The AI Shopping Paradox

Why China’s tech giants are burning $500 million a year on commerce tools that can’t be monetized without destroying the trust they’re built to create.

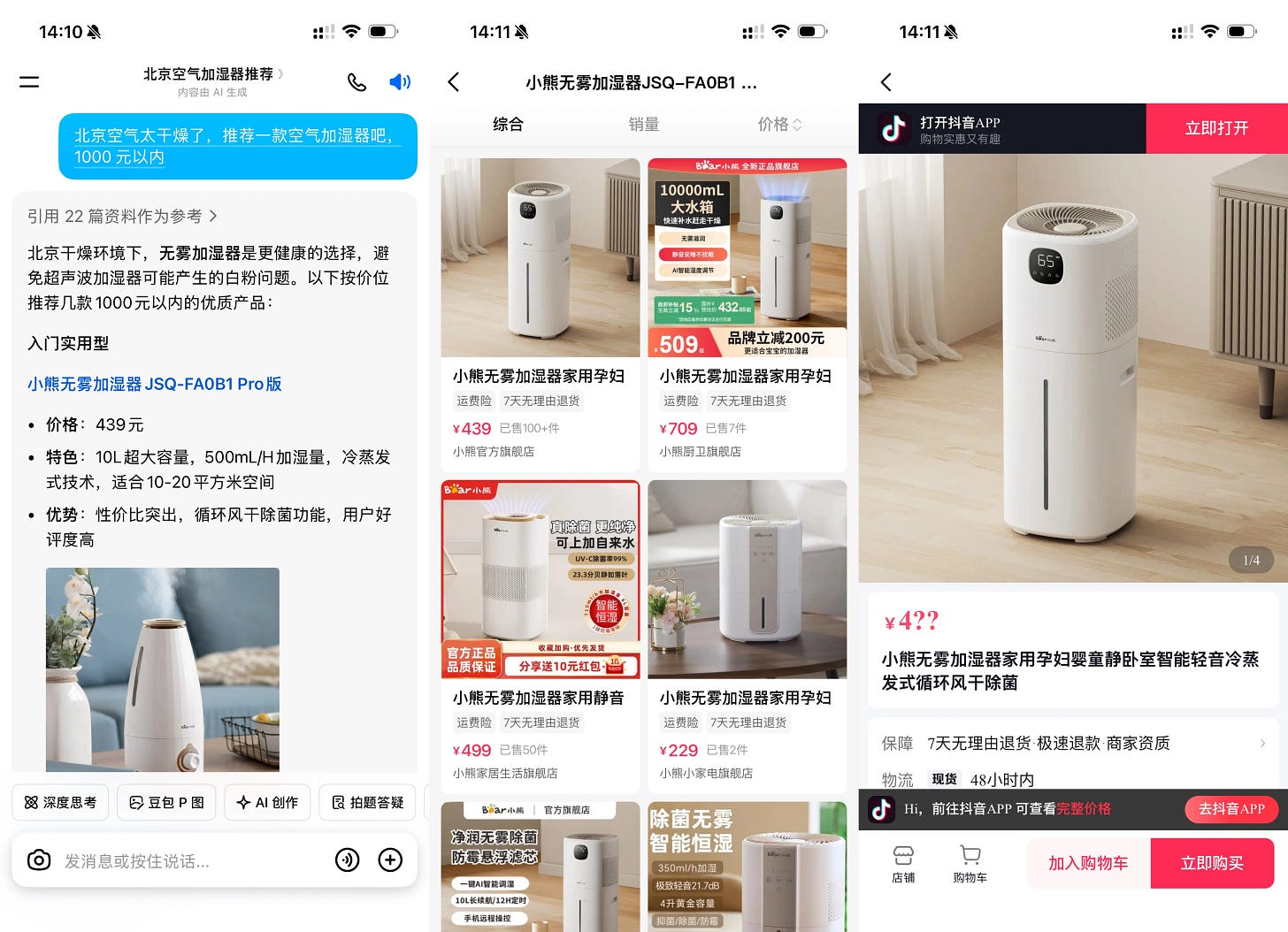

Type “recommend a humidifier for northern homes” into Doubao, ByteDance’s AI assistant. Within seconds, the chatbot returns five products ranging from 499 to 2,999 yuan, each with detailed specifications and direct links to Douyin’s shopping platform. One tap, and you’re browsing product listings. Another tap to select a shop, then checkout. The entire journey takes roughly 30 seconds.

This seamless experience sits atop a multi-billion-dollar gamble that could reshape how $1+ trillion in goods are bought online–or become the most expensive failed experiment in Chinese tech history.

The timing tells you everything. Just weeks before Singles Day–China’s equivalent of Black Friday but significantly larger–ByteDance, Alibaba, and Tencent are collectively burning an estimated 300 million yuan ($42 million) monthly on AI shopping tools. That’s not expansion money. That’s survival spending.

Three questions cut to the core of what’s happening: Why are China’s most powerful tech companies willing to light this much cash on fire? What structural advantages does their closed ecosystem provide that makes this battle uniquely Chinese? And most critically, how can they make money without destroying the user experience they’re spending billions to create?

