From Search to Survival: Baidu’s Forced All-in AI Pivot

From dominance to desperation: how AI reshaped Baidu’s path.

Hello China Tech by Poe Zhao — Weekly insights into China’s tech revolution. I analyze how developments in Chinese AI, electric vehicles, robotics, and semiconductors are reshaping global technology landscapes. Each piece contextualizes China’s innovations within worldwide market dynamics and strategic implications.

👉 Final week to lock in Premium early-bird pricing: $10/month ($100/year) before it rises on Sept 1. Upgrade here.

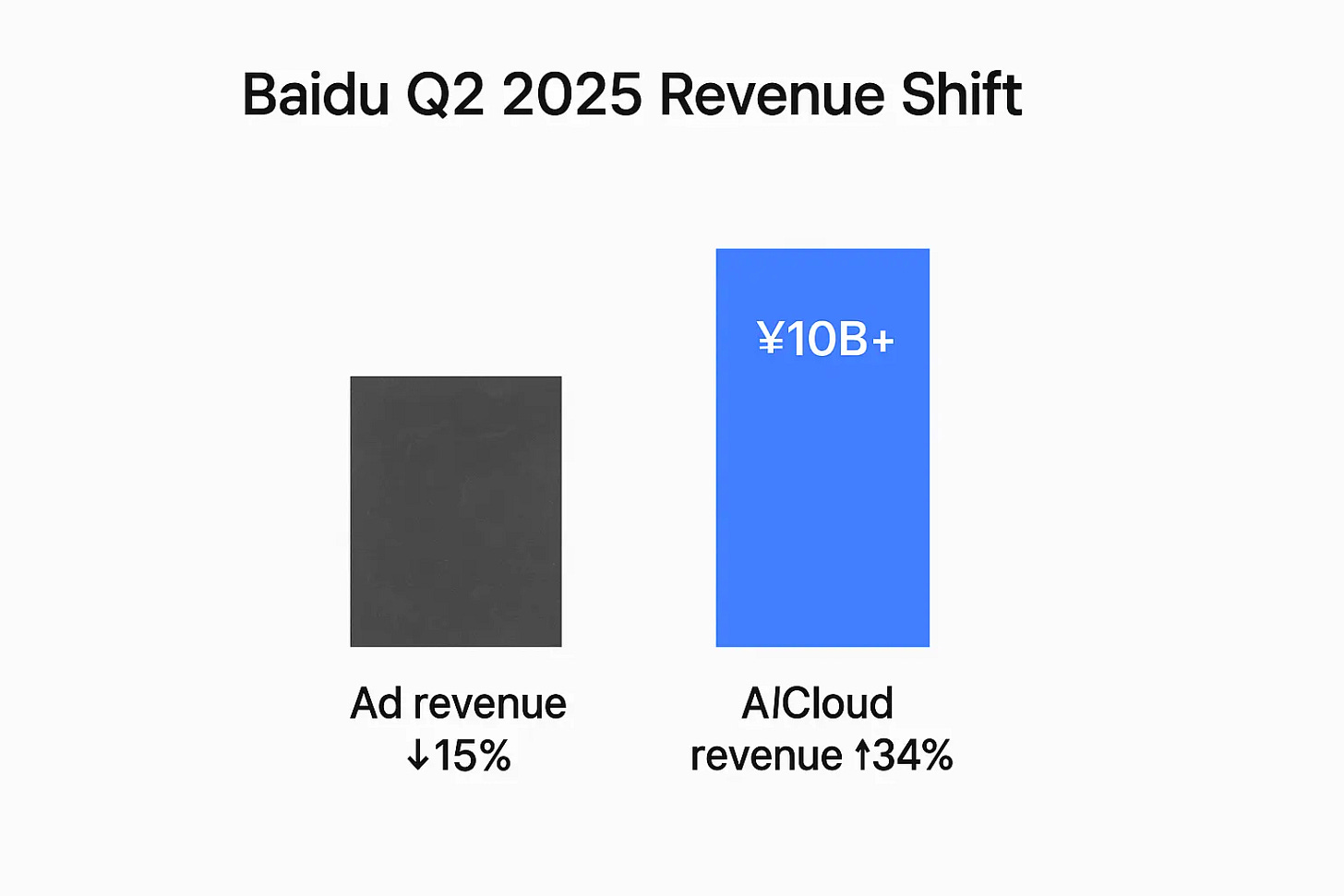

The story of Baidu’s dramatic pivot—from China’s dominant search engine to an AI infrastructure provider—offers a compelling lens for understanding how established tech giants navigate paradigm shifts in the world’s most dynamic digital economy. When Baidu’s Q2 2025 earnings revealed a stark reality—traditional search advertising revenue plummeting 15 % while AI business income surged 34 % past the ¥10 billion threshold (Investors.com report)—it crystallized a transformation that extends far beyond one company’s strategic choices.

