When Subsidy Wars Cool Down, The Real Battle Begins

Alibaba’s Ele.me rebrand isn’t retreat. It’s preparing for a siege Meituan can’t sustain.

Alibaba just consolidated two brands while claiming to pull back from competition.

On December 5, the Ele.me app officially becameTaobao Shangou. Every logo changed. Every marketing asset updated. The rebrand will cost hundreds of millions in user education alone. This happened exactly one week after both Alibaba and Meituan published brutal Q3 earnings reports. Alibaba’s China e-commerce operating profit collapsed 85 percent to ¥5.4 billion ($750 million). Meituan recorded its largest quarterly loss since going public at ¥16 billion ($2.2 billion).

Both companies signaled retreat. Alibaba’s CFO said Q4 spending would contract. Meituan CEO Wang Xing declared the company opposed price wars. Analysts predicted the subsidy battle was cooling.

The context matters. Alibaba is executing its most aggressive transformation in years, betting billions simultaneously on AI infrastructure and instant retail. CEO Eddie Wu calls instant retail a strategic necessity, not a tactical move. The company holds ¥573.89 billion ($79 billion) in cash reserves. It can sustain these losses.

Then Alibaba merged Ele.me into Taobao Shangou.

Companies do not rebrand during genuine pullbacks. They rebrand when they intend to stay. A rebrand of this scale and cost reflects commitment rather than caution. What looks like consolidation during a ceasefire resembles the early stage of a long campaign.

