China’s Answer to Silicon Valley: Alibaba’s $53 Billion Challenge to Big Tech

But can it succeed where others have failed?

Through the misty drizzle of a September morning in Hangzhou, thousands of developers, entrepreneurs, and tech executives streamed into Alibaba’s flagship Apsara Conference 2025, expecting the usual parade of incremental cloud updates and corporate partnerships. What they witnessed instead was nothing short of a corporate metamorphosis. CEO Eddie Wu took the stage to announce that Alibaba would exceed its already massive $53 billion AI infrastructure commitment, unveiled Qwen3-Max, a trillion-parameter AI model designed to rival GPT-5, and declared Alibaba’s ambition to become the “Android of the AI era.” The market’s response was immediate and dramatic: Alibaba’s NYSE-listed shares soared to nearly $180, touching four-year highs and capping off what has become a stunning year-to-date rally of nearly 100% for the once-beleaguered e-commerce giant.

To an outside observer, this looks like a classic case of market froth, with investors rewarding promises of massive spending in a desperate pivot away from a struggling core business. Bloomberg Intelligence analysts rightly pointed to the immediate consequence: a staggering $2.6 billion free cash flow outflow in a recent quarter as capital spending tripled. This seems, on the surface, like a reckless bet.

But to see this as merely a spending spree is to miss the forest for the trees. This isn’t just a pivot; it’s a fundamental reconstitution of Alibaba’s identity. The market’s sudden euphoria reflects a dawning realization of the sheer scale and strategic coherence of the company’s ambition. Alibaba is not just trying to build China’s best AI model. It is executing a meticulous, two-pronged strategy to construct an entire, parallel AI universe, walled off by geopolitics but powered by its own technology.

The strategy is as simple as it is audacious: First, become the “Android” for AI applications through its open-source Qwen model family, capturing developer mindshare. Second, become the “AWS” for AI compute, forging a vertically integrated, self-sufficient infrastructure stack to run it all on. This is a bid to become the indispensable operating system and the foundational utility for China’s entire AI economy, a move that could either redefine the company for the next decade or become one of the most expensive failed experiments in corporate history.

The “Android” Play: A Flood of Models to Win the War

The first pillar of Alibaba’s strategy is a masterclass in platform warfare, updated for the age of AI. At its Apsara developer conference in Hangzhou, the company didn’t just announce one new model; it unleashed seven. The star of the show was Qwen3-Max, a trillion-parameter behemoth that Alibaba claims surpasses GPT-5 and Claude Opus 4, ranking it “among the top three globally.”

Whether these specific claims hold up to independent scrutiny is almost secondary to the strategy they reveal. The real weapon isn’t a single superlative model, but the entire Tongyi Qianwen (通义千问) or Qwen family–a sprawling portfolio of over 300 open-source models covering every conceivable modality: massive language models (Qwen3-Max), specialized coding models (Qwen3-Coder), vision (Qwen3-VL), audio (Fun-ASR), and all-in-one multimodal systems (Qwen3-Omni).