This isn’t simply a tale of corporate reinvention. Rather, Baidu’s “forced All-in AI” journey illuminates a broader pattern of adaptive restructuring that characterizes how Chinese tech giants respond to fundamental technological disruptions. By examining this transformation through a systematic framework, we can extract valuable insights about innovation cycles, ecosystem evolution, and competitive dynamics that apply well beyond China’s borders.

The Great Disruption: From SEO to GEO

To understand why Baidu feels “forced” into AI, we must first grasp the magnitude of the underlying shift. The company that once commanded nearly 90 % of China’s search market share in 2022 has watched that dominance erode to below 70 % by 2024. This isn’t merely market share loss—it represents a fundamental disruption of the search paradigm itself.

The transition from Search Engine Optimization (SEO) to Generative Engine Optimization (GEO) represents more than a technical evolution; it’s a complete reimagining of how users discover and consume information. Data from 2024 shows AI platform-related traffic growing at over 30 % annually in China, while traditional SEO channels declined 10–20 %. This isn’t a temporary trend—it’s a structural shift that renders traditional search monetization models increasingly obsolete.

What makes this particularly fascinating from an analytical perspective is how the disruption arrived. Unlike previous technology transitions that emerged gradually, the GEO shift created an immediate existential threat to Baidu’s core business. The company’s advertising revenue decline accelerated from a manageable 6 % in Q1 2025 to 15 % in Q2—a pace that demanded immediate strategic response rather than gradual adaptation.

For Chinese tech companies specifically, this disruption carries additional complexity. The concept of “super apps” (超级App)—platforms like WeChat and TikTok that integrate multiple services within single ecosystems—means that search functionality increasingly happens within closed environments rather than through general-purpose search engines. Each super app’s built-in search captures user intent within its own content universe, fragmenting the universal search market that Baidu once dominated.

The Anatomy of Forced Transformation

Baidu’s response illuminates several critical patterns about how established tech companies navigate paradigm shifts. The transformation reveals three interconnected adaptation mechanisms that offer broader insights for understanding corporate evolution during technological disruptions.

Capability Repurposing and Value Chain Repositioning

Perhaps the most instructive aspect of Baidu’s transformation is how it leveraged existing capabilities for entirely new purposes. The company’s years of investment in AI research—initially intended to enhance search algorithms—suddenly became the foundation for a comprehensive AI infrastructure business. This repurposing wasn’t merely opportunistic; it represented a strategic reframe of core assets from supporting technologies to primary value propositions.

The numbers tell the story: Baidu’s AI-related business crossed ¥10 billion in quarterly revenue with 34 % year-over-year growth (Investors.com report), while traditional advertising revenue contracted. More tellingly, Baidu’s intelligent cloud revenue reached ¥6.5 billion with 27 % growth (Reuters analysis), primarily driven by enterprise clients seeking AI capabilities. This shift from B2C advertising to B2B infrastructure represents a fundamental business model transformation—from monetizing user attention to monetizing computational capabilities.

This pattern—repurposing internal capabilities to serve emerging market demands—offers a framework for understanding how companies can navigate technological transitions. The key insight is that successful adaptation often involves identifying latent value in existing assets rather than building entirely new capabilities from scratch.

Ecosystem Role Redefinition

Baidu’s transformation also demonstrates how companies can redefine their role within technology ecosystems during periods of disruption. Rather than fighting to maintain its position as a consumer-facing search portal, Baidu increasingly positions itself as an infrastructure provider for other companies’ AI initiatives.

This shift becomes clear when examining Baidu’s intelligent cloud performance. According to IDC reports, Baidu has maintained its position as China’s leading AI public cloud service provider for six consecutive years. The company’s self-developed Kunlun AI chips and AI Heterogeneous Compute (百舸) platform now serve as the foundation for thousands of enterprise AI applications. This represents a move from being a direct competitor for user attention to becoming an enabler of others’ AI capabilities.

Innovation Investment During Transition

Interestingly, Baidu’s financial allocation during this transition reveals another important pattern. While facing revenue pressure, the company reduced R\&D spending by 13 % to ¥5.1 billion in Q2 2025 (Futunn analysis). This contrasts sharply with competitors like Tencent, which increased R\&D investment by 17 % to ¥20.25 billion, and Alibaba’s announced ¥380 billion investment commitment for cloud and AI over three years.

