s defensibility can no longer be based purely on access to a powerful model. Moats must now be built elsewhere: in proprietary data, unique user experiences, or deep vertical integration. For investors, this changes the due diligence calculus, shifting focus from a team’s AI research credentials to their product-market fit and go-to-market strategy in a highly commoditized environment.

The Integrated Fortress: Why Alibaba Bets on Enterprise Incumbency Over Developer Velocity

Alibaba Cloud’s strategy is a classic incumbent’s defense, built on leveraging existing strengths to navigate a disruptive technological shift. Its focus on total AI revenue is a direct reflection of a business model designed for value capture within a mature enterprise ecosystem. In its fiscal 2026 first quarter (ending June 30, 2025), Alibaba Cloud’s revenue reached RMB 33.4 billion ($4.6 billion), up 26% year-over-year, with AI-related product revenue maintaining triple-digit growth for the eighth consecutive quarter. This approach is less about winning the future of development and more about owning the present of enterprise transformation.

The Primacy of Existing Contracts and Trust

Alibaba’s core advantage is its decade-long incumbency as China’s leading cloud provider. As of September 2025, over one million corporates and individuals are using Qwen through Model Studio, with the platform supporting over 800,000 AI agents built on its infrastructure. It holds the “systems of record” for the country’s largest enterprises. For a CIO at a major bank, the decision to adopt an AI service is not a greenfield choice; it is an extension of an existing, multi-million dollar relationship. The primary decision drivers are not token price, but security, data sovereignty, reliability, and seamless integration with legacy systems. Alibaba’s strategy is to make adopting its Tongyi models the path of least resistance for this massive, high-value customer base. Its revenue metric is a direct measure of its success in this endeavor.

The Strategic Trade-off of Integration

By focusing on the integrated, full-stack model, Alibaba is making a critical trade-off. It is prioritizing the complex, high-margin needs of its top-tier enterprise clients at the potential expense of agility and appeal to the fast-moving, grassroots developer community. Its platform, designed for stability and security, may be perceived as more cumbersome and expensive by a startup looking to rapidly iterate. The analytical risk for Alibaba is that while it successfully defends its fortress, a new, more dynamic AI economy could flourish outside its walls, powered by utility providers like ByteDance. It risks winning the battle for today’s IT budgets while losing the war for tomorrow’s innovation platform.

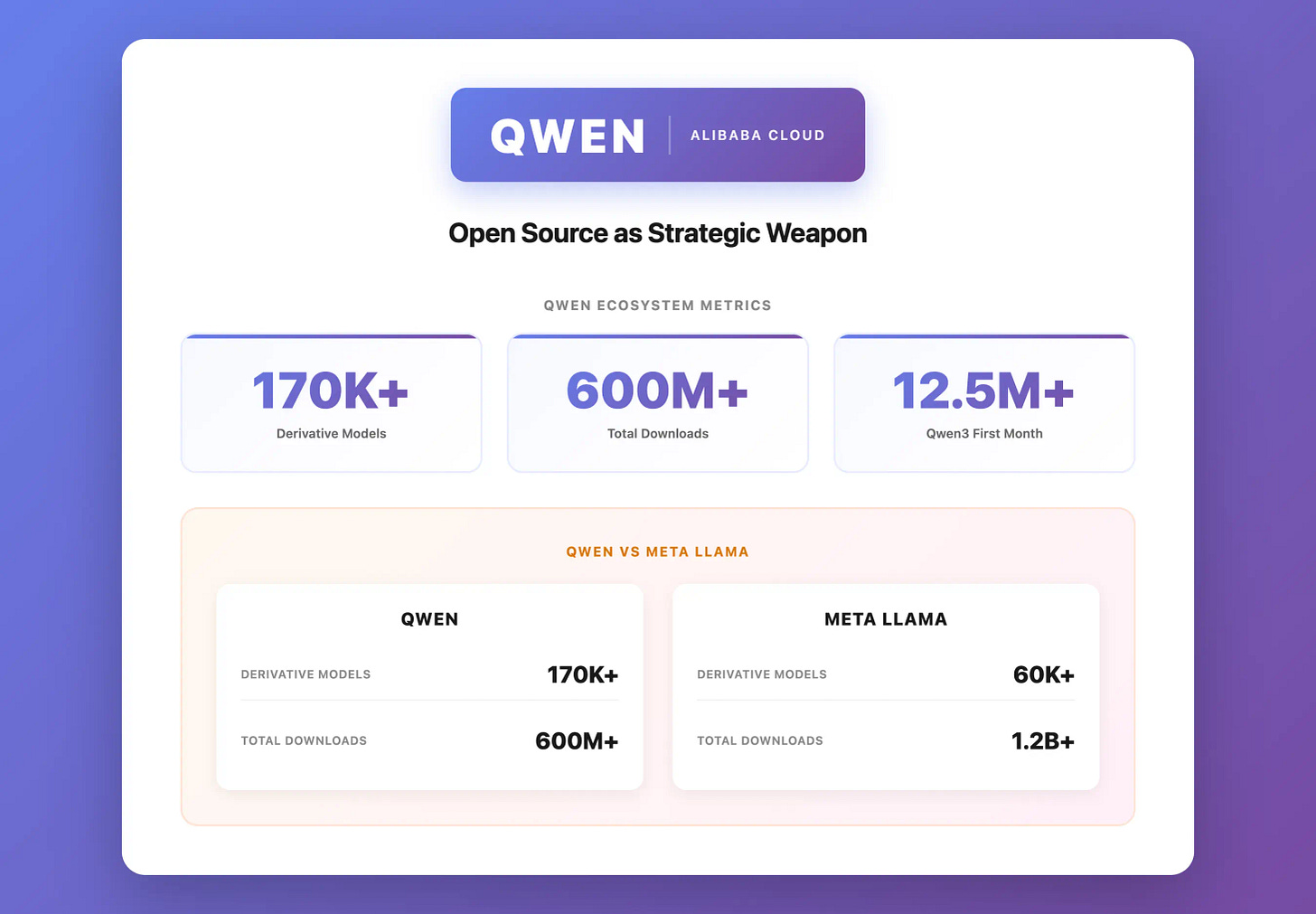

Open Source as a Strategic Weapon

Alibaba’s open-sourcing of its Qwen models is a sophisticated strategic maneuver, not an act of altruism. As of September 2025, approximately 170,000 derivative models have been developed globally based on the Qwen family, surpassing Meta’s Llama series and making it one of the largest AI model families worldwide. The momentum accelerated dramatically in 2025: Qwen3, released in April 2025, achieved over 12.5 million global downloads, with total Qwen series downloads reaching over 600 million. This move directly targets the private deployment market–large enterprises that prefer to run models on their own infrastructure for security and control.

By providing a best-in-class open-source option, Alibaba achieves several goals simultaneously:

It starves MaaS-only competitors of a lucrative market segment.

It establishes Tongyi as a de facto enterprise standard, creating a wide funnel of users who may later convert to paid, managed services.

Most critically, it drives significant demand for its core IaaS business, as running these large models requires immense GPU power, which Alibaba is perfectly positioned to sell.

This turns the open-source movement from a potential threat into a powerful engine for its most profitable business line.