The answers reveal a paradox that may prove unsolvable: platforms are building AI shopping tools that are technically sophisticated but commercially self-contradictory, capable of genuine utility but unable to generate profit without betraying user trust. What happens next will determine not just which companies dominate Chinese e-commerce, but whether AI can fundamentally reshape how commerce works online.

Fighting for survival

The massive spending isn’t about expansion–it’s defensive. The underlying fear is straightforward but existential: whoever controls the AI shopping interface can redirect traffic flows across the entire digital ecosystem, potentially rendering competitors invisible.

Consider the scenario keeping executives awake. If consumers develop a habit of asking Doubao for recommendations and completing purchases through its integrated channels, entire business models become vulnerable. A user ordering food delivery might bypass Meituan’s app entirely, simply asking their AI assistant to “order my usual from the best spicy chicken place nearby.” If Doubao routes that order through Alibaba’s Ele.me delivery service, Meituan becomes a ghost in the machine. The same logic applies to travel booking, financial services, and especially retail.

The math justifies the burn rate. Spending 3.6 billion yuan annually on customer acquisition seems extravagant until weighed against protecting multi-trillion-yuan ecosystems. China’s e-commerce market generates approximately 15 trillion yuan annually. Douyin commanded 3.5 trillion yuan of that in 2024–23% market share and growing. Alibaba’s platforms still lead with over 8 trillion yuan, but that dominance becomes meaningless if traffic migrates to AI interfaces ByteDance controls.

This mirrors China’s ride-hailing wars in the 2010s, when Didi and rivals burned through billions in subsidies to establish market dominance. The difference: this battle isn’t for one vertical market but for control of the primary interface through which consumers access all digital services.

Back in late 2023, Alibaba founder Jack Ma reportedly told executives the company needed to “fully commit to AI e-commerce to meet the new cycle,” signaling recognition that traditional search-and-browse models face disruption from conversational interfaces.

This platform war creates insurmountable barriers for smaller players. The capital requirements alone eliminate most challengers. Consider Kimi, the AI assistant from well-funded startup Moonshot AI. Despite starting 2025 with 100 million yuan in monthly ad spend, the company collapsed to just 400,000 yuan by June–a 99.6% decline. Even with competitive technology, standalone AI apps lack the integrated infrastructure necessary to complete transactions profitably. Without payment systems, logistics partnerships, and merchant relationships already in place, startups simply cannot compete. This is a platform war, not an application competition.

The October offensive

ByteDance moved first. In mid-October, Doubao–China’s most popular AI app with 157 million monthly users–quietly integrated shopping capabilities across categories: electronics, appliances, mother-and-baby products, cosmetics, and home goods. The assistant even recommends restaurant deals and entertainment tickets through Douyin’s group-buying platform.

The counterattack was immediate. Earlier, on October 17th, at its Singles Day launch event, Alibaba declared this would be “the first Singles Day with AI comprehensively implemented”–a direct shot across ByteDance’s bow. The platform unveiled six distinct AI applications designed to saturate the shopping experience with touchpoints: semantic search that understands complex queries, conversational product selection, multimodal visual search, AI-generated category lists, virtual try-ons, and personalized shopping lists based on browsing history.

Days later, on October 23rd, Alibaba unveiled its Quark “C Plan”–a revamped conversational assistant. The “C” reportedly draws inspiration from Pac-Man, the classic game where a character gobbles up dots. The implication is unmistakable. A day later, Ant Group launched “Lingguang,” another AI shopping tool. Tencent’s Yuanbao assistant is being woven deeper into WeChat’s ecosystem.

The timing carries strategic weight. Singles Day officially kicks off on October 20th at 8 PM, making these AI tools available just days before the most intense shopping period in global e-commerce. Last year, Alibaba’s platforms generated over 1 trillion yuan during the festival. This year’s AI integration represents a bet that conversational and visual interfaces can capture additional share from competitors, particularly Douyin.

Yet growth dynamics are shifting in ways that make this defensive spending necessary. Live-streaming commerce–which propelled Douyin’s early success–has matured. The platform’s traditional product shelf section now accounts for over 40% of gross merchandise value, up from less than 30% a year ago. As entertainment-driven impulse buying plateaus, Douyin needs new traffic sources. AI shopping represents ByteDance’s attempt to build longer-term customer relationships less dependent on viral trends and streaming personalities.

Alibaba’s strategy differs fundamentally. While Doubao embeds shopping within a standalone AI assistant, Alibaba embeds AI within its existing e-commerce platforms. According to Kaife, president of Alibaba’s China E-commerce Business Group’s search and recommendation intelligence division, the company used AI to reorganize 2 billion products, resulting in measurable improvements: search relevance for complex queries increased 20 percentage points, recommendation feed click-through rates rose 10%, and merchant advertising ROI improved 12%.

The Western contrast: OpenAI’s different path

Meanwhile, OpenAI has pursued a fundamentally different approach that illuminates why the Chinese battle plays out so aggressively.