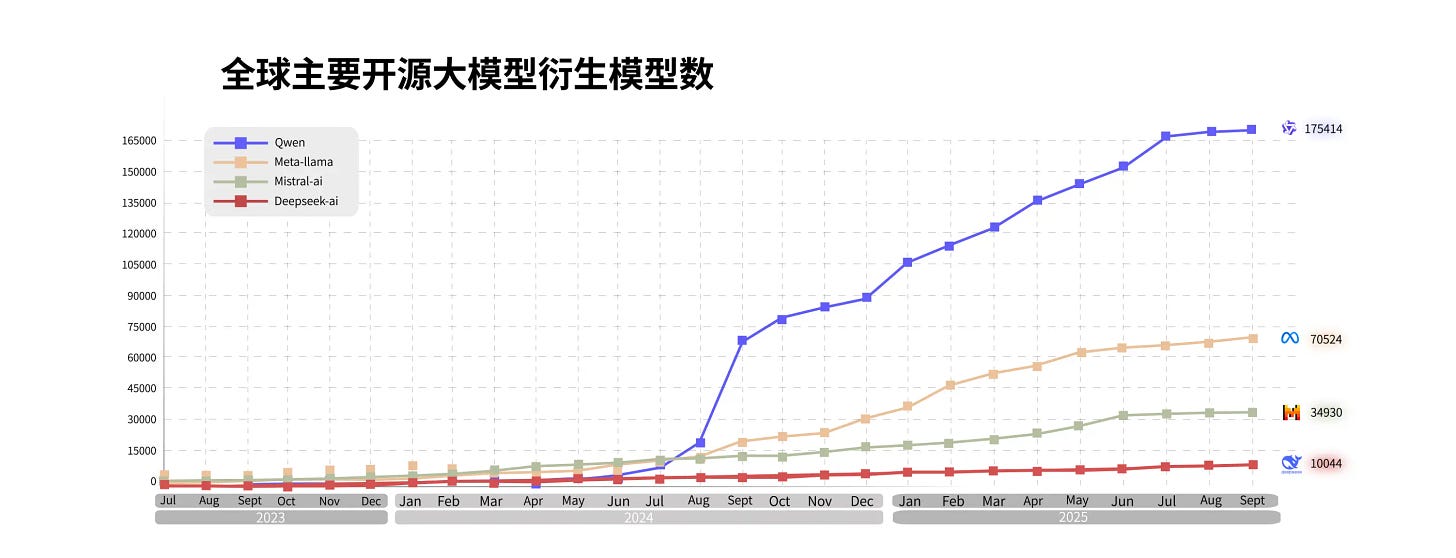

This is a deliberate “shock and awe” campaign aimed not at end-users, but at developers. While Silicon Valley’s leaders like OpenAI and Anthropic build largely closed, proprietary systems, Alibaba is giving away the keys to the kingdom. Alibaba reports that the open-source Qwen ecosystem now includes 300+ released models, 600M+ cumulative downloads, and 170K+ derivativesacross major hosting platforms. Alibaba is making Qwen the default starting block for a generation of Chinese AI developers and startups.

The logic is straight out of Google’s Android playbook. Why spend billions developing a foundation model from scratch when a world-class, free, and open-source alternative from Alibaba exists? This approach dramatically lowers the barrier to entry for AI innovation, but in doing so, it subtly locks the resulting ecosystem onto Alibaba’s rails. Every startup building on Qwen, every university experimenting with it, and every enterprise fine-tuning it becomes a potential customer for Alibaba’s other services. This isn’t just about technological benevolence; it’s about cultivating a vast, dependent ecosystem that it can later monetize. As GAM Investment Management’s Jian Shi Cortesi noted, “Alibaba is increasingly viewed more as an AI/cloud infrastructure player than strictly an e-commerce name.” This perception shift is the entire point.

The “AWS” Play: Forging a Full-Stack Fortress

If the open-source Qwen family is the seductive, free-for-all software layer, the second pillar of the strategy is the hard-nosed, brutally expensive hardware and infrastructure layer designed to capture its value. This part of the plan isn’t a choice; it’s a necessity dictated by Washington.

The ever-tightening US export controls on high-end Nvidia AI chips have created an existential crisis for China’s tech giants. For Alibaba, this threat has been transformed into a strategic mandate: build a completely self-reliant, full-stack AI infrastructure. This is what CEO Eddie Wu means when he speaks of building the “next-generation computer.”

The $53 billion (380 billion yuan) three-year investment plan is the down payment on this vision. The internal presentation from the Apsara conference reveals the sheer depth of this vertical integration. It’s not just about designing chips through its T-Head semiconductor unit, which recently secured a landmark deal with state-owned China Unicom. It’s about re-engineering the entire data center stack:

Servers: The new “Panjiu 128” super-node AI server, a high-density system designed in-house.

Networking: The proprietary “HPN 8.0” high-performance network, designed to connect up to 100,000 GPUs in a single cluster with massive bandwidth (6.4 Tbps).

Storage: High-performance file systems (CPFS) and object storage (OSS) optimized for AI training’s massive data throughput needs.

Platform: The “Lingjun” intelligent computing cluster, which manages these resources for maximum training efficiency.

This is Alibaba building its own AWS, but for an era where the core workload is AI, not traditional cloud computing. The invisible hand guiding this entire endeavor is, of course, Beijing. The national drive for technological self-sufficiency provides both the political air cover and the captive market for such a colossal undertaking. Chinese state-owned enterprises and private companies alike are being pushed, both by policy and by geopolitical prudence, to onshore their AI development. Alibaba is positioning its cloud as the safest, most patriotic, and increasingly, the most powerful place to do it.