Why Baidu's Best Assets Only Unlock Value After Leaving

Kunlun’s IPO filing reveals a $36.7B valuation gap. What it means for Apollo Go and Chinese tech conglomerates.

Last year, I argued that Baidu had identified the right AI strategy for China. While Western labs chased frontier model benchmarks, Baidu built optimization engines for traffic grids, domestic chip clusters for AI infrastructure, and a robotaxi fleet delivering 250,000 driverless rides weekly. The company’s Famou system adjusts traffic signals across entire cities. Its Kunlun chip clusters handle large-scale AI inference workloads. Apollo Go operates across 22 cities with over 17 million cumulative rides. These accomplishments align with China’s systems-first approach to AI development, where value comes from integrating software, hardware, and domain expertise into operational infrastructure.

But technical progress and market value follow different logics. On January 2, 2026, Baidu announced its AI chip unit Kunlun had filed confidentially for a Hong Kong IPO. The market’s reaction was immediate. Baidu’s Hong Kong shares jumped 9.35% in a single day. The implied valuation tells a striking story. If Kunlun receives multiples comparable to recently listed Chinese AI chip companies, Baidu’s 59% stake could be worth $22 billion. That represents 45% of Baidu’s entire current market capitalization of $51.4 billion.

The arithmetic creates a puzzle. How can a subsidiary account for nearly half of a parent company’s total value? The answer reveals something fundamental about how markets price conglomerates with frontier technology bets. The real question extends beyond Kunlun. Baidu’s autonomous driving unit Apollo Go operates at a scale that smaller competitors cannot match. Yet Pony.ai and WeRide both went public while Apollo Go remains locked inside the conglomerate. The pattern demands explanation.