What Six Months of War Produced

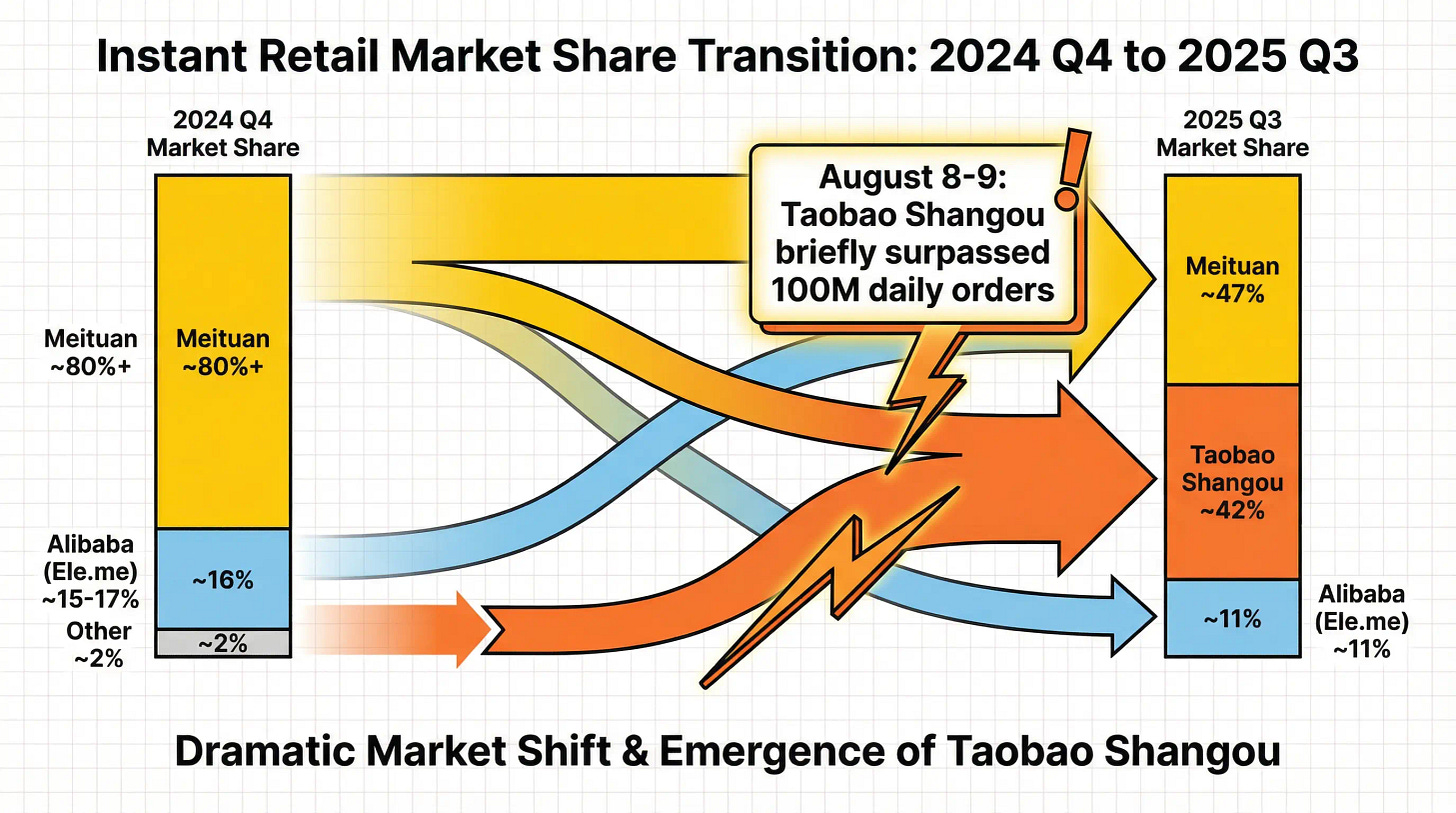

The summer campaign achieved its immediate goal. Alibaba’s instant retail revenue jumped 60 percent year over year in Q3. Meituan’s core local business revenue fell 2.8 percent. The market share gap narrowed at high speed.

Six months earlier, Meituan dominated the category and controlled more than 80 percent of food delivery orders in China. By Q3 2025, that dominance had weakened. Several data sources place Meituan near 47 percent share and Taobao Shangou near 42 percent. On August 8 and 9, Taobao Shangou briefly surpassed Meituan and exceeded 100 million daily orders.

The redistribution carried a heavy financial cost. Alibaba burned ¥35–36 billion ($4.8–5 billion) in Q3 on instant retail subsidies. Since the launch of Taobao Shangou in late April, cumulative losses exceeded ¥46 billion ($6.4 billion). Meituan spent ¥15–20 billion ($2.1–2.8 billion) in Q3 to defend its position. Its sales and marketing expenses rose 90.9 percent year over year to ¥34.3 billion ($4.7 billion).

The investment logic runs deeper than food delivery competition. Alibaba views instant retail as a traffic reconstruction tool. Taobao Shangou already attracts over 100 million daily active users. The goal is converting these high frequency interactions into broader e-commerce engagement. This explains why Alibaba treats instant retail losses as customer acquisition costs rather than operational failures.

Both companies now signal reduced spending. Yet their statements contain qualifiers. Jiang Fan, CEO of Alibaba E-commerce Business Group, said the company completed the first phase of rapid scale expansion and added that unit economics improved since September. The CFO said Q4 spending would contract while maintaining market share.

Wang Xing used nearly identical framing. Meituan did not intend to join price wars but would make investments to preserve its lead. Both management teams left ample room to increase pressure if competitive dynamics shift.

The rebrand clarifies Alibaba’s intentions. Ele.mecarried strong recognition in food delivery but was tightly associated with meals. The perception constrained expansion into broader instant retail. A parallel exists in the United States. Uber Eats is a powerful brand within food, yet it does not naturally extend to groceries or pharmacy delivery.

Taobao Shangou, launched in late April 2025 as a primary entry point within the Taobao app, reached 40 million daily orders in one week. By August, peak daily orders reached 120 million. Monthly buyers climbed to 300 million. Taobao’s daily active users rose more than 20 percent year over year.

Bringing all services under one brand concentrates marketing impact and simplifies user behavior. It also indicates a long timeline. A company does not redesign an entire consumer facing identity to pursue a temporary advantage. The shift suggests an intention to anchor instant retail as a core part of the ecosystem.

The summer answered a clear question. Force can disrupt entrenched positions. The next phase explores a different question. Endurance determines outcomes once the initial break has already occurred.

Meituan’s Structural Problem

Imagine a delivery platform whose profit engine resembles Yelp and Groupon. Then imagine Amazon Fresh attacking the delivery business while Google Maps and TikTok weaken local discovery. The comparison illustrates Meituan’s position.