This seemingly counterintuitive approach—reducing research investment during a technological transition—actually reflects a sophisticated resource allocation strategy. Rather than pursuing broad-based innovation, Baidu appears to be concentrating resources on specific, high-impact areas where it can achieve differentiation. The focus on Kunlun chips, autonomous driving (Apollo Go, 萝卜快跑), and enterprise AI solutions suggests a precision-targeting approach to innovation investment.

This pattern offers important insights for understanding how resource-constrained companies can compete during technological transitions. The lesson isn’t that less R\&D investment is better, but that strategic focus can be more effective than broad-based spending when resources are limited and competition is intense.

The Global Context: China’s Unique Innovation Dynamics

Baidu’s transformation cannot be understood in isolation from China’s broader tech ecosystem and policy environment. Several distinctly Chinese factors shape both the pressures driving the transformation and the strategic options available to the company.

Policy Environment and Strategic Support

The Chinese government’s emphasis on “New Infrastructure” (新基建) policies specifically supports AI computing infrastructure development. Government bodies like the Ministry of Industry and Information Technology (MIIT, 工信部) and the National Development and Reform Commission (NDRC, 发改委) have prioritized AI capabilities as national strategic assets. This policy support creates market opportunities for companies like Baidu that can provide AI infrastructure services, effectively subsidizing the company’s pivot away from consumer advertising.

Moreover, China’s approach to AI governance—emphasizing both innovation promotion and security control—creates unique opportunities for domestic providers. Baidu’s compliance with regulations like the Data Security Law and Algorithm Recommendation Management Provisions positions it favorably in a market where international competitors face increasing regulatory scrutiny.

The Self-Reliance Imperative

China’s broader push for technological self-reliance (科技自立自强) adds another dimension to Baidu’s AI infrastructure strategy. The company’s development of Kunlun AI chips represents more than competitive positioning—it’s a response to potential supply chain vulnerabilities highlighted by US-China tech competition. This strategic context helps explain why Baidu’s cloud business growth focuses heavily on domestic enterprise clients who prioritize supply chain security.

The success of Baidu’s Kunlun chip clusters—reportedly deploying 30,000 cards and providing cost-competitive alternatives to imported solutions—demonstrates how geopolitical factors can create market opportunities for domestic technology providers. This dynamic is particularly important for understanding Chinese tech companies’ strategic calculations.

Unique Monetization Pressures

The Chinese market’s competitive intensity creates unique pressures that accelerate transformation timelines. Unlike tech giants in other markets who might gradually transition over several years, Chinese companies face more immediate threats from agile competitors. The rapid rise of AI-native applications like DeepSeek and ByteDance’s “豆包” (Doubao) in the Chinese market illustrates how quickly new entrants can capture user attention and market share.

Baidu’s challenge is particularly acute because its traditional moat—search algorithm superiority—has become less relevant in an AI-powered world where multiple companies can provide high-quality generative responses to user queries. This competitive dynamic forces faster strategic pivots than might be necessary in less competitive environments.

Extracting Broader Patterns: A Framework for Understanding Tech Giant Transitions

Baidu’s experience offers several generalizable insights about how established technology companies navigate paradigm shifts. These patterns form a framework for analyzing similar transitions across different companies and markets.

The Capability-Market Fit Evolution

Successful navigation of technological disruption often requires reframing existing capabilities to serve new market needs. Baidu’s AI research, initially developed to enhance search relevance, became the foundation for cloud services and enterprise AI solutions. This suggests that companies facing disruption should systematically inventory their capabilities and explore alternative applications rather than simply defending existing business models.

The key insight is that capability-market fit is dynamic rather than fixed. Technologies developed for one purpose may find their highest value in entirely different applications, especially during periods of rapid technological change.

The Platform Strategy Pivot

When direct competition becomes unsustainable, pivoting to become a platform or infrastructure provider for competitors can be a viable strategy. Baidu’s transition from competing for search queries to providing AI capabilities for other companies’ applications illustrates this pattern. This approach leverages existing assets while avoiding direct competition in disrupted markets.

This pattern appears across multiple industries and technological transitions, suggesting it represents a fundamental strategic option for established companies facing disruption.

Resource Concentration Under Pressure

Contrary to conventional wisdom that companies should increase innovation investment during technological transitions, Baidu’s focused approach to R\&D allocation suggests that strategic concentration can be more effective than broad-based investment when resources are constrained. This insight is particularly relevant for companies that lack the financial resources to compete across all potential innovation areas simultaneously.

The Autonomous Driving Wild Card

No analysis of Baidu’s transformation would be complete without examining its autonomous driving initiative, Apollo Go (萝卜快跑). This business represents perhaps the most ambitious aspect of Baidu’s AI strategy and offers insights into how Chinese tech companies approach long-term, capital-intensive innovation projects.