When Integration Destroys Value

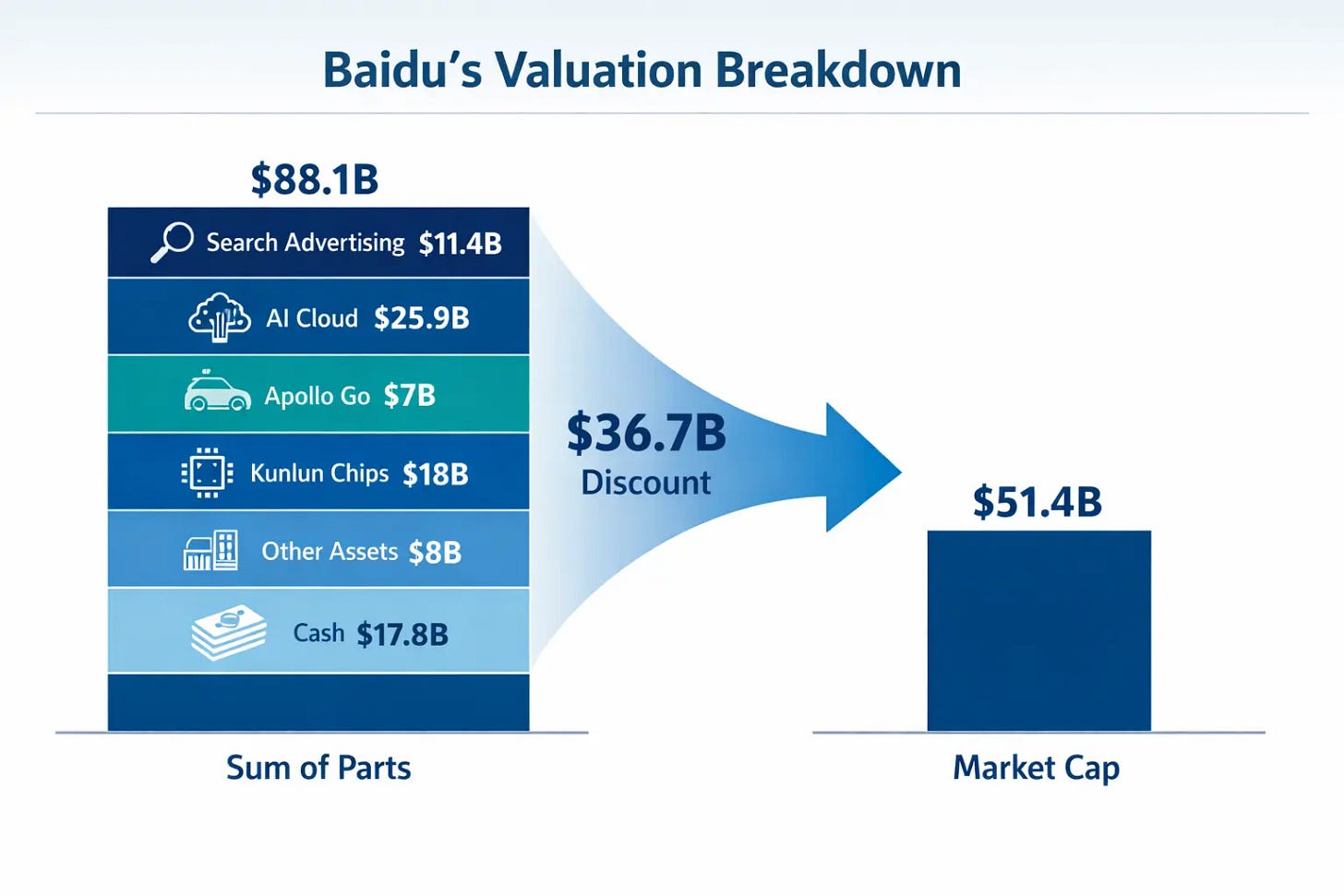

Baidu’s valuation gap can be measured precisely. A detailed analysis published by Chinese financial media breaks down the company’s business segments. The core advertising business generated approximately 63.5 billion RMB in 2025, with an estimated net margin of 25%. Using a conservative price-to-earnings ratio of 5x yields a valuation of roughly $11.4 billion for the legacy search advertising operation.

The AI cloud business recorded 19.3 billion RMB in revenue for the first three quarters of 2025, growing at 31% year over year. Projected full-year revenue reaches approximately 26 billion RMB, or $3.7 billion. Applying a 7x price-to-sales multiple, commonly used for cloud infrastructure providers, suggests a valuation of $25.9 billion.

Apollo Go’s autonomous driving service completed 17 million cumulative rides through late 2025. Conservative estimates place 2025 revenue at approximately 2 billion RMB, or $280 million. Using a 25x price-to-sales ratio, reflecting the premium multiples granted to autonomous vehicle companies, produces a valuation of $7 billion. Some international research firms suggest Apollo Go could command valuations closer to $40 billion based on comparisons with Waymo.

Kunlun chip business projections from Goldman Sachs estimate 2025 sales of 3.5 billion RMB, rising to 6.5 billion RMB in 2026. At roughly $900 million in 2025 revenue and applying a 20x price-to-sales multiple consistent with recently listed Chinese AI chip companies, the business carries an implied valuation of $18 billion.

Additional assets including iQiyi and other holdings contribute roughly $8 billion. Cash and short-term investments exceed $17.8 billion.

The sum reaches $88.1 billion. Baidu’s actual market capitalization sits at $51.4 billion. The gap exceeds $36 billion. Markets are applying a systematic discount to the entire structure.

This discount reflects a specific market logic. When investors evaluate a company combining mature advertising revenue with capital-intensive chip development and long-cycle autonomous driving investments, they face analytical uncertainty. The advertising business delivers predictable cash flows. The frontier technology bets consume capital with unclear return timelines. Traditional valuation models struggle to reconcile these different risk profiles within a single equity security.

The result is cross-contamination. The advertising business gets discounted because investors worry about capital allocation to speculative ventures. The frontier bets get penalized because they sit inside a structure optimized for different economics. Neither business receives the multiple it might command independently.

Google’s 2015 reorganization into Alphabet provides a useful comparison. The restructuring separated Google’s core search and advertising business from “Other Bets” including Waymo, Verily, and various experimental projects. The move allowed investors to evaluate cash-generating operations separately from capital-consuming moonshots. Alphabet’s market capitalization expanded significantly following the reorganization. The underlying businesses remained the same. Investors gained analytical clarity.

Amazon faced a similar dynamic with AWS. For years, the cloud infrastructure business remained buried inside retail operations. Only after Amazon began reporting AWS financial results separately did markets fully appreciate its economics. AWS carries fundamentally different unit economics, margin structures, and growth dynamics compared to e-commerce. Separate disclosure enabled separate valuation.

Baidu’s challenge mirrors these patterns. The company bundles businesses with incompatible investment horizons and risk profiles. Markets respond by applying blanket discounts.

Yet Baidu’s discount appears particularly severe. The $36.7 billion gap reflects more than valuation mechanics. It reveals deeper organizational constraints.

The company pioneered China’s AI chip development in 2011 and autonomous driving in 2013. Key technical architects later left to build competing unicorns. Lu Qi joined from Microsoft to lead AI transformation in 2017. He departed after sixteen months. The pattern suggests structural issues beyond normal talent competition.

Kunlun’s spin-off filing came only after watching smaller competitors achieve extraordinary valuations in late 2025. Apollo Go continues expanding into Dubai and London while remaining integrated inside the conglomerate. The timing raises a critical question: has Baidu learned from its delays, or is it repeating them?