The New Alibaba: Why China's Profit Machine is Choosing Growth Over Cash

CEO Eddie Wu is burning billions on AI infrastructure and instant retail subsidies. It’s a necessary gamble with a three-year clock.

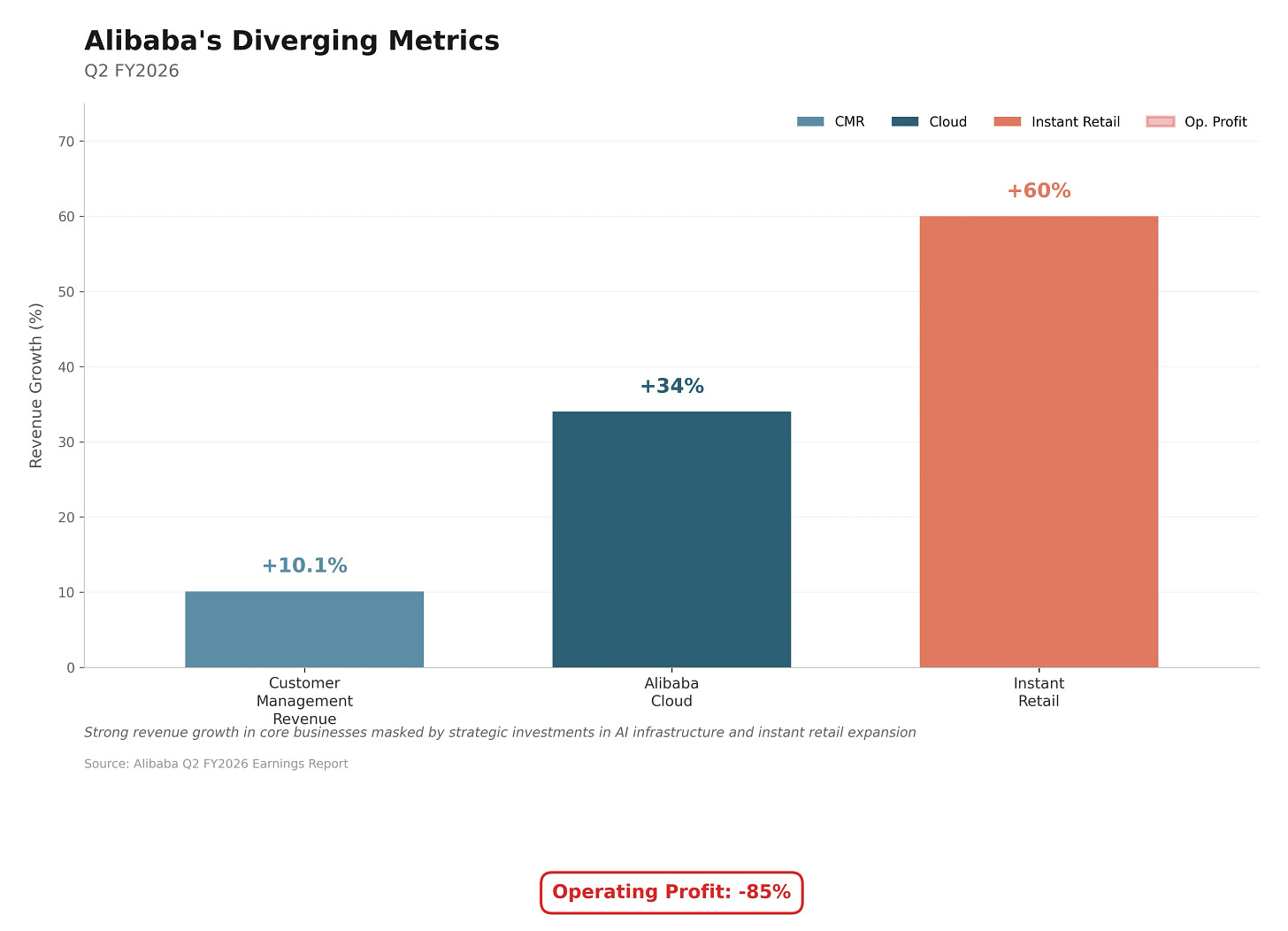

Alibaba just reported one of its most dramatic quarterly results in years. Operating profit plunged 85% to RMB 5.37 billion ($740 million). Cloud revenue accelerated to 34% growth. The contradiction is sharp: China’s once-reliable profit machine is burning cash at an unprecedented rate.

This volatility reflects a deeper question that matters far beyond Alibaba: Can Chinese tech giants successfully pivot from mature, profit-generating businesses to high-growth platforms powered by AI and new consumer behaviors? Alibaba’s answer is clear.

Under CEO Eddie Wu, the company is executing the most aggressive strategic transformation in its history, simultaneously investing billions in AI infrastructure while losing hundreds of millions daily in the instant retail war. This is not the old Alibaba that Wall Street knew. This is a company betting its future on becoming something entirely different.

The Profit Model That Stopped Working

For years, Alibaba’s e-commerce was a reliable cash cow. Customer Management Revenue (CMR), its core advertising metric, grew steadily. Margins stayed healthy. That model has now hit its limits.

This quarter, CMR grew 10.1% to RMB 78.9 billion ($11.1 billion). That looks respectable. It’s not. Since September 1, 2024, Alibaba has charged merchants a 0.6% basic software service fee. It also pushed full-site promotion tools. These monetization rate increases created a one-time boost. The underlying business momentum is weaker than 10% suggests.

The competitive landscape has shifted dramatically. Pinduoduo used aggressive pricing to capture younger users and extend their time spent on app. Meituan built an unassailable moat in local services. ByteDance reconstructed content distribution with AI. Meanwhile, Alibaba’s international e-commerce business, once seen as a growth engine, has deliberately slowed to 10% growth as the company shifts to profitability over scale amid challenging overseas conditions.

The window for transformation is narrow. The AI wave offers perhaps a three-to-five-year window before competitive positions solidify. User habits in instant retail are forming now. If Alibaba fails to claim its position in these two races, it risks marginalization in China’s next generation of internet platforms.

One data point crystallizes the urgency: Taobao has reclaimed clear leadership in daily active users over Pinduoduo, according to QuestMobile. But this leadership came at enormous cost through instant retail subsidies. The old Alibaba business model could never achieve this. That realization drove the company’s radical strategic shift.

Two Fronts, One Strategy

Alibaba’s new strategy rests on two pillars: AI as the soul, consumer platforms as the foundation. Each represents a multi-billion dollar bet with uncertain returns but existential importance.