Apollo Go (萝卜快跑)’s progress—over 2.2 million rides in Q2 2025, 148 % year-over-year growth, and near-profitability in cities like Wuhan (The Driverless Digest report)—demonstrates the potential for AI applications to create entirely new markets rather than simply optimizing existing ones. The service’s expansion into 16 cities and partnerships with global players like Uber and Lyft for international deployment suggest a different scaling model than traditional internet services.

From a framework perspective, Apollo Go (萝卜快跑) illustrates how companies can use long-term, speculative investments to hedge against uncertainty about their core business transformation. While Baidu’s cloud and search AI initiatives address immediate revenue pressures, autonomous driving represents a potential future where the company could achieve dominance in an entirely new transportation paradigm.

The project’s progress also highlights China’s unique advantages in deploying AI applications at scale. Regulatory support for autonomous vehicle testing, urban planning that accommodates new transportation modes, and consumer willingness to adopt AI-powered services create conditions that may be difficult to replicate in other markets.

Looking Forward: Key Indicators and Analytical Framework

Understanding whether Baidu’s transformation will succeed—and what lessons other companies can extract—requires tracking specific indicators that reveal the health of the transition process.

Revenue Mix Evolution

The most critical indicator is the speed at which AI-related revenue grows relative to traditional advertising decline. Baidu needs AI business growth to accelerate beyond the current 34 % rate to offset advertising revenue contraction. The crossover point—when AI revenue exceeds advertising revenue—will mark a successful business model transition.

Margin Profile Changes

Baidu’s operating margins in AI businesses will reveal whether the transformation creates sustainable value. Currently, the company’s core business operating margin declined from 21 % to 13 % year-over-year, reflecting investment costs and competitive pressures. Sustainable success requires AI businesses to eventually achieve margin profiles comparable to or better than traditional search advertising.

Ecosystem Position Strengthening

Baidu’s competitive position increasingly depends on becoming indispensable to other companies’ AI initiatives rather than directly competing for consumer attention. Tracking client retention, expansion of partnerships, and integration depth with enterprise customers will indicate whether the platform strategy succeeds.

International Scaling Capability

The success of Apollo Go (萝卜快跑)’s international expansion and broader AI service exports will test whether capabilities developed for the Chinese market can generate value globally. This dimension is particularly important for assessing the long-term potential of Baidu’s transformation.

Implications for Global Tech Strategy

Baidu’s “forced All-in AI” transformation offers several lessons for technology strategy more broadly. First, it demonstrates that even dominant market positions can become vulnerable remarkably quickly during paradigm shifts. Companies with seemingly unassailable competitive advantages must remain vigilant about fundamental technology changes that could render their core value propositions obsolete.

Second, the case illustrates the importance of maintaining optionality through diversified capability development. Baidu’s AI transformation was possible precisely because the company had invested in AI research for years before it became commercially essential. This suggests that companies should cultivate capabilities in emerging technologies even before clear market applications emerge.

Third, the transformation shows how companies can leverage unique market conditions—whether regulatory, competitive, or cultural—to create differentiated strategic positions. Baidu’s success with enterprise AI services partly reflects China’s specific regulatory environment and domestic companies’ preferences for local providers.

Finally, the case demonstrates that successful adaptation during technological transitions often requires accepting short-term financial pressure in exchange for long-term strategic positioning. Baidu’s willingness to sacrifice near-term profitability to establish AI market position illustrates this trade-off dynamic.

For observers of global technology trends, Baidu’s transformation provides a framework for analyzing how established companies navigate disruption. The patterns of capability repurposing, ecosystem role redefinition, and strategic resource concentration likely apply across different technologies, markets, and competitive contexts.

The ultimate test of this framework will be whether Baidu’s transformation succeeds in creating sustainable competitive advantages in the AI era. As the transformation continues to unfold, it offers a real-time case study in corporate adaptation during one of technology’s most significant paradigm shifts.

What emerges from this analysis is not just the story of one company’s adaptation, but a template for understanding how technological disruption reshapes entire industries—and how established players can survive and thrive through fundamental reinvention.

About Hello China Tech

I’m Poe Zhao, and I bridge the gap between China’s rapidly evolving tech ecosystem and the global community. Through Hello China Tech, I provide twice-weekly analysis that goes beyond headlines to examine the strategic implications of China’s technological advancement.

Found this useful?

→ Share this newsletter with colleagues who need to understand China’s tech impact

→ Subscribe for free to receive every analysis:

→ Follow the conversation on 𝕏 for daily updates and additional insights

Get in touch: Have questions about China’s tech sector or suggestions for future analysis? Reply to this email – I read every message.